Discover the Rich Flavours of Northeast India at Tamra, Shangri-La Eros New Delhi with Chef Pin

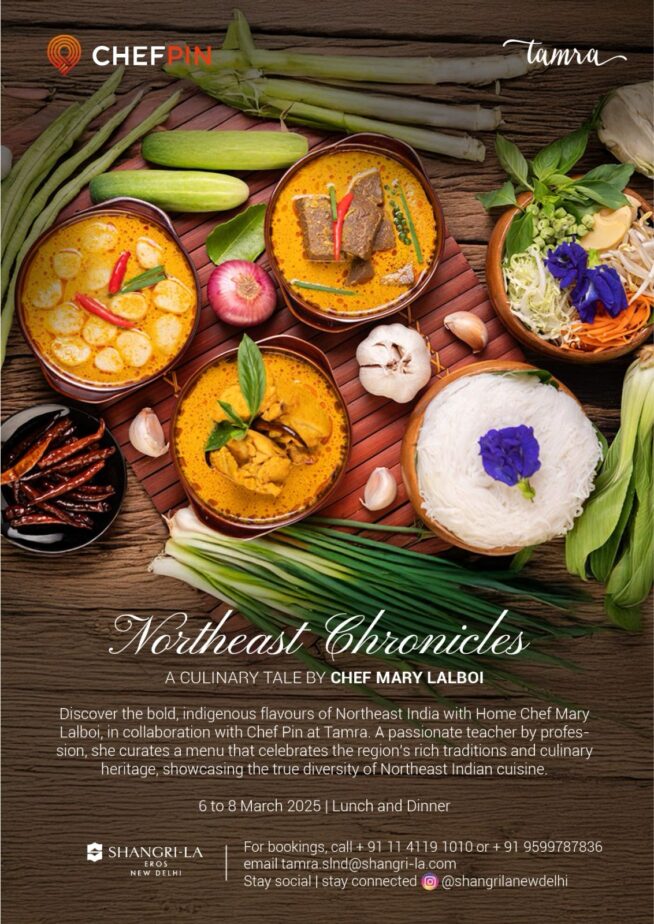

New Delhi, March 2025: Shangri-La Eros New Delhi in collaboration with Chef Pin, presents an incredible culinary experience celebrating the indigenous flavours of Northeast India. Running from 6th to 8th March 2025, Tamra, the hotel’s international cuisine restaurant, will serve an authentic selection of regional specialities crafted by Chef Mary Lalboi.

A changemaker in Northeast Indian cuisine, Chef Mary Lalboi has been influential in bringing the region’s exquisite and diverse culinary traditions to the spotlight. As the founder of Rosang Café, one of the first establishments to introduce Northeast Indian flavours to Delhi, she has dedicated her journey to preserving and sharing the treasured food culture of her homeland.

This exclusive pop-up highlights the soul of Northeast India with a meticulously curated menu featuring signature dishes that complement the region’s bold and earthy flavours. Guests can savour Kelsa, a mutton curry infused with exotic Northeast herbs; Kanga, a flavoursome goose curry with Manipuri wild roots and leaves; and Kolposola, a notable Assamese banana trunk curry. The experience continues with comforting delights like Bai, a Mizo-style seasonal mixed curry. Sanpiau, a delicate Northeast rice porridge, and Chow Satui, a soulful mutton noodle soup, complete this delightful journey. To conclude the overall experience on a sweet note, the rich and aromatic Chakhao Kheer, a black rice pudding, offers the perfect finish.

Set against the cosmopolitan backdrop of Shangri-La Eros New Delhi, this exclusive three-day event welcomes guests to appreciate the lesser-explored yet interesting world of Northeast Indian cuisine. Each dish presents guests with an enveloping experience applauding authenticity, heritage, and excellent culinary craftsmanship.

Guests can enjoy the Lunch Buffet at INR 3,200 plus taxes per person or the Dinner Buffet at INR 3,500 plus taxes per person, making this an unmissable experience for food connoisseurs.

Air Canada Secures Exclusive Spring Perks for Aeroplan Members

New Delhi, 10 March 2025 – Air Canada, Canada’s largest airline and flag carrier has taken to the skies with its latest campaign, aimed at Aeroplan members looking to fly between India and Canada.

The limited-time campaign will allow customers to earn 15,000 bonus points on one eligible round trip, or two eligible one-way trips between the two destinations, as the leading global carrier reinforces its presence between India and North America.

The offer means that with just a single transaction, customers will earn enough Aeroplan points to book a one-way trip within India with one of Air Canada’s partner airlines.

Customers looking to put a spring in their step can also earn 7,500 bonus points on an eligible one-way trip from India to Canada as part of this offer if tickets are booked during the promotional period.

Available for bookings between now and 31 March, the offer is valid for travel up to 15 December 2025, and is applicable across all classes of travel — Business Class, Premium Economy, Premium Rouge and Economy, with the exception of Air Canada’s Basic fare.

Arun Pandeya, General Manager & Country Head of India, Air Canada said: “March heralds the beginning of spring season in Canada, so our spring promotion is an excellent opportunity for travellers to start planning their summer adventures to Canada, whether for business or leisure, while also enjoying all the benefits of our renowned loyalty programme.

“This is our way of rewarding the immense trust and loyalty that our frequent fliers have shown us. For those who are not yet Aeroplan members, we urge you to join the family, so you don’t miss out on said fantastic offers!”

To register for this offer, Aeroplan members can click on the ‘Register and book’ tab in their personalised offer e-mail before booking eligible flights. Alternatively, those yet to sign up to Aeroplan can become a member free of charge via the website.

Air Canada’s Aeroplan loyalty programme allows members to enjoy several exclusive benefits including reward points that can be redeemed on flights, upgrades, merchandise, hotel stays, car rentals, Air Canada vacation packages, gift cards, travel experiences, and other exclusive benefits.

The membership also includes several perks such as priority boarding, discounts, and access to Air Canada’s Maple Leaf Lounges which are known for their luxurious ambience, comfortable seating, complimentary snacks and beverages, high-speed Wi-Fi, and shower facilities.

Customers looking to travel between India and Canada can also benefit from Air Canada’s unrivalled connections, including direct flights from Delhi to Montreal and Toronto, in addition to Mumbai to Toronto. Those looking to head further west, can also enjoy flights from Delhi to London Heathrow, allowing connections onto Air Canada’s Calgary and Vancouver services.

Lauritz Knudsen Welcomes a New Era in Industrial Automation

March 10, 2025 – New Delhi: Lauritz Knudsen Electrical and Automation (formerly L&T Switchgear), a leader in the Indian electrical and automation industry, today unveiled its next-generation smart energy and automation solutions to drive energy efficiency and cost optimization by upto 30%.

These solutions align with India’s decarbonization goals by optimizing industrial processes and cater to the nation’s energy infrastructure future readiness. With the integration of automation, energy management, and software-driven intelligence, the product innovations empower industries, OEMs, utilities, and infrastructure to reduce energy consumption.

“Our commitment to ‘Viksit Bharat’ is reflected in our drive for industrial transformation and energy resilience. By merging Nordic design excellence with India’s energy transition, we deliver scalable solutions that enhance operational efficiency, drive productivity, and support the nation’s vision for a sustainable future. Through strategic investments in technology, partnerships, and R&D, we are strengthening India’s global competitiveness while building a future-proof industrial ecosystem“, said Mr. Naresh Kumar, Chief Operating Officer (COO), Lauritz Knudsen Electrical and Automation.

With decades of expertise, the company powers 2 Lakh TCD of sugar mills, automates 8K+ tons of rice mills, and drives 60 Lakh textile spindles with its cutting-edge solutions. Recognized for its reliability, Lauritz Knudsen also supports over 20 municipal corporations, 80+ petrochemical terminals, and 25K+ hospital beds. It also plays a vital role in powering India’s largest airports, leading pharmaceutical companies, and 2G ethanol plants, ensuring efficiency and innovation across sectors.

Lauritz Knudsen, a trusted partner for industries such as pharmaceuticals, chemicals, textiles, and metals, has introduced next-generation automation solutions to enhance efficiency and accelerate India’s digital transformation.

Designed to cater to the needs of Indian customers, this entire range of products and solutions is poised to revolutionize energy and operational efficiencies, and future-proof businesses. By enabling smart energy control and advanced automation, Lauritz Knudsen aims to enhance productivity and catalyze growth in ‘Deep India’, in both the Industrial and Infrastructural sectors.

These advanced products include Variable Frequency Drives (VFDs), Programmable Logic Controllers (PLCs), Human-Machine Interfaces (HMIs), IoT-enabled Edge Gateways, and SMARTCOMM Process SCADA Software. Tailored to meet the unique needs of ‘Bharat,’ these innovations optimize industrial automation, streamline operations, and drive productivity.

Lauritz Knudsen’s VFDs enable precision motor control and energy efficiency across key sectors, including water, chemicals, metals, pharmaceuticals, and infrastructure. The company’s PLCs offer advanced automation and real-time monitoring for manufacturing and process control, ensuring seamless operations. Complementing these, the intuitive HMIs provide real-time data visualization and process optimization, enhancing decision-making.

Further strengthening digital connectivity, IoT-enabled Edge Gateways facilitate predictive maintenance and operational insights, enabling businesses to maximize efficiency. Additionally, the SMARTCOMM Process SCADA Software integrates on-premise and cloud-based applications, delivering robust control and monitoring solutions for industrial processes. Together, these innovations position Lauritz Knudsen at the forefront of India’s automation and energy transformation.

Lauritz Knudsen continues to invest in India’s industrial and energy future, expanding its R&D and manufacturing footprint with state-of-the-art facilities across Tamil Nadu, Maharashtra, and Gujarat. With an expansive. manufacturing presence and 33+ offices in 500+ cities, the company is at the forefront of India’s Make in India and Viksit Bharat 2047 initiatives.

Novocaine Welcomes Rave Reviews – A Wild Ride of Action & Laughter Arrives March 14

March 10,2025:High-stakes action thriller with a pulse-pounding love story at its core, Novocaine is set to hit Indian theatres on 14th March 2025. Early reviews for Novocaine are rolling in, and they’re nothing short of electrifying! Critics are raving about its wild, blood-soaked action-comedy blend, calling it an “amped-up blast” packed with gleeful mayhem and grotesque thrills. The film is being praised for its perfect mix of gnarly humor, brutal action, and even a surprising dose of heart, making you truly root for its characters. With Jack Quaid delivering a knockout performance, Novocaine is shaping up to be the high-octane, hilariously twisted ride you can’t afford to miss!

Film critic, Denny O’Leary, teases the bloody and brutal approach to the action-comedy, saying, “Novocaine is an amped-up blast, fully aware of how much fun this wacky premise is delivering at every turn. The level of gleeful mayhem this action-packed outing manages to achieve is impressive, incorporating some grotesque violence that will even satisfy certain horror fans.”

Popular film critic Sean Chandler called Novocaine “an absolute blast! Gnarly, hilarious, & romantic. There are non-stop wince-inducing gags that are hilarious. But the reason you care is that you’re rooting for the characters. This was one of my most anticipated films of the year & it did not disappoint.”

Director Logan Mitts mentions, “NOVOCAINE is a brutal, gore filled riot. At the center of all the chaos is a committed performance from Jack Quaid who once again brings charisma and proves his capabilities as a leading man.”

Across the globe, Novocaine is already receiving widespread acclaim. As the release date approaches, excitement is building, and the audience cannot wait to watch the action-packed love story!

Business Today Welcomes Milestone 33rd Anniversary with Power-Packed ‘Unstoppable33’

10 March 2025 – Business Today, India’s leading business news magazine, marks its 33rd anniversary with a landmark edition under the dynamic campaign Unstoppable@33, reaffirming its unmatched influence in the business and financial media landscape. The special issue, themed *Future Perfect: Charting India’s Path to Prosperity,* presents a forward-looking vision of India’s economic growth and is now available on stands.

This over 220-page mega edition stands as a testament to Business Today’s legacy of excellence. Featuring five covers it underscores the magazine’s scale and innovation.

Driven by an overwhelming response from advertisers, the anniversary issue showcases over 110 pages of advertising from 70+ brands, including eight unique ad innovations.

Additionally, more than 15 industry stalwarts have contributed insightful guest columns, making it an essential read for business leaders, policymakers, and professionals.

For 33 years, Business Today has been the benchmark of excellence in business journalism in India, unrivaled in its scale, reach, and influence. This special edition delves deep into India’s emergence as a global economic powerhouse, covering key themes such as job creation, policy reforms, AI leadership, inclusive growth, and the transformative power of MSMEs. It explores India’s booming consumer market, the rise of future industry giants, the evolution of banking and financial markets, and critical developments in renewable energy, electric vehicles, and healthcare reforms. The issue also examines India’s IPO landscape, including the potential for a record-breaking $10 billion listing, and the growing global dominance of Indian cricket.

With no competition matching its scale, Business Today continues to be the definitive voice in business journalism, shaping corporate discourse in India and beyond. The Unstoppable@33 campaign not only celebrates the magazine’s remarkable journey but also sets the stage for the future of business journalism in India. This landmark edition reinforces Business Today’s commitment to delivering insightful, in-depth, and authoritative content that drives conversations on India’s economic future.

Anmol Industries Welcomes Food Enthusiasts at Aahar 2025, Showcasing Innovation

New Delhi, 10th March 2025: Anmol Industries Limited, a leading packaged food company, attracted significant visitor attention while participating in the five-day (4th to 8th March) mega International Food and Hospitality Fair, “Aahar 2025”, organized at Pragati Maidan, New Delhi.

Drawing significant consumer engagement, Anmol offered an exclusive opportunity to witness the company’s latest innovations in the indulgent food category. Its stall located at Bharat Mandapam featured Anmol’s high-quality and irresistible products. These included Anmol Dream Lite, Anmol Butter Bake, Anmol Marie Plus, Anmol Crunchy and Anmol Yummy Chocolate Cake—all of which received widespread appreciation from the visitors who thronged the pavilion.

Mr. Aman Choudhary, Executive Director—Marketing at Anmol Industries Limited said, “At Aahar 2025, Anmol reaffirmed its commitment to consumer satisfaction and innovation. At this well-attended fair, our exclusive product line grabbed the limelight by attracting a wider audience. This event also allowed us to further strengthen our position as an innovative leader in the industry.”

The visitors at Anmol’s pavilion had the opportunity to relish the brand’s premium offerings while also interacting with the team to learn more about the company’s commitment to ensuring quality, transparency and trust in its every product. It is by taking part in Aahar 2025, Anmol Industries reinforced its commitment of strengthening India’s standing in the global F&B trade.

‘Aahar 2025’ in a nutshell, provided Anmol with an excellent opportunity to engage directly with its valued consumers and gain insights into their preferences. The company also utilized the event’s vast platform to broaden its market footprint and establish key partnerships.

Anmol Industries remains dedicated to driving innovation and growth in the sector. With a strong focus on quality and consumer satisfaction, the brand continues to expand its reach, strengthen industry collaborations, and contribute to India’s fast-growing prominence in the global market.

JS Institute of Design Welcomes Cultural Harmony at Echoes of the Northeast Event

Schneider Electric Commends South Bihar Power Distribution Company for Modernization Efforts

Mumbai, March 10, 2024: Schneider Electric, the leader in the digital transformation of energy management and automation, has partnered with South Bihar Power Distribution Company Ltd. (SBPDCL) to modernize and enhance the state’s power distribution network. This collaboration marks a significant milestone in delivering reliable, efficient, and sustainable energy and digital solutions to the people of Bihar.

The increasing energy demand in the state posed a major challenge for SBPDCL, highlighting the urgent need for modernization to guarantee reliable and seamless power distribution. Effective management of the electrical distribution system became crucial to tackle these issues and ensure an uninterrupted power supply for consumers.

Schneider Electric’s advanced EcoStruxure Grid solutions were instrumental in overcoming these obstacles, delivering robust monitoring capabilities and ensuring 24/7 operational uptime. The partnership has resulted in substantial, measurable benefits for SBPDCL, its consumers, and the state. Power reliability has increased by an impressive 90%, while energy consumption and cost savings have reached up to 80% and 60%, respectively. Furthermore, engineering cost and time optimization improved by 70%, significantly enhancing operational efficiency and driving cost-effectiveness.

Speaking on the partnership, Mr. Deepak Sharma, Zone President, Greater India, Schneider Electric and MD & CEO, Schneider Electric India, said, “Our collaboration with South Bihar Power Distribution Co. reflects our commitment to providing more innovative, sustainable, and energy-efficient solutions that empower utilities to meet growing energy demands. By leveraging our EcoStruxure Grid technology, we aim to create a future-ready power distribution system, contributing to South Bihar’s economic and infrastructural growth. This partnership also underscores Schneider Electric’s commitment to accelerating India’s energy transition and empowering utilities with smart, sustainable, and scalable solutions. Together, we are committed to accelerating the transition towards a more sustainable and resilient Grids of the Future.”

Mr. Udai Singh, MD & CEO, Schneider Electric Infrastructure Ltd and Vice President – Power Systems, Schneider Electric India, said “Our EcoStruxure Grid Solutions have successfully transformed SBPDCL’s power distribution network into a modern, efficient, and resilient system. By integrating advanced technologies like real-time monitoring, GIS-based network mapping, and automated fault detection, we have ensured a more reliable power supply for the people of South Bihar. This partnership not only addresses current energy challenges but also paves the way for a sustainable and future-ready energy ecosystem that supports the region’s growth.”

A spokesperson from SBPDCL commented, “With the growing energy demands in South Bihar, we needed a solution that not only ensured uninterrupted power distribution but also optimized our operational efficiency. Schneider Electric’s EcoStruxure Grid solutions have enabled us to achieve these goals, benefiting both our consumers and the state.”

As part of the project, Schneider Electric established a State-of-the-art Command-and-Control Center and Disaster Recovery Center, enabling real-time monitoring and decision-making for improved grid connectivity and reliability. The deployment included 305 Ring Main Units (RMUs) to enhance distribution power reliability and 550 Fault Passage Indicators (FPIs) on overhead lines to improve fault detection and response times.

This partnership reaffirms Schneider Electric’s commitment to advancing India’s energy transition, creating sustainable and resilient power distribution systems, and supporting the nation’s infrastructural growth.

About Schneider Electric

Schneider’s purpose is to create Impact by empowering all to make the most of our energy and resources, bridging progress and sustainability for all. At Schneider, we call this Life Is On.

Our mission is to be a trusted partner in Sustainability and Efficiency.

We are a global industrial technology leader bringing world-leading expertise in electrification, automation, and digitization to smart industries, resilient infrastructure, future-proof data centers, intelligent buildings, and intuitive homes. Anchored by our deep domain expertise, we provide integrated end-to-end lifecycle AI-enabled Industrial IoT solutions with connected products, automation, software, and services, delivering digital twins to enable profitable growth for our customers.

We are a people company with an ecosystem of 150,000 colleagues and more than a million partners operating in over 100 countries to ensure proximity to our customers and stakeholders. We embrace diversity and inclusion in everything we do, guided by our meaningful purpose of a sustainable future for all.

Coforge Commends AI Advancement with ServiceNow-Powered Generative AI Center of Excellence

Greater Noida, March 10, 2025 – Coforge Limited (NSE: COFORGE), a global digital services and solutions provider elevated its collaboration with ServiceNow, the AI platform for business transformation. As part of this engagement, Coforge will combine its market-leading AI framework- Quasar with ServiceNow AI Agents to launch a GenAI Center of Excellence (CoE) in Greater Noida, India that will empower organizations to harness advanced AI-driven insights, streamline operations, and deliver exceptional customer experiences.

As part of the Gen AI CoE, customers can pilot, navigate, and scale innovative solutions to address industry-specific challenges by leveraging the full potential of AI with ServiceNow. Coforge has over 12 domain-centric, industry-first solutions on the ServiceNow platform across Financial Services, Insurance, Healthcare and Travel. The CoE will be a great foundation for Coforge to accelerate clients’ journey with the ServiceNow platform, especially in the areas of payment, fraud detection, dispute management, and digital operations resiliency.

Sudhir Singh, CEO and Executive Director, Coforge said, “ServiceNow’s market-leading AI platform combines the power of Data, AI and Workflow to enable clients achieve transformational outcomes. With this investment in GenAI CoE for the ServiceNow platform, we will jointly accelerate clients’ adoption of the ServiceNow platform for business transformation.” He added, “By combining our industry expertise with this market-leading AI platform, we can achieve customer success which is our true north star.”

“The Gen AI CoE between Coforge and ServiceNow is a game-changer in the partnership,” said Erica Volini, executive vice president, of Worldwide Industries, Partners, & Go-to-Market at ServiceNow. “The CoE is a market-leading endeavor and will be transformative for our customers, bringing together the power of ServiceNow’s AI platform and Coforge’s market-leading AI framework to deliver industry-specific insights by leveraging AI.”

As part of the collaboration, Coforge is adopting ServiceNow’s agentic AI capabilities to transform HR processes to create experiences for its employees. Coforge and ServiceNow have established a dedicated global CoE where enterprises can pilot, navigate, and scale AI-powered solutions tailored to their industry-specific challenges. The CoE will help businesses leverage AI-driven workflow automation to improve operational efficiency and reduce costs, enhance multi-cloud strategies by integrating ServiceNow cloud management solutions, accelerate AI adoption through best practices in low-code/no-code automation, and develop scalable AI use cases across key verticals such as financial services, insurance, healthcare, and travel.

Coforge is an Elite ServiceNow partner, recognized for its expertise in building seamless digital workflows that transform business operations. For more information on the ServiceNow capabilities- https://www.coforge.com/what-we-do/capabilities/servicenow

Beyond Key Secures a Stronger Future with Women’s Day 2025 Festivities

New Delhi, India, March 10, 2025 – Beyond Key, a leading global technology solutions provider, successfully celebrated International Women’s Day 2025 with a series of inspiring and impactful initiatives, reinforcing its commitment to fostering an inclusive and empowering workplace. The eventful day focused on inspiration, collaboration, and social responsibility, ensuring that women in the organization and beyond receive the support and opportunities they deserve.

The event brought together Shweta Gupta, a passionate social activist associated with Jeevan Shala, Dr. Chhaya Matange, an accomplished music practitioner and cancer warrior, and Saatvika Bhargava, the founder of Let it Count. These remarkable women shared their journeys, highlighting their unwavering commitment to education, empowerment, and social change. Their motivational talks encouraged Beyond Key’s female employees to embrace resilience and drive impact in their personal and professional lives.

Speaking at the event, Saatvika Bhargava, emphasized the importance of grassroots efforts in making a difference, stating, “Real change begins when we empower individuals at the community level. Every effort counts, and together, we can create a more inclusive and empowered society.” Shweta Gupta’s insights on rural education and vocational training, alongside Dr. Chhaya Matange’s inspiring battle against cancer and contributions to music therapy, left a profound impact on the audience. The session fostered meaningful discussions on breaking barriers and achieving holistic growth, reinforcing Beyond Key’s commitment to diversity, inclusion, and women’s empowerment.

Later, Beyond Key also organized a collaborative lunch exclusively for female employees, offering a space for connection, mentorship, and idea-sharing. This gathering fostered a sense of community, enabling women to support and uplift one another while discussing their aspirations and career growth within the organization.

As part of its commitment to social impact, Beyond Key hosted a donation drive to support NGOs dedicated to elderly care. Employees enthusiastically contributed essential supplies, reinforcing the company’s values of giving back and making a difference in the lives of those in need.

Reflecting on the initiative, Mr. Piyush Goel, CEO and Founder of Beyond Key, shared:

“As an organization, we have the power to accelerate change for women—what might take years otherwise, we can drive forward today. Whether it’s fostering societal change, supporting our female employees, or creating career growth opportunities, Beyond Key ensures that women are empowered at every level. We are committed to their well-being, their role in society, and their professional growth within the company. By fostering inclusivity and taking meaningful action, we continue to create a workplace where women thrive.”

Beyond Key remains steadfast in its commitment to diversity, equity, and inclusion, ensuring that female professionals in technology and leadership roles receive the recognition and opportunities they deserve. The Women’s Day 2025 initiatives reflected the company’s dedication to building a work environment where every woman feels valued, empowered, and heard—not just on this special day but every day.