Diadem Miss & Mrs Maharashtra 2025: A Grand Finale of Glamour & Grace

March 27, 2025: The Diadem Miss and Mrs Maharashtra 2025 Grand Finale was nothing short of extraordinary! The event brought together the brightest stars from across Maharashtra for a thrilling celebration of beauty, strength, and unparalleled talent. It was an evening filled with breathtaking performances, inspiring stories, and moments that left the audience on the edge of their seats. For months, the contestants have poured their heart and soul into perfecting their craft, training tirelessly at the stunning in Mumbai. Their dedication, commitment, and hard work throughout the year culminated in this one magnificent night. The stage was set for these exceptional women to show the world what they’re made of, and they didn’t disappoint.

What followed was a dazzling display of empowered women—each one bringing her unique spirit, talent, and passion to the stage, competing not just for the title but for the chance to inspire others across the nation. The atmosphere in the auditorium was absolutely electric, with every contestant showcasing not only their beauty but their intelligence, courage, and fierce determination to succeed.

Amisha Chaudhary, the dynamic Pageant Director, could barely contain her excitement and pride as she addressed the evening. “This has been an unforgettable journey for all of us. Every single contestant has worked tirelessly to get to this stage, and tonight, they’ve shown the world their true potential. I’m bursting with pride for what they’ve accomplished and what they will continue to achieve. This is just the beginning!” she exclaimed.

The competition was judged by a truly remarkable panel of experts—each one a powerhouse in their own right—ensuring the best contestants were crowned. The esteemed jury included: Ketki Raut – Former Miss Maharashtra 2023, Pallavi Rawat – Mrs Maharashtra & Mrs India Legacy Second Runner-up 2024, Prerna Kumari – Mrs India Legacy 2024 First Runner-up, Priya Kaith – Mrs India Legacy 2024, Sonal Kaushal – Celebrity Voice Artist

With the jury’s expert eye, the winners were selected from among these incredible women who made history on that stage. The much-awaited moment arrived, and the winners of Diadem Miss Maharashtra 2025 and Mrs Maharashtra 2025 were finally revealed to thunderous applause: Miss Maharashtra 2025: Second Runner-up: NIVYA NAYAK, First Runner-up: SUSMITA SARPE, Winner: DIYA BASU. Mrs Maharashtra 2025: Second Runner-up: ANSHU YADAV, First Runner-up: DR. DARSHANA BHISE, Winner: DR. RUPALI HAZARI GANGURDE

But this was not just a competition—Diadem Miss and Mrs Maharashtra 2025 was a grand celebration of the sheer power and potential of women. Each contestant proved that beauty isn’t just skin deep—it’s about strength, resilience, passion, and the drive to make a difference in the world. The night was a testament to the fact that these women are not just future leaders; they are already changing the world with their voices, their actions, and their inspiring journeys. The Diadem Miss and Mrs Maharashtra pageant continues to break boundaries, inspire millions, and provide an unparalleled platform for women to shine. This year’s grand finale wasn’t just a show—it was an unforgettable moment in time that will leave an indelible mark on all who witnessed it.

Luminous & SBI Drive Strong Growth in Solar Investments

March 27, 2025: In an important step towards accelerating solar adoption in the country, Luminous Power Technologies, India’s leading solar energy solutions company, has signed a memorandum of understanding (MoU) with India’s largest national bank, the State Bank of India (SBI) to expand its access to solar financing for citizens all over India. By partnering with SBI, India’s largest lender with an extensive distribution network of over 22000 branches, Luminous aims to streamline the consumer journey from financing to installation, ensuring a hassle-free transition to solar energy.

Luminous alliance with SBI will be a long-standing partnership spanning over next two decades. As part of the partnership, Luminous has been onboarded by SBI as its recommended partner in its dedicated portal for solar loans. Furthermore, the partnership extends across various financing subcategories, including solar solution finance and supply chain finance, ensuring accessible and tailored financial solutions for diverse energy needs. Covering all segments MSME, corporate, institutional, commercial and industrial, the collaboration strengthens financial support for sustainable energy adoption.

Under the agreement, loans of up to ₹10 crore will be made available to eligible Customers across all sectors, eliminating financial barriers to solar adoption. Customers will also benefit from reduction in loan processing fees and enjoy a special rate of interest on the loaned amount, making it the most competitive financing option in the market. The loans disbursed will be for a duration ranging up to 10 years, and interest rates will be charged based on the customer credit profile, with the maximum loan value that can be availed being ₹10Cr.

Speaking about the partnership, Preeti Bajaj, CEO & MD, Luminous Power Technologies, said, “We are excited to partner with the State Bank of India in facilitating solar financing and end-to-end solar installation and service support to consumers across commercial and industrial verticals. Last year, we had identified solar financing as a key gap area in our nationwide survey, the Solar Spectrum of India. Acting on the insight, this collaboration will empower people to transition to sustainable solar energy solutions, marking a crucial step in bridging the gap between solar aspirations and affordability. By integrating financing seamlessly into the solar journey, we are enabling more individuals and businesses to adopt clean energy with ease and confidence.”

Amit Shukla, Head, Energy Solutions Business, Luminous Power Technologies added, “Partnering with State Bank of India supports our vision to contribute significantly towards India’s solar adoption. SBI is a trusted name with an extensive reach and deep-rooted presence across every corner of the country. Their robust banking solutions coupled with our end-to-end solar solutions and wide customer base will empower more consumers to seamlessly adopt solar energy in their homes and enterprises. This strategic collaboration reflects our commitment to making clean energy more accessible and affordable, helping customers transition to a sustainable future with greater ease and confidence.”

With a strong nationwide presence Luminous has built a comprehensive ecosystem encompassing solar products, installation, annual maintenance, financing, and insurance solutions. By leveraging SBI’s extensive distribution network, this partnership will simplify and accelerate the consumer journey, ensuring a seamless transition from financing to solar installation.

Customers can opt for Luminous from SBI’s recommended partners’ at the bank branches or through online platform. Luminous’ digital platform offers 100% project management, from site assessment to financing and annual maintenance contracts (AMC). Whether consumers prefer an in-person consultation or an entirely digital experience.

Beyond this strategic partnership with SBI, Luminous has also collaborated with 15 other leading loan service providers, including SBI, SIDBI, ICICI, HDFC, IDFC, YES BANK, CREDITFAIR, ECOFY, EFL, ANNAPURNA, UGRO CAPITAL, BAJAJ FINSERV, SIEMENS

FINANCIAL SERVICES, AEREM, FUSION MICROFINANCE, ensuring the widest financing coverage across customer and industry segments, geographies, and operational scopes. This initiative aligns with Luminous’ core philosophy of keeping the customer at the heart of its operations, reinforcing its commitment to democratizing solar energy access in India.

From Beach Town to Realty Gem: Alibaug’s Rise in Housing

March 27, 2025:Real estate for centuries has focused around the metro cities in India, especially the MMR and NCR regions. But with the advent of infrastructure and the change and shift of buyer’s preference, from concentrating in a particular metropolitan to exploring beyond just the address, many real estate hotspots have emerged. One of the hotspots among others is Alibaug, especially in the eyes of investors due to the scenic perplexity, the beach, and the oceanic serenity.

Contemporary industry research, including by MagicBricks, points to a substantial increase in demand for property in Alibaug owing to its strategic positioning and prospects for high-end development. This trend is not just apparent in residential property sales but also in the expansion of the second home market as investors are increasingly scouting for holiday homes and investment properties that offer luxury as well as long-term value appreciation.

Alibaug’s investment possibilities are also maturing at a fast clip as land buying has picked up in the last year. With investors homing in on this new market, prospective buyers are being served a wide range of possibilities that include plot investments and ready-to-move-in homes. Infrastructure development in the town and connectivity enhancements also boost the potential of the town as a real estate destination.

Mohit Malhotra, Founder & CEO, Neoliv, said, “Alibaug is no longer just a weekend escape, it is fast emerging as Mumbai’s answer to the Hamptons. Enhanced connectivity through the Mumbai Trans Harbour Link (MTHL) and Ro-Ro ferry services has transformed this coastal town into a high-demand real estate destination. What was once a quiet retreat is now a thriving hotspot for luxury living and investment. The region is witnessing an unprecedented surge in demand, driven by ultra-luxury villas, premium plotted developments, and second homes. With its serene landscapes, pristine beaches, and close proximity to Mumbai, Alibaug is attracting high-net-worth individuals, celebrities, and investors looking for long-term value appreciation.”

He further added, “As the preference for open spaces, sustainable living, and private residences grows, Alibaug is becoming the go-to destination for those seeking an escape from the city’s hustle while still staying well-connected. With infrastructure development on the rise and property values steadily appreciating, the town is poised to be the next big real estate goldmine, offering both lifestyle appeal and strong investment potential.”

The rising interest of HNIs and celebrities highlights the attraction of Alibaug as a developing status symbol. A picturesque blend of natural beauty, solitude, and modern facilities is attracting high-net-worth investors, with many seeing the region as the ideal merger of a Pacific lifestyle and rewarding investment opportunities.

All in all, Alibaug’s enticing recipe of investment prospects, celebrity endorsement, emerging second home market, and positive land-buying trends all collectively portend a promising future. For investors hunting for a market with considerable upside potential, Alibaug is emerging from the waves as an irresistible island of opportunity on India’s real estate horizon.

Indians Look to Influencers for Travel Ideas, Amadeus Reports

MARCH 27, 2025 – New research from technology innovators Amadeus explores what travelers are looking for from a trip and how technology can make those ambitions come true. The report – Travel Dreams – draws on input from 6,000 travelers from the US, China, India, the UK, France, and Germany to understand how they choose where to visit, how they want to book, and what factors most impact a trip once they are on the road.

The study finds that the channels now driving travel are changing too. Social media ads and travel influences have risen the most in influence in the last five years, while newspapers, in-person travel agents and TV ads are all seeing fluctuations in importance as a source of inspiration for a travelers’ next destination. In India, 50% of travelers are likely to be inspired by travel influencers, significantly higher than other countries—27% in the US, 21% in the UK, 16% in Germany, and just 11% in France.

Two-thirds of hotel guests (63%) are willing to pay extra for features such as a specific view or floor, to have an Xbox in their room or to have local attractions added to their package. While in India, travelers would pay on average 16% above the standard average daily rate to get the view they want. The research shows these features could add around 12% to the average daily rate (ADR) charged by the hotel, which could increase revenues by over $5,300 per room*, per year, for an average mid-range hotel chain looking to sell these extra features.

Leisure travelers crave the personal touch from hotels, with 50% of travelers saying that receiving a personalized service and welcome would be top of the list in achieving their ideal hotel experience. Over half of the guests (52%) said they would be willing to share personal data in return for tailored deals (with fewer people, 40%, open to doing so for a reduced price). Nearly half (48%) of all leisure guests shared a preference for a traditional check-in desk, with a person to talk them through the hotel amenities. Over half of people from India (53%) say that future trips would be improved with enhanced wellness offerings, such as on-site spas, fitness programs, and mental health retreats.

Business travelers are looking for more technology in their pursuit of efficiency, with 71% of business travelers interested in a form of online or self-service check-in. In India nearly a third (30%) of travelers prefer an online check-in process in advance with keyless access to their room. Nearly a quarter (22%) of business travelers want the option of paying with crypto currency or a digital wallet in the future – suggesting the payments landscape may also be shifting.

Lack of insurance is costing travelers real money. The global travelers surveyed said the average amount they think they have lost due to not having travel insurance stands at an average of US$1,210 per person – a sizeable sum. The average Indian traveler said that they have lost over US$1,000 due to not having travel insurance. While for the average Chinese traveler specifically, they put this figure at over $2,500 per person.

Travelers want to embrace virtual reality and artificial intelligence. 82% of business travelers and 66% of leisure travelers said they would like to explore a destination before arrival with a virtual tour. Among Indian travelers, 85% would like to access to virtual reality to explore a destination ahead of their visit. Half of all travelers said they would now turn to AI to tell them about the best places for dinner at their destination. 18% of travelers said they would even ask an AI assistant to write a review on their behalf about a hotel or dinner they had experienced on their trip.

Commenting on the findings, Francisco Pérez-Lozao Rüter, President, Hospitality, Amadeus, says: “From the moment travelers begin thinking about their trip to the time they return home, our mission is to empower the industry to be able to provide exceptional experiences at every step of the journey.

“Projects of this kind show how diverse people’s needs are, depending on key factors such as the purpose of their trip, their age or where they are from. By combining this knowledge with innovative new technology, hoteliers, destinations, mobility and travel protection, providers have real opportunities to drive profitable demand, create personalized trips for guests and connect the dots across the end-to-end experience for people. Working in lockstep with our customers, together we are transforming travel.

Methodology

Findings for Travel Dreams are based on input from 6,000 travelers around the world. Collaborating with Opinium Research, researchers questioned a combination of business and leisure travelers in six key markets – USA, China, Germany, UK, France and India – to deepen understanding of the end-to-end travel experience.

To deliver an industry perspective on the key topics covered in the report, interviews were conducted with executives from Amadeus, Flemings Hotels, Lexis Hotels, The Trans Hotel Group, Marcus Hotels, Geronimo Hospitality Group, Core Hospitality, Hegg Companies, Europcar, ProColombia and AXA Partners.

NIU Organizes Felicitation Ceremony for Educators in Bankura

27 March 2025: Noida International University successfully organized the Educators Meet & Felicitation Ceremony at Hotel Saptaparna in Bankura, bringing together education professionals and stakeholders. The event was attended by around 55 people who aimed to collaborate in the academic sector and recognize the contributions of educators.

The chief guest Mr. Akash Sharma, Director of Admissions & Outreach, at Noida International University, said the significance of quality education and industry-academia partnerships play a vital role in the education industry. The evolving role of educators in shaping future-ready students for problem-solving & creative thinking. Teaching is a noble profession where learning never ends and to make students future ready for employment educators need to upgrade their skills.

Other notable attendees included Mr. Avinash Jha, Director of Unniqquest, Mr. Bhanu Pratap Singh, Mr. Ankur Sharma, and Mr. Tarun Pratap Singh from Noida International University. Their insights on the importance of outreach and engagement in higher education were well received.

The ceremony also featured discussions on emerging educational trends and strategies to enhance student outreach and admissions. The event concluded with a felicitation segment, where educators were recognized for their dedication and contributions to the field.

Popees Baby Care Expands Reach with New Karamana Location

March 27, 2025: Popees Baby Care, a leading baby care products retailer, has further strengthened its presence in Kerala with the launch of its 86th store in Karamana, Thiruvananthapuram. The new outlet is part of the company’s strategic expansion plan to cater to the growing demand for high-quality baby care products in the region.

Following a successful series of store openings across Kerala and beyond, Popees is reinforcing its commitment to providing soft, safe, and superior baby care essentials to parents and caregivers. The newly launched store in Thiruvananthapuram offers a comprehensive range of baby clothing and essential products, ensuring that parents have access to the best care for their little ones.

Shaju Thomas, Chairman & MD of Popees Group, expressed his enthusiasm about the latest opening, stating, “We are thrilled to expand our footprint in Kerala again with the launch of our 86th store in Thiruvananthapuram. As the demand for premium baby care products continues to rise, we remain dedicated to offering a trusted, high-quality shopping experience to families. This milestone brings us closer to our vision of becoming one of the largest national brands in the baby care industry.”

Popees’ product portfolio includes an extensive collection of baby clothing catering to infants up to six years old, along with a variety of essential baby care items such as baby oil, soap, wipes, fabric wash, body wash, shampoo, lotions, and towels. While clothing remains a major segment, the brand continues to expand its range of baby care products to meet the diverse needs of parents.

The expansion into Thiruvananthapuram aligns with Popees’ broader vision of growing its presence across India. With ambitious plans to open 42 more stores by FY26, the company is set to reach a total of 118 locations, targeting key markets in Tamil Nadu, Karnataka, Andhra Pradesh, Telangana, and metro cities nationwide.

With its latest store launch, Popees Baby Care continues to reinforce its commitment to quality, safety, and innovation, ensuring that parents can rely on trusted products for their little ones.

Dibber Integrates Meritto for Smarter Preschool Management

“Our commitment to excellence in early childhood education extends beyond the classroom. With the launch of our new CRM in partnership with Meritto, we are streamlining admissions and enhancing parent engagement, ensuring every family experiences a seamless journey with us,” said Marvin Dsouza, CEO, Dibber India.

With our expertise in empowering educational organizations with a unified technology platform and Dibber’s excellence in early childhood education, we are committed to making quality education more accessible and efficient for parents and institutions alike. We’re proud to support their vision with technology that is as caring, consistent, and intelligent as their approach to early education. We’re excited to play a meaningful role as Dibber scales with purpose across India.” said Naveen Goyal, Founder and CEO, Meritto.

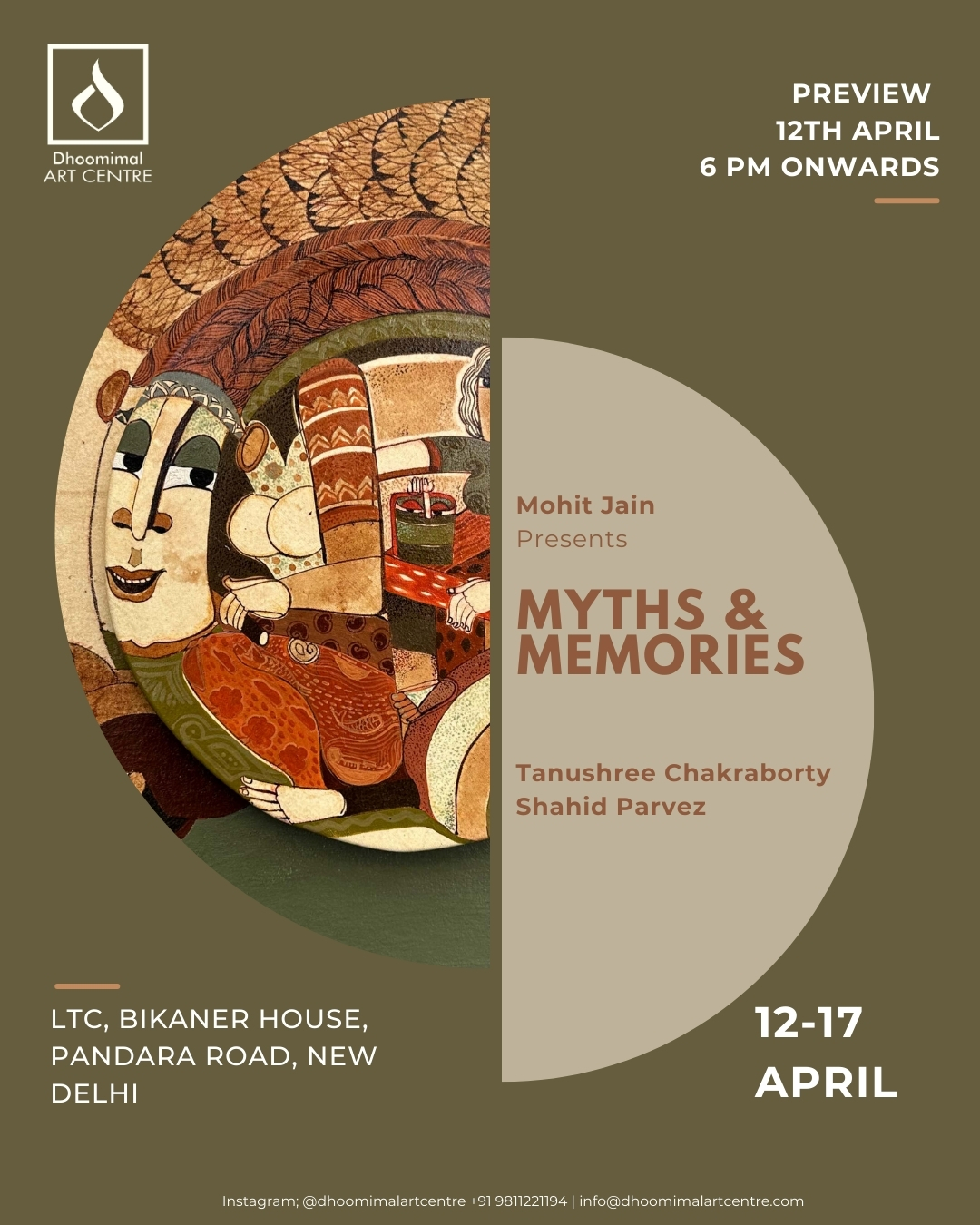

Step Into ‘Myths & Memories’—Dhoomimal Art Centre’s Latest Artistic Voyage

27th March 2025: Dhoomimal Art Centre, one of India’s first private gallery, announces its upcoming exhibition, Myths and Memories, a compelling showcase featuring the works of Tanushree Chakraborty and Shahid Parvez. Exploring the intersection of traditional folk influencers and contemporary artistic expression, the 6-day exhibition opens to the public on April 12 at LTC, Bikaner House, and will be accessible till April 17. During this period, it aims to offer a striking visual dialogue between two distinct yet complementary styles as it beautifully merges the artistic sensibilities of the East and West.

Established in 1936, the Art Centre presents pieces from Tanushree Chakraborty that draw inspiration from the rich heritage of the Santhal Tribe in Bengal, while Shahid Parvez brings to life the tribal and folk arts of Rajasthan. This has been achieved by employing intricate layering and detailing techniques that weave their life stories into their canvases to create works of profound depth and meaning.

speaking on the collection, Shahid Parvez mentioned, “I am truly delighted to present our two-person artwork display, as it holds a special significance for me. Dhoomimal Art Centre has been an integral part of my artistic journey, providing a platform that has nurtured and supported my growth over the years. This showcase is not just an exhibition but a reflection of the creative dialogue and shared vision that has shaped my work. I am excited for art enthusiasts to experience this collection, which brings together distinct yet harmonious artistic expressions.”

Shahid’s works are playful and uninhibited. His layers are not of history but of memories, age, and experience, approached with a child’s imagination—boundless and free. He paints without a fixed plan, allowing the canvas to guide him. His works celebrate spontaneity and joy, revealing the unseen layers that shape human existence. While his themes may seem lighthearted, they hold depth—his use of mixed media, textures, and colours mirrors the complexity of life itself. His art invites us to shed our intellectual masks and approach them with innocence, tapping into the child within us.

In contrast, Tanushree’s work is rooted in history and myth, deeply influenced by her childhood immersed in the stories of the Santhal tribe. She draws inspiration from the Santhal body art tradition, Ulki, where tattoos preserve ancestral history on the skin. Similarly, her canvases become vessels of intricate detailing and mythological storytelling. The concept of Atrinjita—where human history unfolds in grand, exaggerated gestures—runs through her work. She seamlessly blends the traditional with the contemporary, reimagining gods and myths in present-day settings, bridging past and present.

Further commenting on this showcase, Tanushree Chakraborty said, “I believe art is a reflection of an artist’s imagination and aspirations. For me, the ability to give meaning to a line through art brings immense joy and fulfilment. I am deeply grateful to Dhoomimal Art Centre for providing a space that nurtures my creativity, and I look forward to sharing that same sense of freedom and joy with others through my art.”

Elaborating on the exhibit, Mohit Jain, Director of Dhoomimal Art Centre said, “At Dhoomimal Art Centre, we celebrate art that blends cultural roots with personal expression. This exhibition does just that as both artists draw inspiration from Indian folk traditions, yet their approaches contrast beautifully. We look forward to sharing this unique showcase with our audiences.”

What makes Myths & Memories especially compelling is how these two artists, drawing from similar sources of inspiration, have arrived at strikingly different visual languages. While Tanushree transforms the human body into a narrative vessel, Shahid weaves childhood wonder into sophisticated, layered compositions. Their works, together, create a dialogue between tradition and contemporary practice, past and present, myth and reality.

URBAN Introduces Harmonic Soundbar 2080 for a Richer Audio Experience

27th March 2025: URBAN Smart Wearables, the well-known smart wearable technology brand, has expanded its Home Audio portfolio with the launch of the Harmonic Soundbar 2080. A true 2.1 channel 80 Watt compact Soundbar with wired woofer, this soundbar is engineered to deliver a true cinematic experience at home. Packed with signature 3D panoramic surround sound & powerful bass, this soundbar is the most value-for-money product in the category.

The Harmonic Soundbar 2080 is designed to be extremely versatile, compact and portable, making it easy to carry, set up, or connect anywhere. Whether you’re upgrading your living room audio, enhancing your gaming setup, or creating an immersive bedroom cinema experience, the Harmonic Soundbar 2080 delivers theatre-like sound with unmatched flexibility.

Paired with a powerful wired subwoofer, this 2.1-channel soundbar offers deep bass, clear highs, and balanced audio, elevating your experience whether you’re watching movies, listening to music, or gaming.

This launch is a key milestone in URBAN’s brand ideology of making technology better, compact & customised for Indian needs. This product is developed to be extremely versatile especially keeping in mind the Indian household requirement, making it a go to product for the entire family with different needs. This also marks the brands commitment of making technology accessible to all & bringing the home theatre soundbars to every household.

With Smart Standby Mode, remote control functionality, and versatile connectivity options, the Harmonic Soundbar 2080 integrates effortlessly into any home setup; Smart TVs, gaming consoles, and even mobile devices. Its modern, minimal aesthetic ensures it looks as good as it sounds.

Speaking about the launch, Aashish Kumbhat, Co-Founder of URBAN, said: “With the launch of the Harmonic Sound Bar 2080 we aim to redefine the home audio experience for Indian households, because we believe technology should be accessible to all. We Indians love our family but with different people, comes different tastes and ears for sound. With Harmonic 2080 we are presenting a perfect blend of superior sound quality, elegant design, advanced features, and versatility in sound. This is a product for everyday needs of the entire family.

Specifications and Features:

- 80W Powerful Bass Sound – Provides deep, immersive, and distortion-free audio, ensuring a room-filling sound experience perfect for movies, music, and gaming.

- Panoramic 3D Surround Sound – Creating a virtual surround sound environment, this soundbar comes equipped to give you theatre like movie experience at home.

- 2.1 Channel Home Theatre System – Offers a well-balanced sound profile with separate audio channels and a dedicated subwoofer, creating a cinematic audio environment.

- Dedicated EQ Modes – Comes with multiple equalizer presets tailored for different content types, allowing users to fine-tune audio for optimal clarity and depth.

- Smart Standby Mode – Automatically switches to an energy-efficient mode when not in use, reducing power consumption while maintaining quick accessibility.

- Wired HD Subwoofers – Designed to deliver rich and powerful low frequencies, enhancing bass depth for a more dramatic and dynamic listening experience.

- Remote Control Function – Enables effortless control over volume, sound modes, and connectivity settings, making it easy to operate from a distance.

- Versatile Connectivity – Supports multiple input options, including Bluetooth, AUX, HDMI ARC and USB, ensuring seamless integration with TVs, gaming consoles, and mobile devices.

Bring Stadium Vibes Home with Cutting-Edge Projectors

March 27,2025:In April, the excitement of the Indian Premier League (IPL) will return, bringing with it the energy and passion that makes it one of the most celebrated cricket tournaments. The world’s richest cricket league is not just about the top international players competing across 10 teams, it is also a complete entertainment spectacle. From the elegance of a Virat Kohli cover drive to the thrilling finishing touch of a power-hitter like Andre Russell, the tournament delivers high-stakes action. Adding to the spectacle is the glitz surrounding the league, with film stars like Shah Rukh Khan as team owners, cheerleaders energizing the crowds, and DJ performances turning stadiums into festival-like arenas.

Watching this cricketing extravaganza on a big screen is undoubtedly more immersive and this explains the rise of IPL fan parks and public screenings across the country. Now, with ultra-short throw (UST) projectors becoming more affordable and reshaping home entertainment, many households are switching to laser projectors to bring the two-month-long tournament to life. To help you choose the best option, here is a list of premium and budget-friendly home projectors to elevate your live IPL streaming experience.

Formovie Cinema Edge Projector

Cinema Edge, the latest offering from global projector manufacturer Formovie, is a premium 4K UST projector powered by ALPD® technology, delivering high-precision visuals with exceptional colour accuracy, brightness and contrast. Its 3000:1 contrast ratio, HDR10 support and Rec. 709 colour gamut ensure lifelike visuals, making viewers feel as if they are right inside the cricket stadium. The dual 15W built-in speakers, with Dolby Audio and DTS-HD support, capture even the faintest sound, whether it is the subtle nick of the ball or the stadium’s ambience. The projector requires just 49 cm of space from the wall to project a massive 150-inch screen. With MEMC technology, it also ensures smooth motion for fast-paced games like cricket, while a built-in blue light filter reduces eye strain during extended viewing sessions. Distributed in India by Aytexcel Pvt. Ltd., the Formovie Cinema Edge is available at https://formovie.in/formovie-cinema-edge/ and https://aytexcel.com.

E Gate New K9 Pro

If you are looking for an option below Rs 10,000 but need additional features for an excellent home viewing experience, the E Gate New K9 Pro can be a great choice. With 4,500 lumens of brightness, it delivers a clear and vibrant picture even in well-lit rooms. It also offers full HD 1080p native resolution, a 3000:1 contrast ratio, and a long-lasting lamp life of up to 30,000 hours. The projector also comes with a 5W built-in harmonised frequency speaker. For connectivity, it includes three HDMI ports, allowing easy connections to a set-top box, Fire TV Stick, or PC/laptop. The precision keystone knob ensures proper screen alignment for an optimal viewing experience.

It is available on Amazon.in

BenQ TH575

The 4K-compatible Full HD projector, BenQ TH575, offers 3800 ANSI lumens of brightness and can project a 100-inch screen from a distance of 10.8 feet. It delivers FHD images with precise and accurate colours, but what makes it a preferred choice for watching IPL and other sports is its low input lag. The ultra-fast 16.7ms response time ensures live action with zero delay. It also provides excellent contrast with its 0.65 DMD in 1080p projectors, producing deeper blacks and preserving subtle layers and fine details in dark scenes without washout. The device features multiple picture modes, including a Sports mode that enhances the viewing experience by replicating a stadium-like atmosphere.

It is available for purchase on Amazon.in

WZATCO Yuva Go Android 13.0 Smart Projector

The Yuva Go portable projector comes with a powerful LED light source and supports 4K decoding. With a native resolution of 1280×720 and a high dynamic contrast ratio of 5000:1, it delivers better brightness, clarity, and colour depth. The WZATCO Yuva Go Android 13.0 projector is a cost-effective choice for those looking for a lightweight and portable option. With built-in Android 13.0, users can stream IPL matches directly from their preferred OTT platforms without needing an external device. The projector also supports BT 5.0 connectivity, allowing wireless pairing with speakers, headphones, or soundbars for an improved audio experience.

It is available on Amazon.in

Portronics Beem 440 Smart LED Projector

With a 180-degree viewing experience, auto vertical keystone correction, 720p native resolution, 2000 lumens brightness, and the ability to project up to a 120-inch screen, the Portronics Beem 440 Smart LED Projector is a budget-friendly option, especially for those looking for a projector under Rs 7,000. With an inbuilt Android-based OS, it provides direct access to popular streaming services without requiring additional setups. The Beem 440 also reduces blue light exposure compared to TVs, making it a safer and more comfortable choice for extended viewing, such as watching your favourite IPL team in action.