Marriott Strengthens Presence with New Courtyard Hotel in Jharkhand

April 01, 2025 – Courtyard by Marriott, part of Marriott Bonvoy’s portfolio of over 30 extraordinary hotel brands, today announced the opening of Courtyard by Marriott Ranchi, marking the debut of the first Marriott International brand in Jharkhand. Nestled in the state’s most sought-after areas, renowned for the stunning Rock Garden and picturesque Kanke Dam, this 111-room hotel exemplifies refined living and modern design. It offers a welcoming escape for both business and leisure travelers with enhanced comforts, memorable experiences and a delightful mix of local and international cuisines. Courtyard by Marriott Ranchi is ideally situated just 35 minutes from Birsa Munda Airport and 30 minutes from The Ranchi Junction and Hatia Railway Stations.

“We are excited to mark a significant milestone in our expansion journey in India with the opening of Courtyard by Marriott Ranchi, our first in the vibrant, capital of Jharkhand. This launch underscores our commitment to entering promising markets like Ranchi, which offers a unique blend of urban energy and natural beauty. Courtyard by Marriott is designed to cater to the evolving needs of modern travelers, seamlessly combining innovative technology, comfort, and style. We look forward to welcoming guests for business, leisure, or a blend of both, as we continue to bring our signature hospitality to new destinations”, said Ranju Alex, Regional Vice President, South Asia, Marriott International.

Courtyard by Marriott Ranchi features 111 spacious rooms thoughtfully designed for the comfort and convenience of the modern-day traveler. Paired with smart amenities, each room blends sleek, contemporary aesthetics with functionality, offering conveniences such as high-speed Wi-Fi, a flat-screen TV, and a well-appointed writing desk. The room views alternate between the pristine, peaceful waters of the Kanke Dam and lush, manicured gardens, offering guests the option of a refreshing pause between work commitments.

Dining venues at the hotel comprise of an all-day dining – Viraasat, where a warm, bustling open kitchen and a tempting selection of local and international cuisines await to satisfy every palette. For a more casual experience, guests can head to the Courtyard Cafe, the hotel’s charming deli-style cafe, offering a selection of locally inspired small bites, freshly brewed coffees, and a variety of beverages. Whether it’s a quick mid-day break or, wrapping to a day well spent, Skyline, the rooftop bar offers a serene escape to soak in the sun by the poolside, or enjoy a sundowner with expertly crafted cocktails, refreshing mocktails, and a delectable menu.

To keep guests moving forward and help them pursue their passions while on the road, the hotel offers a fully equipped 24-hour Fitness Center with state-of-the-art workout machines. Complementing this is the rooftop pool, an open-to-sky retreat on the top floor, along with a dedicated steam area, where guests can relax while soaking in the breathtaking panorama of Kanke Dam.

Ideally located adjacent to the Nucleus Mall, the hotel offers guests easy access to the Rock Garden and Kanke Dam, which are must-visit attractions. Referred to as the ‘City of Waterfalls’ Ranchi, is dotted with lush green hills and generous waterfalls such as the Hundru, Dassam and Jonha Falls. The city also holds deeply religious roots, with the 17th– century Jagannath Temple and the Pahari Mandir, situated on a hillside, offering panoramic city views. Those interested in the region’s rich tribal heritage can visit the Tribal Research Institute and Museum, which provides a deep dive into Jharkhand’s indigenous cultures, traditions, and artifacts. Ranchi is renowned for its rich tribal heritage and cultural diversity, showcased through local festivals, art, dance and traditional crafts.

The hotel features 9,100 sq. feet of versatile event space, blending elegance and functionality for both corporate and social occasions. Vista Hall, the crown jewel, spans 4,123 sq. feet and accommodates up to 300 guests, making it the ideal venue for grand celebrations, conferences, and receptions. With cutting-edge AV equipment and customizable layouts, it promises seamless service and a sophisticated atmosphere. For more intimate gatherings, the Executive Chamber offers a private, 400 sq. foot sanctuary on the top floor, designed for up to 14 guests, ensuring both productivity and discretion. The 4,000 sq. foot Skyline Venue offers an enchanting open-air setting with breathtaking views of Kanke Dam, perfect for outdoor banquets, evening celebrations, or corporate events. With tailored catering and décor, it promises to elevate any occasion into a truly unforgettable experience.

On this exciting launch, Pramod Singh, Hotel Manager, Courtyard by Marriott Ranchi, shared, “We are excited to introduce the first Courtyard by Marriott hotel in Jharkhand, bringing our signature warmth and hospitality to the heart of this vibrant state. At Courtyard by Marriott Ranchi, our trailblazing guests are welcomed with genuine care, thoughtful comforts and provided an effortlessly inviting atmosphere. Whether you’re exploring the region’s rich heritage or simply looking for a place to relax, we look forward to making your stay truly memorable.”

BenQ Unveils W2720i: World’s First AI Home Cinema Projector

1st April, 2024: BenQ, leading DLP Projector Company has introduced their World’s First AI home cinema projector – W2720i equipped with a “revolutionary’ AI Cinema Mode, redefining home entertainment for AV enthusiasts.

BenQ’s W2720i’s Cinema Mode is engineered with in-built camera sensors to provide a seamless setup and superior picture quality by combining features such as real-time ambient brightness adjustment and scene-specific enhancements to provide an experience that’s tailored to every user.

The W2720i projector comes with In-built Android TV, delivering a premium streaming experience on a stunning big screen up to 200” and utilizing an efficient 4LED light source (RGBB), which has life time up to 30,000 hours.

BenQ’s exclusive CinematicColor™ technology (90% DCI P3) ensures that users see colours exactly as filmmakers intended, bringing their favourite content to life with incredible accuracy, while BenQ’s advanced HDR-PRO™ technology intelligently enhances contrast to reveal subtle details in both bright and dark scenes. W2720i has Local Contrast Enhancer for enhanced dynamic contrast in HDR10+ and HLG modes. It also offers customizable picture modes such as Filmmaker Mode and Cinema Mode.

The W2720i also offers a flexible projection setup that can project a 120” screen from just 2.7 meters away, and can go up to 200” diagonal. With features like 1.3x zoom, Auto Screen Fit, 8-point Corner Fit, and Vertical Lens Shift, it can be installed conveniently. It also supports comprehensive entertainment options with Built-in Android TV with 4K streaming services such as Netflix and Disney+. The projector includes one HDMI 2.1 (4K 120 Hz), & two HDMI 2.0b, SPDIF, and eARC for 7.1 channel sound with Dolby Atmos pass-through, making it easy to connect to soundbars or speakers.

Mr. Rajeev Singh, Managing Director, BenQ India & South Asia, commented on the launch, “The W2720i represents a significant contribution towards making premium AI-powered home cinema experiences accessible to more Indian consumers. Its innovative AI Cinema Mode and superior colour performance demonstrate our commitment to bringing cutting-edge technology to every home.”

JioHotstar and Amitabh Bachchan Unite to Livestream the Sacred Splendor of Ram Navami

1st April 2025; National: JioHotstar continues to revolutionize India’s live streaming experience by making it more inclusive and accessible, connecting millions and bridging the gap between audiences and their favorite events. Following the tremendous success of Coldplay’s Music of the Spheres and Mahashivratri: The Divine Night livestream, which captivated millions, the platform is now set to bring the festivities of Ram Navami to viewers with a special live stream from Ayodhya on 6th April, from 8AM to 1PM. The celebrations will feature the legendary Padma Vibhushan Shri. Amitabh Bachchan narrating evocative stories of the Ram Katha. Combining community celebrations with technology, the livestream reinforces JioHotstar’s commitment to enhancing accessibility, bringing cultural moments closer to millions, and ensuring an unforgettable experience.

At the heart of this momentous occasion, Padma Vibhushan Shri. Amitabh Bachchan will share timeless wisdom and reflections on Lord Ram’s values, offering a celebration of our cultural heritage and inspiring a forward-looking vision for India. The festivities will capture the joy and reverence of Lord Ram’s birth and journey, depicting the seven kands of the Ramayana, all while streaming live from the heart of Ram Janmabhoomi to spiritually uplift viewers with his legacy. Shri. Amitabh Bachchan will also host an interactive session with kids, showcasing select stories and couplets of the kands in an engaging and relatable manner. From a special pooja performed at Ayodhya, sacred rituals across temples, to soul-stirring LIVE aartis from Bhadrachalam, Panchvati, Chitrakoot and Ayodhya, to devotional bhajans, and mesmerizing cultural performances by revered artists including Kailash Kher and Malini Awasthi, the livestream will evoke a collective sense of devotion and togetherness.

Speaking on the initiative, a JioHotstar spokesperson stated, “Our live streaming capabilities have enabled us to bring culturally significant experiences to viewers across India. The overwhelming success of events from live sports to Coldplay – Live from Ahmedabad to the 14-hour livestream of the recent Mahashivratri: The Divine Night has inspired us to push boundaries and offer unparalleled experiences to Indian consumers. Ram Navami is a deeply revered occasion in our country, and we’re honored to bring its sacred celebrations to millions in every corner of the country. With the legend himself, Shri Amitabh Bachchan narrating Lord Ram’s journey, this experience promises to evoke profound emotions on this auspicious occasion.”

Padma Vibhushan Shri. Amitabh Bachchan said, “To be part of such a sacred occasion is an honor of a lifetime. Ram Navami is more than a festival—it is a moment of deep reflection, a time to embrace the ideals of dharma, devotion, and righteousness that Lord Ram personified. Through JioHotstar, we are blessed with the power of technology to transcend distances, uniting hearts across the nation in an unprecedented celebration of faith, culture, and spirituality.”

With initiatives like these, JioHotstar is unlocking Infinite Possibilities, enabling viewers across the nation to experience the beauty of festivities from the comfort of their homes. By curating live-stream events like Coldplay, Mahashivratri, and Ram Navami, the platform celebrates the nation’s rich heritage in a manner that is immersive and deeply engaging.

Celebrate India’s rich cultural heritage through the power of digital devotion, with a special livestream on 6th April, only on JioHotstar

Where Pets Vacation in Style: Barker and Meowsky Sets a New Standard in Luxury Pet Boarding

April 1, 2025:Imagine a world where your dog enjoys a relaxing oil massage, your cat dozes in a sunlit nook after a play session with carefully chosen companions, and you receive adorable real-time updates while sipping coffee, knowing your furry friend is in expert hands. That’s not a dream — it’s Barker and Meowsky.

Redefining the way pet parents experience boarding and daycare, Barker and Meowsky (BnM) introduces boutique pet care that fuses luxury, love, and loyalty into every detail. With state-of-the-art, temperament-based groupings, and emotionally attuned staff, BnM ensures that pets aren’t just accommodated — they’re celebrated.

“Boarding shouldn’t feel like a compromise. At Barker and Meowsky, we’ve created a space where pets feel like they’re on vacation too,” says Pratik Sheth, Co-Founder of Barker and Meowsky. “From curated activities to one-on-one cuddles, every moment is designed with intention and care.”

More than just a facility, Barker and Meowsky feels like a second home — complete with spa-style grooming, calming aroma therapies, and premium nutrition options. Whether it’s a senior dog needing extra attention or an energetic pup eager for structured play, every pet’s stay is tailored to their unique personality and needs.

But it doesn’t stop at the pets. BnM caters to pet parents with concierge-like transparency — think personalized consultations, behavior tracking, and constant updates to keep them connected throughout their pet’s stay.

Beyond the walls of its plush facility, Barker and Meowsky is building a community of conscious pet lovers through events, workshops, and social gatherings, making it a lifestyle brand in the pet care space.

For those who believe their pets deserve more than the ordinary, Barker and Meowsky offer a luxury escape — a boutique boarding experience where wagging tails and purring hearts say it all.

CREDAI Haryana Welcomes New Executive Committee for 2025-2027

1st April 2025: The Haryana Chapter of CREDAI NCR proudly announces the appointment of its new Executive Committee for the term 2025-2027, following the successful elections held at 5th Floor of PHD House, New Delhi. The newly elected team is poised to bring transformative leadership, foster industry growth, and drive positive policy changes to create a robust and sustainable real estate ecosystem in Haryana.

The new Executive Committee is as follows:

• President: Shri Manish Agarwal.

• Vice Presidents: Shri Lalit Jain, Shri Pankaj Goel, Shri Pankaj Singla.

• Secretary: Shri Arpit Goel.

• Joint Secretary: Shri Anubhav Jain.

• Treasurer: Shri R.C. Gupta.

Visionary Leadership for a Progressive Future

The newly elected leadership is committed to bolstering the real estate sector in Haryana with a vision focused on transparency, innovation, and sustainable development. The team aims to actively engage with government authorities, industry stakeholders, and homebuyers to streamline processes, encourage ethical practices, and address key challenges in real estate development.

“Our primary goal is to make Haryana a benchmark state for real estate development by fostering a transparent, efficient, and investment-friendly environment. With policy advocacy, infrastructure enhancement, and sustainable development at our core, we will work towards making housing and commercial projects more accessible and affordable for all,” said Shri Manish Agarwal, President, CREDAI Haryana.

CREDAI Haryana remains dedicated to ensuring ease of doing business, accelerating approvals, and promoting technological advancements in real estate. The new leadership also plans to focus on environmentally responsible urbanization, ensuring that future developments align with the principles of green and smart infrastructure.

Commitment to Stakeholders and Industry Growth – The new Executive Committee will undertake key initiatives to boost investor confidence and champion regulatory reforms that benefit Real Estate Developers and Home-Buyers alike. With a focus on Collaboration and Innovation, the team aims to reinforce CREDAI Haryana’s position as a leading voice in the Real Estate Industry of Haryana.

Dhruv Galgotia Commends Bold Shift: Transforming Indian Education Beyond Rote Learning

Dr. Dhruv Galgotia, CEO of Galgotias University said, “The rapid technological advancements defining Industry 4.0 require an education system that is agile, interdisciplinary, and deeply integrated with real-world applications. For India to realize the Viksit Bharat 2047 vision, institutions must focus on equipping students with a combination of critical thinking, technological proficiency, and entrepreneurial mindsets. The future of education lies in creating adaptive, skill-based learning frameworks that prepare students not just for existing jobs, but for careers that will emerge in the next decade. Galgotias University is committed to developing a curriculum that bridges the gap between academia and industry, ensuring that our students become industry leaders and innovators.”

India Inc Commends Resilience Amid Global Tariff War Threat: CareEdge Ratings

1st April, 2025: CareEdge Ratings’ Credit Ratio, which measures the ratio of upgrades to downgrades, strengthened to 2.35 times in H2 FY25, up from 1.62 times in H1 FY25. During this period, there were 386 upgrades and 164 downgrades.

The upgrade rate increased to 14% from 12% in the first half, driven by sectors that benefited from strong domestic consumption and government spending. Meanwhile, the downgrade rate dropped 200 bps to 6%, driven by asset quality concerns in NBFCs catering to microfinance and unsecured business loans, alongside pricing pressures faced by small-sized entities in the Chemical and Iron & Steel sectors, as well as export-focused Cut and Polished Diamond players.

Sachin Gupta, Executive Director and Chief Rating Officer, CareEdge Ratings, shared his insights on the evolving economic landscape, stating, “Despite global headwinds, the credit ratio for CareEdge Ratings’ portfolio strengthened in the second half of FY25—a testament to the resilience of India Inc. However, the journey ahead is far from smooth. The imposition of US tariffs could disrupt momentum for export-driven sectors, particularly those reliant on discretionary spending, while also sparking intense price competition from other affected economies. This uncertainty could keep private sector capital expenditure on the sidelines until clearer signals emerge. That said, not all is bleak—trade agreements and rupee depreciation could offer much-needed relief to exporters. At the same time, Corporate India’s strong, deleveraged balance sheets act as a sturdy shield against external volatility.”

CareEdge Ratings’ credit ratio for the manufacturing and services sector has seen a notable rebound, with its credit ratio rising from 1.21 in H1 FY25 to 2.06 in H2 FY25. The uptick reflects improving business fundamentals, particularly among mid-sized, domestic-focused entities, even as global headwinds persist. Ranjan Sharma, Senior Director, CareEdge Ratings (Corporate Ratings), noted the broad-based nature of this recovery, stating, “The improvement in credit ratio was evenly spread across both investment grade and sub-investment grade rating categories, driven by mid-corporate players leveraging strong domestic demand. Large corporates, too, maintained a healthy credit ratio, continuing their stable performance from previous periods. The sectors leading the upgrade wave included capital goods, automotive and automotive components, and real estate, all of which benefited from rising consumption and momentum in infrastructure. The services sector also witnessed sustained improvement, with hospitality and healthcare continuing their strong upward trajectory, while pharmaceuticals remained a consistent performer, reinforcing its long-standing resilience.”

However, not all industries rode the wave of optimism. Basic and commodity chemicals, smaller iron & steel players, and export-focused CPD entities faced credit downgrades. The chemicals sector struggled with pricing pressures, while smaller steel manufacturers faced heightened competition from Chinese imports. Meanwhile, some trading and distribution entities also found themselves grappling with market volatility.

The credit ratio of the infrastructure sector witnessed a continued uptrend in H2FY25 to 3.94, with the Transport Infrastructure and Power sectors leading the upgrades. Rajashree Murkute, Senior Director at CareEdge Ratings (Infrastructure Ratings), highlighted, “Key factors driving these upgrades include the successful commissioning of projects, particularly in the road Hybrid Annuity Model (HAM) segment and solar power generation. Additionally, timely payments from most state distribution utilities have accelerated deleveraging for power producers and transmission infrastructure providers. A shift in ownership to financially strong sponsors or Infrastructure Investment Trusts (InvITs) has also played a pivotal role in enhancing credit quality for both, project assets as well as developers. However, challenges persist. Delays in receipt of requisite approvals, project execution and weak order books have increased working capital pressures for some mid-sized EPC players, compromising their credit profile. Besides, increased leverage due to top-up debt has weakened the financial flexibility of certain project assets, posing additional risks.”

The Banking, Financial Services, and Insurance (BFSI) sector experienced a sharp moderation in its credit ratio, declining from 2.75 in H1 FY25 to 1.07 in H2 FY25, reflecting emerging stress in select lending segments. While the sector remains fundamentally strong, challenges in asset quality and profitability have affected certain areas. Sanjay Agarwal, Senior Director at CareEdge Ratings (BFSI Ratings), attributed the decline to pressures in the microfinance and unsecured business loan segments, stating, “The increase in loan sizes, coupled with rising debt levels per borrower, has heightened the financial strain on MFI borrowers, leading to asset quality concerns for NBFCs in this space. Consequently, NBFCs catering to microfinance and unsecured business loans are expected to witness elevated credit costs at least until H1FY26.” Despite these headwinds, the overall credit outlook for the BFSI sector remains stable, supported by healthy capitalisation levels among NBFCs and banks, which continue to provide a strong buffer against potential stress.”

In summary, while Corporate India continues to hold its ground, CareEdge Ratings expects the credit ratio to remain range-bound in the near term, navigating the crosscurrents of global headwinds. The resilience of Indian corporates is reinforced by strong and deleveraged balance sheets, providing a crucial buffer against external shocks. While the strength of domestic demand will serve as a key anchor, the unfolding global tariff war and geopolitical uncertainties will shape the road ahead.

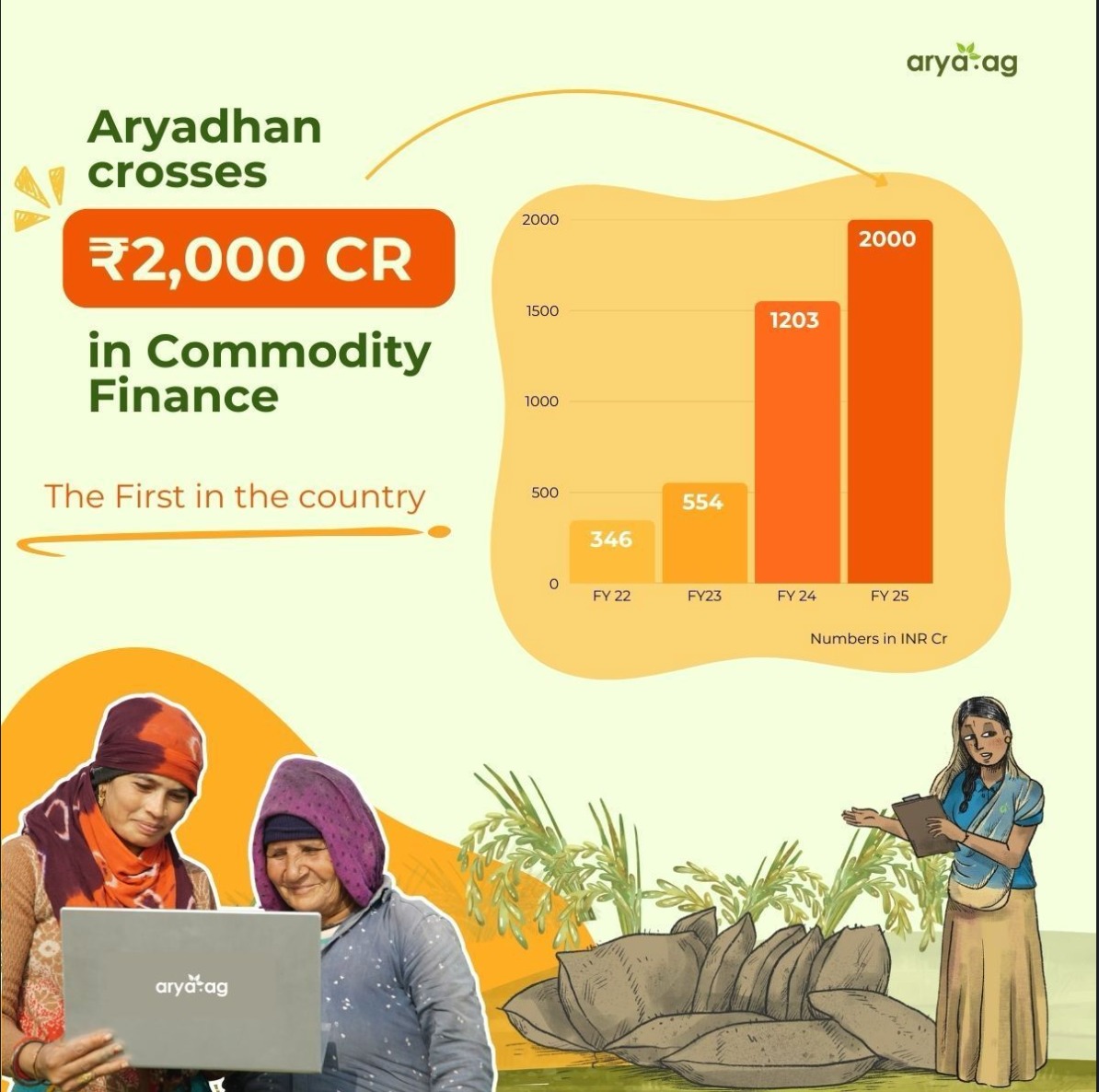

Arya.ag’s NBFC Secures Historic ₹2000 Crore Milestone in Commodity Finance

1st April 2025 — Arya.ag, India’s largest and only profitable grain commerce platform, today announced that its Non-Banking Financial Company (NBFC) arm has crossed the landmark figure of ₹2000 crore in commodity finance, becoming the first in the country to achieve this scale in agri-based lending of this kind.

This achievement marks a significant advancement in rural finance, challenging conventional wisdom that commodity finance at the farmgate level is too risky, fragmented, and unscalable. Unlike traditional lending models, Arya.ag’s approach is anchored in financing against actual grain stored across India’s heartland, supported by its robust technology infrastructure and decentralised storage network.

Anand Chandra, Co-founder of Arya.ag, commented: “Reaching ₹2000 crore in commodity finance through our NBFC validates our integrated approach to post-harvest solutions. This milestone positions us as the largest NBFC in India’s commodity collateral funding space, effectively doubling the scale of other players in this segment. We’ve developed a model where farmers receive loans in under 30 minutes based solely on KYC, changing the dynamics of rural finance. The virtually nil NPAs we’ve maintained while serving approximately 8 lakh farmers shows that when financial products align with real commodities and farmer needs, scale and sustainability naturally follow. Beyond our NBFC’s direct lending, we’ve facilitated an additional ₹10,000 crore through partner banks against our warehouse receipts, bringing the total financing enabled this year to ₹12,000 crore.”

The company reports that its NBFC has become the largest in India in the commodity collateral funding space, effectively doubling the scale of other players in this segment. This achievement is part of a larger financing ecosystem, where partner banks have additionally disbursed over ₹10,000 crore against warehouse receipts issued by Arya.ag, bringing the total facilitated financing to ₹12,000 crore this financial year.

This achievement follows Arya.ag’s recent recognition with the 2025 Forward Faster Sustainability Award in the Climate Action category by the UN Global Compact Network India, and its securing of an INR 2.5 billion loan facility backed by GuarantCo and HSBC India.

Operating across 21 states and covering 60% of Indian districts, Arya.ag manages over 4 million metric tons of commodities across 3,500+ warehouses with a total value exceeding ₹10,000 crore. Its success in commodity finance demonstrates that post-harvest solutions may be the key to unlocking the next frontier in agricultural financial inclusion.

OMG AI Commands the Second Edition of Future Tech World Cup, Eyes Championship Glory

Speaking on the achievement, Co-founder & CEO Suhas Ashok, OMG AI, said, “Securing a spot in the grand finale of the Future Tech World Cup is a monumental achievement for OMG AI and a testament to the hard work, innovation, and vision of our team. We are incredibly excited to represent India on the global stage, where we can showcase our platform and its potential to transform industries worldwide. This recognition is not just a win for us, but for the entire AI community in India, and we look forward to collaborating with like-minded innovators at the Dubai AI Festival as we continue to push the boundaries of what’s possible in AI.“

Varaha Sells 60,000 plus Tonnes of Carbon Credits to Klimate

INDIA, New Delhi & Bengaluru, 1 Apr 2025– Varaha, a leading developer of carbon removal projects in Asia, has sold over 60,000 tonnes of carbon credits to Denmark-based Klimate across five contracts. These agreements span three projects – biochar in India and afforestation initiatives in both India and Nepal – reinforcing Varaha’s ability to repeatedly sell credits to US and European companies across diverse pathways spanning technology and nature-based projects.

This series of contracts, valued at several million dollars, strengthens Varaha’s position as a preferred partner for buyers such as Klimate. By leveraging its diversified portfolio of technology-based and nature-based carbon projects, Varaha has become a critical collaboration for Klimate, who seeks reliable, scalable, and high-integrity credits across multiple methods to create well-balanced portfolios on behalf of their clients.

This announcement follows Varaha’s recent project investment from UK-based Conductor Capital and builds on its growing track record of supplying high-impact carbon removal credits to global buyers. In January 2025, Varaha sold 100,000 carbon dioxide removal (CDR) credits to Google – its first large-scale purchase of carbon removal credits in India. With repeat sales to Europe and other Western markets, Varaha continues to demonstrate its ability to serve corporate climate commitments across diverse carbon removal pathways, including regenerative agriculture, biochar, afforestation, and enhanced rock weathering.

“Our ongoing relationship with Klimate is a testament to the trust that global carbon credit buyers place in our platform”, said Madhur Jain, CEO and co-founder of Varaha. “By offering a broad portfolio of carbon removal projects, we provide flexibility and reliability to meet the diverse needs of our partners. Through partnerships with Klimate, Google, and others, we are scaling high-impact climate solutions that drive positive change for both the environment and the communities we serve.”

From Simon Bager, CIO and Co-founder of Klimate, “”Our partnership with Varaha is essential to our mission of scaling reliable, trustworthy, and impactful carbon removal solutions. Through this collaboration, we’re able to provide our clients access to a diverse range of carbon removal projects across multiple pathways and certification standards. Having a trusted partner in the south Asia region with expertise in local contexts ensures the development of high-impact climate solutions that resonate strongly with our clients’ priorities”