Sony SAB’s Veer Hanuman Actors Celebrate Hanuman Jayanti

New Delhi, April 10, 2025 – Sony SAB’s epic mythological saga, Veer Hanuman has been delighting viewers with the adventures of young Maruti, as he embarks on a journey to uncover his extraordinary powers and purpose. The thrilling tales of Maruti’s early life, showcasing his playful and courageous spirit, his devotion to his parents has struck a chord with audiences who are seeking to discover more about the legend of Lord Hanuman through this show.

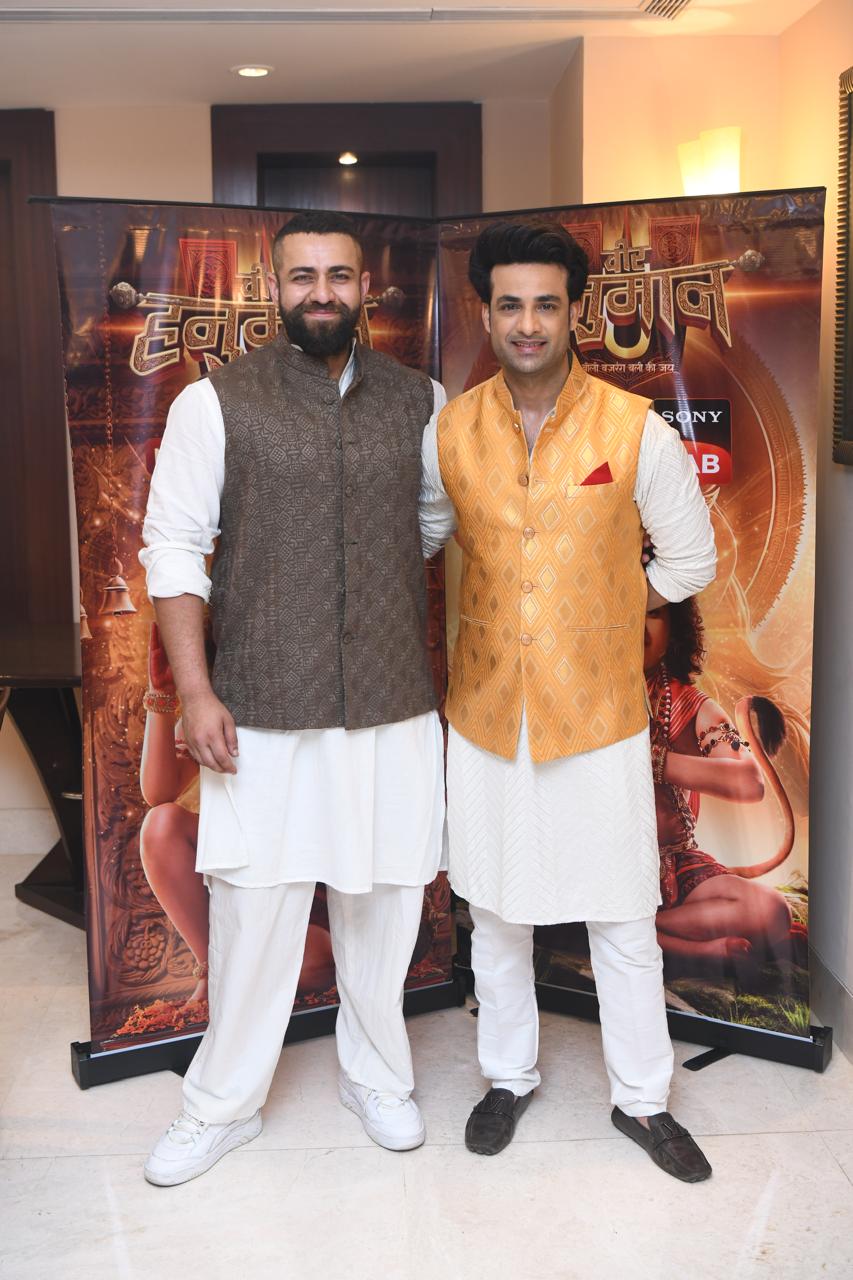

To celebrate the birth of this revered deity, the actors of Sony SAB’s Veer Hanuman – Mahir Pandhi (as Bali and Sugreev) and Himanshu Soni (as Lord Vishnu) visited New Delhi to usher the festivities of Hanuman Jayanti and received an overwhelming response from enthusiastic fans across the capital. To mark the auspicious occasion of Hanuman Jayanti, viewers will get to witness a week-long special celebration with the Maha Saptha of Veer Hanuman , airing from 7th to 12th April .

Sharing his excitement over the visit, Mahir Pandhi, who essays the dual role of Bali and Sugreev, shared, “Playing the contrasting characters of Bali and Sugreev has been an intense and rewarding experience for me, and meeting fans in Delhi brought it all full circle. Bali and Sugreev are complex characters and seeing how viewers have embraced these personalities makes me feel grateful. The upcoming Hanuman Jayanti gave us the perfect time to celebrate this bond with our viewers.”

Adding his thoughts about the visit and the show, Himanshu Soni, who plays Lord Vishnu said, “Ahead of Hanuman Jayanti, visiting Delhi was truly special. It was an emotional moment to see the love and devotion that people carry in their hearts for Hanuman Ji, and for Lord Vishnu as well. The energy, the chants — it was overwhelming in the most beautiful way. It reminded me why this role is so much more than just a character. It is a way to connect with millions of hearts. who believe, pray, and draw strength from these divine stories. This visit was a beautiful reminder of how deeply the show has connected with the audience.”

Zebra Technologies Expands Partner Network to Empower Indian Frontline Workers

JAIPUR, India – 10 April, 2025 – Zebra Technologies Corporation (NASDAQ: ZBRA), a global leader in digitizing and automating frontline workflows, today reaffirmed its commitment to enhancing its channel partner network across India, with a strategic emphasis on expanding its influence in emerging business hubs. Recognizing these areas as pivotal for growth, Zebra aims to extend its reach and impact nationwide.

At the India Partner Summit in Jaipur, Zebra unveiled strategic initiatives to fortify its presence and foster partner innovation. Key announcements included insights into product advancements and initiatives tailored to the Indian market. Industry experts and Zebra’s leadership team participated, underscoring the company’s dedication to driving growth through collaboration and innovation.

“India’s vast potential drives Zebra’s expansion into emerging business hubs,” said Subramaniam Thiruppathi, Director of Sales for India and Sub-Continent, Zebra Technologies. “By empowering frontline workers with AI-driven solutions, we enhance capabilities, allowing partners to explore new sectors like government and healthcare alongside manufacturing, transport & logistics, and retail, allowing them to thrive in the evolving digital landscape.”

Zebra’s vision for India includes equipping frontline workers with advanced, AI-driven tools that are essential for success in today’s competitive environment. This initiative supports partners in delivering solutions that meet the evolving demands of businesses in burgeoning markets through enhanced asset visibility. Additionally, Zebra integrates the concept of connected frontline workers into its strategy, ensuring individuals are equipped with the necessary technology to optimize performance.

As Zebra expands its footprint across India, the company remains dedicated to fostering a collaborative ecosystem that enhances the capabilities of its partners. By leveraging its global expertise and intelligent automation, Zebra is committed to supporting its partners in achieving sustained growth and success.

KEY TAKEAWAYS

- Zebra expands its Indian partner network, targeting emerging business hubs for growth.

- The company is focused on empowering frontline workers with AI-driven solutions unveiled at its India Partner Summit.

- Zebra equips partners with cutting-edge tools to enhance their success in India’s evolving digital landscape.

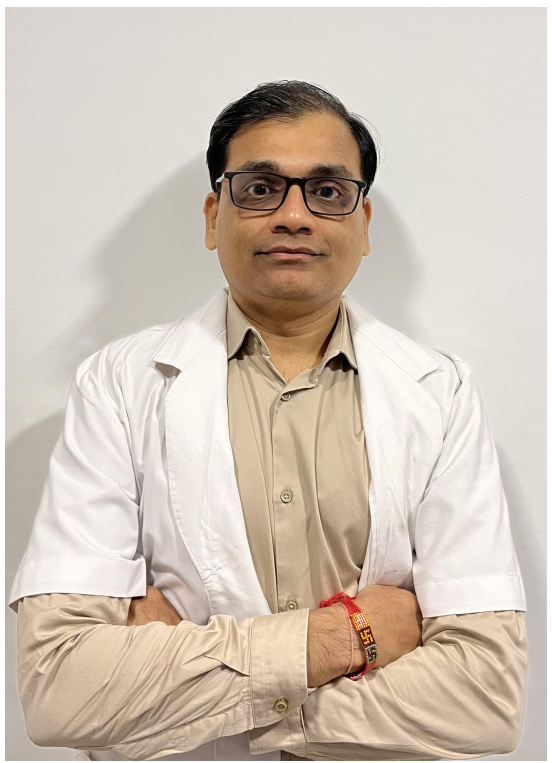

Birla Fertility and IVF Mangalore Offers Hope for Families

Mangalore, April 10th , 2025 – Birla Fertility & IVF Mangalore helped a couple from Kerala fulfil their dream of parenthood with twin babies after enduring years of emotional strain and multiple failed IVF cycles at various other clinics. Under the guidance of Dr. Gaurav Gujarathi, Senior Consultant & Centre Head at Birla Fertility & IVF Mangalore, a personalised treatment strategy based on an in-depth clinical evaluation of the couple’s condition was implemented.

The couple, aged 40 (wife) and 45 (husband), had been through a long and emotionally exhausting journey, facing several failed IVF attempts over the years, with each setback taking a toll on their mental and emotional well-being, leading them to disappointment, and a growing sense of hopelessness. Despite exploring various treatment options and visiting multiple clinics, they were unable to conceive after multiple IVF cycles using both self and donor eggs. The couple then turned to Birla Fertility & IVF Mangalore for a solution to their concerns.

At Birla Fertility & IVF Mangalore, a comprehensive assessment revealed that the female partner had a diminished ovarian reserve, while the male partner was diagnosed with reduced sperm motility, as well as abnormal sperm size and shape. Additionally, the female partner consistently showed a favourable endometrial lining during her natural cycles. Based on this, Dr. Gaurav Gujarathi recommended a modified natural cycle IVF, incorporating donor eggs and the husband’s sperm to best address the couple’s specific clinical profile.

Giving details of the case, Dr. Gaurav Gujarathi, Senior Consultant & Centre Head at Birla Fertility & IVF Mangalore, said, “This couple had endured the emotional toll of multiple IVF failures, we developed a tailored treatment plan that addressed both their medical and emotional needs. Given the wife’s low ovarian reserve and the husband’s sperm challenges, we opted for a modified natural cycle IVF to minimise the physical and emotional strain of medications, optimising their chances of pregnancy.”

“Additionally, we used Platelet-Rich Plasma (PRP) therapy, which involves taking a concentrated form of the patient’s own blood cells and applying it to the uterine lining. This makes the lining thicker and healthier, helping the embryo attach better. After that, we carefully placed two high-quality embryos into the wife’s uterus. This was an important step to give the embryos the best chance to grow and develop.” Dr. Gujarathi added.

After years of uncertainty and emotional hardship, the couple was overjoyed to learn that the treatment had been successful. The wife conceived and gave birth to healthy twins, marking a moment of immense relief and joy for a couple who had endured significant challenges throughout their journey.

At Birla Fertility & IVF, we believe in offering care that goes beyond just medical treatment. Our approach focuses on providing individualised care that addresses both the physical and emotional needs of our patients. We understand that each couple’s journey is unique, and through advanced medical techniques, cutting-edge technology, and compassionate support, we aim to help our patients navigate their path to parenthood. We are thrilled that this approach led to success for this couple, bringing them the joy they had longed for.

Prashant Chaudhary Now Front Office Manager at Novotel Hyderabad

April 10 2025, Hyderabad – Novotel Hyderabad Convention Centre & Hyderabad International Convention Centre (HICC) is pleased to announce the appointment of Prashant Chaudhary as the Front Office Manager. With over a decade of experience in the hospitality industry, Prashant brings a wealth of expertise in front office operations, guest relations, and team leadership.

Prashant Chaudhary

Prior to joining Novotel Hyderabad Convention Centre & HICC, Prashant served as Front Office Manager at Hyatt Centric Kathmandu and Hyatt Place Hyderabad, where he played a key role in enhancing guest experiences and streamlining operational tasks. He has previously worked with renowned hotel brands, including Accor’s Ibis Mumbai Vikhroli and Ibis Gurgaon, where he contributed significantly to customer service excellence and revenue growth.

In his new role, Prashant will oversee the front office team, ensuring seamless guest experiences, optimizing operational strategies, driving the ALL-loyalty program within the property, and upholding the highest standards of hospitality at Novotel Hyderabad Convention Centre & HICC. His leadership will be instrumental in driving guest satisfaction, service innovation, and operational success.

“We are thrilled to welcome Prashant to our team,” said Rubin Cherian, General Manager, Novotel Hyderabad Convention Centre & HICC. “His proven track record in front office management, combined with his passion for guest service, will further elevate the hospitality experience we offer at our property.”

Expressing his excitement about joining the team, Prashant Chaudhary said, “I am delighted to be a part of Novotel Hyderabad Convention Centre & HICC. Looking forward to leading the front office team in creating memorable guest experiences.”

Prashant holds a Bachelor of Science in Hotel and Motel Management from Punjab Technical University and is proficient in multiple hospitality management systems, including PMS-Opera and Opera Cloud. In his leisure time, Prashant enjoys exploring different cuisines, staying active through sports especially cricket and badminton and is passionate about fitness as a gym enthusiast.

Gartner Forecasts Task-Specific AI Surge Over LLMs by 2027

April 10, 2025 — Gartner, Inc. predicts that by 2027, organizations will implement small, task-specific AI models, with usage volume at least three times more than those of general-purpose large language models (LLMs).

While general-purpose LLMs provide robust language capabilities, their response accuracy declines for tasks requiring specific business domain context.

“The variety of tasks in business workflows and the need for greater accuracy are driving the shift towards specialized models fine-tuned on specific functions or domain data,” said Sumit Agarwal, VP Analyst at Gartner. “These smaller, task-specific models provide quicker responses and use less computational power, reducing operational and maintenance costs.”

Enterprises can customize LLMs for specific tasks by employing retrieval-augmented generation (RAG) or fine-tuning techniques to create specialized models. In this process, enterprise data becomes a key differentiator, necessitating data preparation, quality checks, versioning and overall management to ensure relevant data is structured to meet the fine-tuning requirements.

“As enterprises increasingly recognize the value of their private data and insights derived from their specialized processes, they are likely to begin monetizing their models and offering access to these resources to a broader audience, including their customers and even competitors,” said Agarwal. “This marks a shift from a protective approach to a more open and collaborative use of data and knowledge.”

By commercializing their proprietary models, enterprises can create new revenue streams while simultaneously fostering a more interconnected ecosystem.

Implementing Small Task-Specific AI models

Enterprises looking to implement small task-specific AI models must consider the following recommendations:

- Pilot Contextualized Models: Implement small, contextualized models in areas where business context is crucial or where LLMs have not met response quality or speed expectations.

- Adopt Composite Approaches: Identify use cases where single model orchestration falls short, and instead, employ a composite approach involving multiple models and workflow steps.

- Strengthen Data and Skills: Prioritize data preparation efforts to collect, curate and organize the data necessary for fine-tuning language models. Simultaneously, invest in upskilling personnel across technical and functional groups such as AI and data architects, data scientists, AI and data engineers, risk and compliance teams, procurement teams and business SMEs, to effectively drive these initiatives.

Gartner clients can learn more in “Predicts 2025: AI-Powered Analytics Will Revolutionize Decision Making.”

Learn how to ensure that your data is ready for use in the specific AI initiatives you plan to pursue in the complimentary Gartner AI-Ready Data Essentials Roadmap.

Gartner Data & Analytics Summit

Gartner analysts will provide additional analysis on data and analytics trends at the Gartner Data & Analytics Summits, taking place April 28-29 in São Paulo, May 12-14 in London, May 20-22 in Tokyo, June 2-3 in Mumbai, and June 17-18 in Sydney. Follow news and updates from the conferences on X using #GartnerDA.

Hinduja Foundation and Gulf Oil Lubricants India Ltd. Install 500 LPH Water ATM in Chotila for Communities

Mumbai, 10th April, 2025: Hinduja Foundation, as part of its Jal Jeevan Initiative, supported by Gulf Oil Lubricants India Ltd. (GOLIL), inaugurated a 500 LPH capacity Water ATM with a multi-stage treatment system in Chotila, Rajkot, located along the NH-47 highway. The initiative, carried out by Waterlife, was officially launched by Mr. Jayeshbhai, the Upsarpanch of Chanpa Village, with leadership representatives from Gulf Oil Lubricants Ltd. in attendance. The site features a water treatment plant with a 500 LPH processing capacity and multi-stage treatment to ensure the provision of safe, clean drinking water.

Designed to serve local residents, truck drivers, and travellers along the busy highway, the Water ATM will provide purified water to communities in need. Waterlife, an organization dedicated to sustainable water solutions, implemented this project to address the challenge of accessing safe drinking water, particularly in rural areas where clean water sources are often limited or unreliable. By making purified water easily accessible, the initiative aims to reduce the risks associated with waterborne diseases, improving health and well-being for the community.

Mr. Rijvanbhai Ikbalbhai Agariya, owner of Trishual Enterprise and the land provider for the project, expressed his pride in supporting this initiative, believing it will have a lasting, positive impact on the local community. Mrs. Leela Ben, a local female leader, highlighted the crucial role of such initiatives in improving the lives of women and children, who are disproportionately impacted by water scarcity and poor water quality.

The Water ATM is part of a larger effort by the Hinduja Foundation and Gulf Oil Lubricants India Ltd. to address critical issues like health, education, and access to essential resources. Gulf Oil, through its other CSR initiatives, has been actively supporting truckers by providing access to safe and clean drinking water, making this Water ATM in Chotila a natural extension of its commitment to community well-being. The Hinduja Foundation, a philanthropic organization committed to social welfare programs in India, works to positively impact communities by meeting their essential needs and promoting sustainable development. Both entities remain dedicated to supporting initiatives that uplift communities, with the Water ATM serving as an example of how corporate social responsibility can effectively address real-world challenges.

Global & National Fertility Experts Convene at Birla’s ‘Fertility Unscripted’

New Delhi, 10 April 2025: Birla Fertility & IVF, India’s third-largest IVF network and a part of the USD 3 billion CK Birla Group, reaffirmed its leadership in reproductive care with ‘Fertility Unscripted,’ a Continuing Medical Education (CME) programme that hosted an incredible lineup of fertility specialists, thought leaders, and industry pioneers from around India and globally. The event, which was organised in New Delhi, was a unique confluence of medical brilliance, fostering an exchange of excellence, cutting-edge advancements in infertility treatment, high-risk pregnancy management, and the future of reproductive technologies.

The event was graced by some of the most renowned personalities in reproductive medicine, including Dr. Professor (Colonel) Pankaj Talwar, President of the Indian Fertility Society (IFS), Guest of Honour Dr. Neerja Bhatla, former Head of Obstetrics & Gynaecology at AIIMS, Dr. B.B. Dash, renowned Gynaecologist and Laparoscopic Surgeon at Rejoice Hospital, and Dr. Jyotsana Pundir, leading global fertility specialist with over 25 years of experience. Discussions were led by expert doctors of Birla Fertility & IVF, including Dr. Prachi Benara, Dr Muskaan Chhabra, Dr. Shilpa Singhal, and Dr. Nidhi Tripathi. Their vast expertise, combined with international insights, elevated the discussion to make it a distinctive experience for everyone present.

Infertility affects nearly 15% of Indian couples, but only 1% seek treatment due to the lack of awareness and accessibility. To bridge this gap and shape the future of fertility care in India, Birla Fertility & IVF is spearheading efforts to bring advanced knowledge into the circuit. Through ‘Fertility Unscripted,’ Birla Fertility & IVF is encouraging knowledge sharing, collaborative learning and technological innovation, equipping medical professionals with evidence-based, best-practice approaches to modern fertility treatments.

The programme was a convergence of expertise and insight, with discussions covering some of the most pressing topics in reproductive medicine today. From the role of advanced laparoscopic techniques in fertility treatment to the evolving landscape of Assisted Reproductive Technology (ART) regulations, each session was meticulously designed to provide deep insights and understanding. Experts exchanged insights on topics such as varied regulations for recurrent pregnancy losses, the integration of advanced imaging and diagnostic technologies in fertility treatment, smart surgeries in infertility, the techniques of mastering an ultrasound, going beyond nuchal translucency in first-trimester screening, and male infertility. These discussions emphasised the increasing need for multidisciplinary collaboration to improve treatment success rates and enhance patient satisfaction.

Abhishek Aggrawal, CEO, Birla Fertility & IVF, highlighted the significance of such forums in driving the future of fertility care. “Gynaecologists are usually the primary point of contact for couples or individuals with fertility or reproductive health needs. Their role is pivotal in early identification of concerns, initiating the right interventions at the right time and guiding patients with advanced knowledge and utmost empathy. Through our initiative, ‘Fertility Unscripted,’ our aim is to foster the exchange of expertise, experiences, and evidence-based practices across the medical community. By bringing together the voices from across India and the world, we want the practitioners to be proficient in the latest advancements and protocols that can transform patient outcomes and make reproductive healthcare more accessible, standardised, and effective across the country.”

With its distinguished panel of experts and a firm focus on scientific advancements, ‘Fertility Unscripted’ asserted Birla Fertility & IVF’s commitment to leadership in thinking, international collaboration, and clinical quality. As the fertility chain continues its rapid expansion across India, its commitment remains to empower both patients and specialists with the best in fertility care.

By bringing together medical experts, encouraging innovative conversations, and propelling technological advancements, ‘Fertility Unscripted’ has created a new standard in reproductive healthcare discussion, solidifying Birla Fertility & IVF’s leadership in fertility care in India.

LVPEI Launches WHITATHON 2025 Poster with Mascot ‘Pearlee’

Hyderabad, 10th April 2025: WHITATHON is L V Prasad Eye Institute’s (LVPEI) annual cause-related run to raise awareness and funds for early diagnosis and treatment of Retinoblastoma. The funds raised from the WHITATHON Run will be used towards the free treatment of underprivileged children battling retinoblastoma at LVPEI, and to fund groundbreaking research that improves the understanding of the eye cancer and develop more efficient and effective treatment protocols.

Designed as a friendly and approachable character, Pearlee features a visible ‘white reflex’ (Leukocoria) in the eye—one of the symptoms of Retinoblastoma. Pearlee plays many roles, that of an ambassador, an advocate, a buddy, an educator, a motivator bringing attention to the symptoms, encouraging parents and caregivers to seek timely medical attention.

WHITATHON 2025 offers diverse running categories suitable for various fitness levels – 21 km, 10 km and 5 km competitive runs, alongside 5 km and 3 km fun runs. WHITATHON has also introduced a 21K half marathon category this year which will serve as a qualifying run for individuals aspiring to participate in the NMDC Hyderabad Marathon.

Thanks to the funds raised over the years, LVPEI has been able to offer over 3000 treatments free of cost and was able to save the life of the child in 90% of the cases presented. However, vision could be saved in only 45% of these cases, due to delayed presentation for treatment.

“When identified promptly and in the early stages, Retinoblastoma is highly curable and can save the vision of numerous young lives”, said Dr Swathi Kaliki, Head of the OEU – Institute for Eye Cancer, LVPEI.

11 New Passive Funds Tracking Nifty Indices Explained

In FY 2024-25, a total of eleven new passive funds (Exchange Traded Funds and Index Funds) tracking Nifty Indices were launched in Japan and Korea. Of these, 9 funds track the Nifty 50 Index, while one tracks the Nifty India Corporate Group Index – Tata Group 25% and another tracks the Nifty Midcap 50 Index.

| Sl. No. | Issuer Name | Country | Index Name |

| 1 | Amundi Asset Management | Japan | Nifty 50 |

| 2 | Asset Management One | Japan | Nifty 50 |

| 3 | Asset Management One | Japan | Nifty Midcap 50 |

| 4 | au Asset Management Corporation | Japan | Nifty 50 |

| 5 | Daiwa Asset Management Co. Ltd. | Japan | Nifty 50 |

| 6 | iShares Blackrock | Japan | Nifty 50 |

| 7 | KB Asset Management | South Korea | Nifty 50 |

| 8 | Nikko Asset Management Co. Ltd. | Japan | Nifty 50 |

| 9 | Rakuten Investment Management, Inc. | Japan | Nifty 50 |

| 10 | Samsung Asset Management Co Ltd. | South Korea | Nifty India Corporate Group Index – Tata Group 25% |

| 11 | Shinhan Asset Management | South Korea | Nifty 50 |

Presently, there are 33 passive funds tracking Nifty Indices outside India with a total AUM of USD 4.3 billion. These products have been launched by large global asset managers.

As of the end of February 2025, the total AUM of passive funds (Equity & Debt) in India is Rs 9.8 Lakh Crores of which 73% is tracking Nifty Indices. There are 391 passive funds tracking various Nifty Indices in India with a total AUM of Rs 7.1 Lakh Crores.

Shri Aniruddha Chatterjee, MD, NSE Indices Limited, said: “There is a growing demand from global asset managers for India-focused passive investment products. FY 2024-25 has been a landmark year for NSE Indices with the successful launch of eleven passive products based on Nifty indices outside of India. We anticipate this trend to continue with numerous India-focused passive products

set to be introduced globally in the current financial year. We remain committed to collaborating with our clients to develop and launch innovative India-focused indices for these products.”

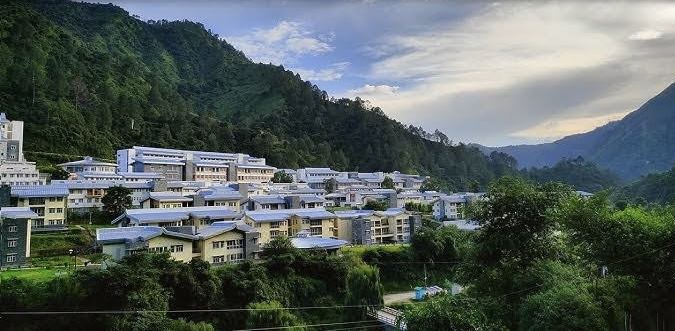

IIT Mandi’s Sharma Receives Institute of Engineers Fellowship

April 10th, 2025; Mandi: Superintending Engineer – Vijay Kumar Sharma from IIT Mandi has been awarded with a fellow membership by the “Institute of Engineers (India)”. With over 30 years of experience in the field of civil engineering, Sharma contributed to the numerous significant projects throughout his career. It was for his outstanding performance over two years at IIT Mandi, he has been selected as a Fellow in the Institute of Engineers (India). Additionally, Sharma has also been awarded the Chartered Engineer (India) Certificate.

It is to be noted that Vijay Kumar Sharma started his career as an engineer in BSNL construction. He served BSNL for 29 years. During this time period, he worked on telephone exchange building, colony, mobile tower and many big projects of the state in BSNL. He also constructed polytechnic college, hospital and many schools of Himachal government.