Dupahiya Characters Meet OG Roadies Judges in Epic Crossover

3rd March 2025: What happens when three desperate small-town misfits crash a reality show audition, convinced it’s their only shot at winning back a stolen motorbike? Absolute mayhem! In a never-before-seen crossover, Prime Video’s upcoming dramedy Dupahiya unleashes a promo like no other—Kaun Le Jayega Dupahiya—featuring Banwari Jha (Gajraj Rao), Amavas (Bhuvan Arora), and Bhugol (Sparsh Srivastava) as they hilariously attempt to impress the formidable trio in reality TV—Raghu, Rajiv, and Rannvijay.

Dressed in their most “audition-worthy” outfits, Banwari, Amavas, and Bhugol walk into the audition room, armed with misplaced confidence and zero clue about what’s coming. The result? One of the riotous yet funniest auditions in reality show history! Banwari, lost in translation, accidentally lists “Looking for Dupahiya” as his occupation, dramatically justifying it with, “I thought this was an aim, so I wrote – TO FIND DUPAHIYA,” leaving Raghu and Rajiv completely stunned. Meanwhile, Bhugol, under the hilarious delusion that it’s a dance competition, breaks into an over-the-top performance, while Amavas battling with hiccups slyly steals Rannvijay’s watch mid-audition! The chaos skyrockets as Rannvijay chases Amavas across the set, while Banwari and Bhugol watch the madness unfold. If you thought Roadies auditions were intense, Dupahiya takes it to a whole new level of insanity!

With this outrageous audition and mind-blip crossover, Dupahiya promises a high-energy, laugh-out-loud adventure packed with quirky characters, razor-sharp humor, and a delightful dose of small-town charm.!

Created and Executive Produced by Salona Bains Joshi and Shubh Shivdasani under their banner, Bombay Film Cartel, Dupahiya is directed by Sonam Nair and created and written by Avinash Dwivedi and Chirag Garg. The nine-episode rollercoaster boasts a superbly talented cast, featuring Gajraj Rao, Renuka Shahane, Bhuvan Arora, Sparsh Shrivastava, Shivani Raghuvanshi, and Yashpal Sharma in key roles. Dupahiya will premiere exclusively on Prime Video in India and over 240 countries and territories worldwide on March 7.

Rescript Boosts Brand Awareness with Upload Digital Campaign

3rd March 2025: Upload Digital, a leading digital transformation and growth studio in India and the UAE, has been working with Rescript Stationery for the past four years, helping to shape Rescript’s journey from an emerging startup to a recognized pioneer in sustainable stationery. From designing its logo to executing a strategic marketing approach, Upload Digital has played a crucial role in establishing Rescript as a pioneer in sustainable stationery.

The stationery industry has traditionally prioritized conventional materials, making it difficult for sustainable alternatives to gain mainstream acceptance—rescript aimed to change this by introducing eco-friendly paper. However, a major challenge was consumer skepticism—many believed sustainable paper lacked the quality of traditional white-bleached options. Upload Digital needed to shift this perception and prove that sustainability and quality could coexist.

To address this, Upload Digital launched a campaign featuring direct product comparisons, lots of educational content, and experiential marketing. One of the most impactful initiatives involved sending personalized letters printed on Rescript paper to over 100 businesses, allowing them to experience its quality firsthand.

Additionally, the team used data-driven strategies and SaaS tools to identify and engage corporate clients seeking sustainable alternatives. This approach helped Rescript expand its reach in both the B2B and D2C markets.

Rescript’s branding and marketing efforts led to significant business growth. The company recorded 400K+ yearly website visitors since launch (until 2024), built an organic social media community of over 12K followers, and generated 2,000 wholesale inquiries in a year. Following Upload Digital’s on-ground activation, Rescript saw a 30% increase in website traffic and a 50% rise in sales inquiries.

With Upload Digital’s expertise, Rescript has not only carved a niche in the sustainable stationery market but has also proven that eco-friendly products can match industry standards in both quality and appeal.

Radhika Gupta, Founder of Upload Digital, said, “Rescript’s commitment to sustainability aligns seamlessly with our mission to drive purpose-led brand growth. Over the past four years, we have not just built their brand identity but crafted a strategy that fosters engagement, trust, and business impact. Over the past four years, we have worked closely to not only build their brand identity but also drive meaningful engagement and business growth. It’s been incredibly rewarding to see Rescript become a pioneer in eco-friendly stationery.”

Naren Raj, CEO of Rescript Stationery, added, “Working with Upload Digital has been a game-changer for us. Their expertise in branding, marketing, and digital strategy has helped us establish Rescript as a leader in the sustainable stationery market. From logo design to targeted campaigns, they have been instrumental in our journey of growth and innovation.”

TFI Delegates Visit TSCS Hyderabad

Hyderabad, 3rd March 2025: A special delegation from Thalassemia International Federation (TIF) visited Kamala Hospital and Research Centre for Thalassemia and Sickle Cell Patients (KHRCTSCS) – a dedicated unit of the Thalassaemia and Sickle Cell Society (TSCS) in Shivrampally, Hyderabad. This marks a historic achievement, as TSCS has been recognized as the largest and best hospital globally for its unwavering dedication to the care of Thalassemia patients, offering 100% free services to those in need.

This recognition follows a thorough inspection by leading figures from the “THALASSEMIA INTERNATIONAL FEDERATION “, based in Italy and Greece. The esteemed delegation, led by Professors Antonio Piga & Dr. Dimitrios Farmakis, Associate Professor at the University of Cyprus Medical School, Greece, expressed their full satisfaction after an entire day of assessment. Kamala Hospital & Research Centre’s remarkable services to the Thalassemia community stood out, cementing its reputation in India to enter into such an exclusive collaboration with TIF.

Dr. Farmakis, alongside Dr. Chandrakant Agarwal, President of the Thalassemia and Sickle Cell Society, and Dr. Suman Jain, CEO & Secretary, recognized Kamala Hospital’s unmatched role in providing comprehensive, high-quality care to Thalassemia patients. They also commended the hospital’s commitment to delivering these services free of cost to thousands of patients across India.

Dr. Farmakis further stated, “I am incredibly impressed by the work done at TSCS. It is, without a doubt, the biggest and most significant Thalassemia Centre I have ever visited. This collaboration with the Thalassemia International Federation will set a new benchmark in the global fight against Thalassemia, enabling us to work together to achieve miracles in thalassemia prevention and care.”

The collaboration was celebrated in the presence of TSCS leadership and community members, including Mrs. Ratnavali, Vice President, and the Board Members, key doctors, senior staff, and patients. The visit also included a tour of the Thalassemia and Sickle Cell Society (TSCS), which was also lauded for its pioneering role in serving Thalassemia patients.

“We are honored to be recognized by the Thalassemia International Federation and feel grateful to have an opportunity to collaborate with such a prestigious global organization. This partnership will help us expand our reach and impact, offering life-saving treatments to even more Thalassemia patients in India and beyond,” said Dr. Chandrakant Agarwal, President, TSCS.

Ryan International Kanakapura Celebrates Annual Day & Graduation

Bengaluru,3rd March, 2025 – Ryan International Academy, Kanakapura hosted a spectacular Annual Day and Graduation Day celebration with the inspiring theme “Roots to Grow, Wings to Fly.” The event held recently was a grand showcase of talent, achievement, and resilience, bringing together students, parents, and distinguished guests.

The celebration was graced by Chief Guest Mrs. Chaitanya Subrahmanya, a passionate environmentalist and social worker, who presided over the Mont 3 Graduation Ceremony, marking an important milestone for young graduates stepping into their primary school journey. The esteemed Guests of Honor, Kannada film actor Praveen Tej, Priya Prashanth (Mrs. India Galaxy Runner-up 2017), and Dr. Jhanvi Rayala (Actor, Dancer, and Producer) joined in celebrating the success and aspirations of Ryanites.

The event had commenced with a series of spectacular performances that had beautifully brought the theme to life. An instrumental symphony by Grade 5-6 students had mesmerized the audience, while The Dreamers Boys had delivered a power-packed dance performance that had left the crowd enthralled. A captivating musical skit by Mont, Grade 1, and Grade 2 students had spellbound the audience, encapsulating the essence of the theme. A grand musical orchestra had showcased the artistic excellence of Ryanites, and the choir group’s soulful performance had resonated with the audience, adding a touch of harmony to the evening.

One of the key highlights was the Ryan Prince & Princess Awards, alongside the Student of the Year and Rising Star Awards, recognizing exceptional talent and dedication among students. Parents expressed immense pride in their children’s achievements, appreciating the hard work and dedication showcased on stage.

“The vision and leadership of Chairman Dr. A.F. Pinto, Managing Director Madam Grace Pinto, and CEO Ryan Pinto continue to shape and inspire young minds, empowering them with strong values and confidence to achieve greatness. We aim to nurture well-rounded individuals who are rooted in values while being prepared to embrace the future with strength, determination, and confidence,” said Ms. Laxmi Kedareshwaran, Principal at Ryan International Academy, Kanakapura.

The Annual Day and Graduation ceremony at Ryan International Academy, Kanakapura, showcases the institution’s dedication to promoting both academic excellence and creative expression. With over 90 students participating in various performances, the event not only celebrated individual achievements but also reinforced the school’s vision of creating confident, culturally aware young leaders. As the school continues to build on its foundation of holistic education, this year’s theme “Roots to Grow, Wings to Fly” stands as a testament to Ryan International’s commitment to nurturing students who are firmly grounded in values while being empowered to reach for their highest aspirations.

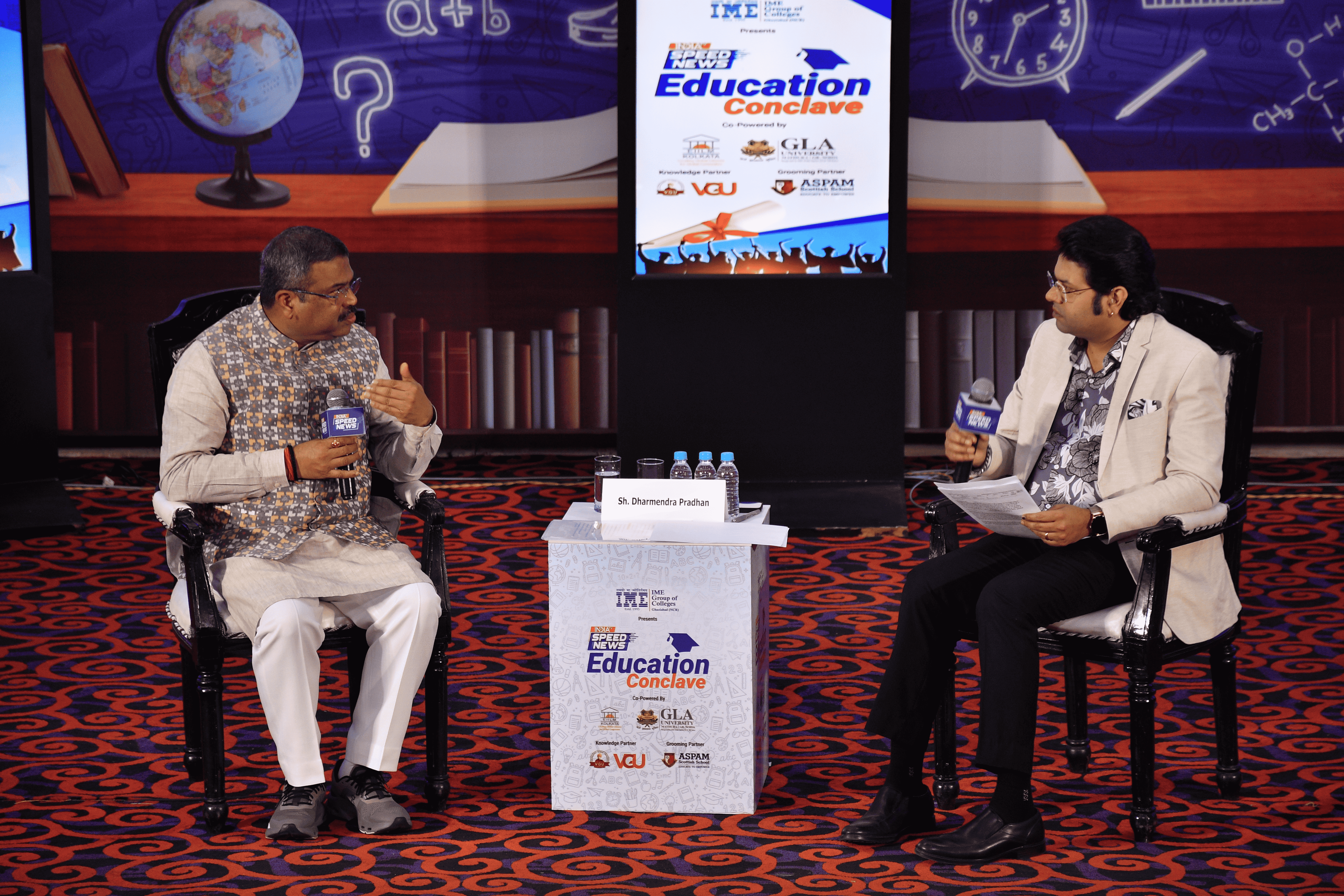

India TV Speed News Hosts Education Conclave Key Highlights

New Delhi, March 3rd, 2025: A premier news and broadcasting channel, India TV Speed News recently held the much-anticipated Education Conclave 2025 in New Delhi. The event brought forth key stakeholders from the education sector to nurture discussions on equipping Indian students with future-forward skills.

The Chief Guest of the day, Shri Dharmendra Pradhan, Union Education Minister of India, discussed strategic initiatives to enhance the nation’s educational output. In the same spirit, he underlined the role of NEP 2020 in influencing the future of students, thereby ensuring quality education and overall skill development. He further reiterated that the policy prioritises education in mother tongues to enhance comprehension and cognitive development. Addressing a question about the progress in the Indian education system, he expressed optimism in its ability to provide holistic development to an enormous 26 crore student population. In addition, he discussed the role of emerging technologies in education which are bound to equip students with the necessary skills to compete globally.

The first session of the day, ‘Dakhile ki Daudh, Dakhile ki Hoadh’ kicked off discussions on the growing pressure of nursery admissions, where parents compete for top schools. The panellists opined that while securing quality education is important, instilling good values in students is equally crucial. The next session was titled, ‘How are Indian Educational Institutions Enhancing Infrastructure and Curriculum to Meet International Standards?’ As part of it, eminent educationists discussed the need for government initiatives to fall in tandem with quality education and training to meet the needs of a global workforce. Then, ‘Berozgaari ko karo Kill, Badhao Yuvaaon ka Skill’, emphasised the need for skills in education. The keynote speaker, Dr. Anil Sahasrabudhe, Chairman of NET shared his views on the relevance of fields like ML, Data Science, Data Security, Cybersecurity and AI, which will create new jobs and raise employability. He also stressed upon the need for acquiring skills through digital platforms to stay abreast.

Furthermore, Ms. Ritu Dhawan, Managing Director, India TV shared her thoughts on the conclave, “India TV Speed News Education Conclave 2025 sparked important conversations about the future of education. By bringing together eminent educationists, policymakers and officials, we hoped to shed light on the improvements in the quality of education in the country. In this context, we aim to empower students with the pertinent skills and knowledge to succeed in an evolving world. This conclave is a step forward in ensuring that education remains relevant to the needs of tomorrow’s workforce.”

Following this, the panel, ‘Why do Engineering and Medical Graduates Opt for Civil Services, Banking, or Startups?’ had insights from Rajesh Kumar Pathak, Secretary, Technology Development Board, Ministry of Science and Technology. He debated the shift of graduates from core fields, underlining the importance of understanding one’s interests early in their education. He advised parents against pushing children into conventional careers and hoped that NEP 2020 would help bridge this gap. The session on ‘The Role of Social Media in Education – Opportunities & Threat’ then discoursed the rising number of smartphones, social media platforms which have emerged as powerful tools of attaining education. Weighing its pros and cons, the panel converged on the need for regularisation to ensure that the right knowledge reaches students.

During the conclave, a special session was devoted to ‘National Education Policy’. It comprised prominent speakers, JS Rajput, Former Director, NCERT and Professor Poonam Verma, Principal, Shaheed Sukhdev College of Business Studies. They discussed the relevance of new-age skills and the need for modern learners to adapt to them. In the next panel, ‘Abroad Education Craze’, Professor H.P Gupta, Chairman, IME Group of Colleges and Er. Onkar Bagaria, CEO & Trustee, VGU, Jaipur examined the reasons behind the pursuit of an education abroad. They delved whether foreign degrees truly guarantee better job placements.

In ‘Admission is not Guaranteed’, eminent professors from the University of Delhi discussed the struggle of high cut-offs and the CUET entrance examination system, which has rendered board percentiles irrelevant. They focused on skilling, upskilling and re-skilling to stay relevant in today’s job market scenario. Additionally, the session ‘Indian Education System & the Coaching Industry: Necessity, Business, or Burden?’ underlined on the role of coaching institutes in competitive exams, the challenges faced, and the growing need for regulation. It also included debates on the financial, emotional, and social burdens that coaching institutes place on students and their families. In line with this, ‘Paper Leak: System Kaise Thik?’, addressed the critical challenges of building a robust examination system to cater to a vast student population at both national and state levels. Dr. Sanyam Bhardwaj, Controller of Examinations, CBSE and Prof RK Singh, Dean Student Welfare, Indira Gandhi Delhi Technical University emphasised the need for corrective measures to be implemented in response to paper leak incidents.

Towards the end, ‘Is Our Education System Becoming Excessively Competitive and Stressful for Children and Youth?’, underscored the mental pressure students experience, debating instances of student suicide in coaching hubs like Kota. Dr. Sameer Malhotra, Director and Head, Department of Mental Health and Behavioral Sciences, Max Healthcare, Dr. Surabhika Maheshwari, Associate Professor, Psychologist and Pooja Chadda, Senior Councellor, Amity International School expressed their views on the subject. They concluded that striking a balance between academic pressure and mental well-being is the need of the hour.

As a prominent media organisation, India TV is creating awareness and empowering today’s youth by exploring innovative educational solutions. It remains committed to ensuring that education is relevant, accessible, and futuristic for the upcoming generation of learners.

India TV Speed News:

Driven by the core values of Continuity, Composition, and Credibility, India TV Speed News is India’s first 24X7 fast news channel, brought to you by the India TV Group. Offering a comprehensive range of updates in Hindi, it covers everything from political developments and general news to sports, entertainment, business, and global events. Starting on connected TV, it has broken new ground as the first linear channel to adopt a digital-first strategy.

Cornitos Shines at Gulfood 2025 with Bold Flavors and Innovation

3rd March 2025 – Cornitos, the flagship brand of Greendot Health Foods Pvt. Ltd., made a dynamic impact at the 30th edition of Gulfood, the world’s largest annual food and beverage trade show, held at the Dubai World Trade Centre. The brand-captivated attendees with its latest range of innovative and healthy snacks, including the newly launched Crusties, a baked, guilt-free delight that adds a bold twist to snacking. With a focus on flavor, quality, and health, Cornitos reaffirmed its commitment to providing premium snacking experiences to a global audience.

At the event, Cornitos unveiled exciting flavours of Crusties, a range of crunchy, baked snacks designed for those who crave indulgence without the guilt. The newly launched flavors took center stage, with Korean Chilli bringing a spicy, umami-rich punch, Fiery Peri Peri delivering a bold and zesty kick, and Sour Cream & Onion offering a creamy, tangy delight. The Cheese Balls—available in Classic Cheese and Honey Chilli Potato Ball—proved to be crowd favorites, offering a perfect balance of savory richness and subtle heat. Cornitos presented its beloved Nacho Crisps, crafted with premium corn and infused with flavors such as Peri Peri, Cheese & Herbs, and Sea Salt. Alongside the other highlighted products include Gourmet Nachos, Taco shells and Combo Tray Packs, elevating the snacking experience to a whole new level for the guests.

Manoj Singh, Head of Marketing at Cornitos expressed his excitement about the brand’s participation at Gulfood 2025, quoted “The event proved to be a tremendous opportunity for Cornitos, with attendees particularly drawn to CRUSTIES, the brand’s latest baked snack range. The newly introduced flavors received high praise for their unique and bold taste profiles, further establishing Cornitos as an innovator in the snacking industry. The brand’s signature Nacho Crisps and dips also remained a favorite among visitors. With Gulfood serving as a global platform to showcase innovation, Cornitos strengthened its presence in the international market, winning the hearts of snack enthusiasts and industry professionals alike”.

Cornitos’ participation at Gulfood 2025 was met with phenomenal enthusiasm, as attendees relished the brand’s offerings and appreciated its focus on innovation and health. The event, which saw over 50000 exhibitors visited Indian Pavillion from 30+ countries, reinforced the brand’s global appeal and commitment to catering to evolving consumer preferences. With innovations and high-quality snacking at the core, Cornitos continues to push boundaries in the snacking industry, bringing flavourful and wholesome experiences to snack lovers worldwide.

MIA & Zerodha Varsity Empower Women with Financial Literacy

Chandigarh, 3rd March 2025: This International Women’s Day, Mia, one of India’s leading fine jewellery brands, is celebrating women by offering them the power to take control of their financial future. Mia, in partnership with Zerodha Varsity, the educational wing of India’s leading fintech platform Zerodha, is hosting an exclusive, all-women, free online masterclass designed to make financial independence accessible, achievable, and truly empowering.

For years, Mia has championed women—helping them unlock their potential, whether through health, sports, or now, finance. This initiative is yet another step towards that mission – It’s about giving women the confidence to own their financial narratives, the freedom to make choices, and the security to dream bigger.

The online session will offer practical, easy-to-understand lessons on managing personal finances, understanding the basics of investing, and building long-term wealth. With Zerodha at the forefront of India’s fintech revolution, Zerodha Varsity has emerged as a trusted financial education platform, equipping individuals with the knowledge to navigate the world of finance. Participants will also learn how to incorporate gold investments into their wealth-building journey, bridging Mia’s legacy in fine jewellery with modern financial wisdom. Register today to take your first step towards financial freedom through financial literacy.

Commenting on the initiative, Ms. Shyamala Ramanan, Business Head, Mia, said, “At Mia we believe confidence shines brightest when it comes from within, and financial literacy is a powerful way to build that confidence. This International Women’s Day, we’re thrilled to partner with Zerodha Varsity with a collective aim to make financial literacy more accessible and practical. We’re excited to go beyond jewellery and equip women with the tools to achieve financial freedom.”

Commenting on the collaboration, Mr. Karthik Rangappa, Chief of Education, Zerodha said “Money conversations in Indian households have long been unequal—not due to lack of capability, but because women were kept away. Yet, women are natural money managers, bringing emotional balance and long-term thinking to financial decisions. While participation remains low, change is happening. We’re excited to partner with Mia for a special Women’s Day personal finance session—because financial independence isn’t just about money, but the choices and freedom that come with it. This initiative is just the beginning of a larger movement to empower women in finance.”

Prega News Challenges Perceptions with Women’s Day Campaign

Mumbai; March 3, 2025: Prega News, India’s leading pregnancy detection kit brand from Mankind Pharma, has unveiled its latest Women’s Day campaign that addresses the critical issue of societal attitudes towards working mothers. The thought-provoking campaign video titled #shecancarryboth showcases how society often struggles to accept and appreciate women who excel in both their professional and maternal roles.

The emotionally resonant narrative follows a parent-teacher meeting at a school, where Sanvi, a young student, awaits her mother’s arrival amidst judgmental whispers from other parents. The story takes a powerful turn when Sanvi’s mother, a decorated Army officer, arrives in full uniform, just in time for Sanvi’s turn. Before the meeting, Sanvi’s teacher asks her to read out a paragraph she wrote on her role model, challenging preconceived notions about maternal responsibilities and professional commitments.

“Through this campaign, we aim to spark a crucial conversation about how society views and treats working mothers,” said Joy Chatterjee, Vice President, Sales and Marketing Head of Mankind’s Consumer Business Unit. “While women have made significant strides in their professional journeys, societal mindsets often lag behind, creating unnecessary pressure and judgment. This campaign reinforces our commitment to supporting and celebrating women who challenge these stereotypes.”

The campaign gains added significance as an Ashoka University report revealed that 73% of Indian women exit their jobs after childbirth and struggle to re-join the workforce. Among those who manage to return to work, 48% drop out within four months of reintegration. By showcasing a military officer who successfully balances her role as a mother and a defender of the nation, Prega News emphasises that maternal love isn’t measured by conforming to traditional expectations.

“What makes this campaign special is its focus on the child’s perspective. Through Sanvi’s heartfelt essay about her ‘superhero’ mother, we see how children appreciate and draw inspiration from their working mothers,” Mr Chatterjee added. “This narrative challenges the guilt often imposed on working mothers by highlighting how their professional success can positively influence their children’s aspirations.”

The #shecancarryboth campaign builds upon Prega News’ consistent commitment to women’s empowerment, following last year’s successful #shecancarryboth initiative. As India’s premier pregnancy detection brand with an 85% market share (as per IQVIA, MAT March 24), Prega News continues to champion progressive values and challenge societal norms that limit women’s potential.

Godrej Launches Smart Security Range for Modern Homes and Businesses

Chandigarh 3rd March, 2025: The Security Solutions business of Godrej Enterprises Group has introduced its latest range of premium, tech-enabled Home Lockers, strengthening its portfolio and market share in the Security domain. Designed to seamlessly integrate with modern home aesthetics, these home lockers combine sophisticated design with technology, ensuring both uncompromised security and elegant appeal. The business is targeting a growth of 20% in FY26.

Mr. Pushkar Gokhale, Executive Vice-President and Business Head of the Security Solutions Business of Godrej Enterprises Group, said, “As a preferred brand for over a century, we have continuously reinvented ourselves shaping a category that has evolved alongside Indian homes. With our latest range of home lockers, we are once again redefining security. We are eager to launch our new range of lockers that are equipped with varied of unique features, robust security and spacious design to meet the need of the consumers. We have also launched lockers that are catering to Tier 2 markets to further strengthen our brand presence. We are constantly exploring new technology partnerships and investments to stay ahead of the market. We have invested significantly in the past 3 years to build a robust portfolio of advanced security products and solutions”.

He further added, “We continue to lead the home locker category and we are aiming to achieve a market share of close to 70% in the category by FY2026, and these state-of-the-art products shall further strengthen our leadership in the security solutions market”.

As the only player offering a comprehensive suite of security solutions across households, institutions, BFSI and large-scale infrastructure projects, Godrej is strategically positioned to expand its footprint in both consumer and institutional segments. Building on this momentum, the company’s latest home locker range addresses diverse consumer needs; from offering discreet, space-saving designs to robust security solutions that are premium and aesthetic. A key driver of this growth is continuous investment in R&D that Godrej has been instrumental in. The new range of home lockers reinforces Godrej’s commitment to offering future-ready security solutions tailored to evolving consumer needs.

The newly launched range of home lockers includes NX Pro Slide, NX Pro Luxe, Rhino Regal, and NX Seal. Designed to cater to diverse consumer needs, these products feature dual-mode access (digital & biometric), intelligent Ibuzz alarm system, efficient storage and elegant interiors that seamlessly integrate security with modern home aesthetics. Additionally, Godrej has also launched the Defender Aurum Pro Royal Class E safe, a BIS-certified high-security safe designed for jewellers, meeting the new Quality Control Order (QCO) effective June 2024. The AccuGold iEDX Series enables precise, non-destructive gold testing for jewelers, banks, and hallmarking centers. The Godrej MX portable strong room modular panels offer high-security, easy transport, and setup.

Expanding into Tier 2 and Tier 3 cities, Godrej is strengthening its distribution, partnerships, and digital presence while accelerating global expansion across 45+ countries. With cutting-edge products and a customer-first approach, Godrej Security Solutions continues to set industry benchmarks in safety and reliability.

With a strong pipeline of innovative products, strategic investments, and a customer-first approach, the Security Solutions business of Godrej Enterprises Group continues to set industry benchmarks—offering security solutions that protect, empower, and inspire confidence.

AMD Unveils RDNA 4 Architecture with Radeon RX 9000 Series

India, March 3rd, 2025 – AMD (NASDAQ: AMD) today unveiled the highly-anticipated AMD RDNA™ 4 graphics architecture with the launch of the AMD Radeon™ RX 9070 XT and RX 9070 graphics cards as a part of the Radeon™ RX 9000 series. The new graphics cards feature 16GB of memory and extensive improvements designed for high-quality gaming graphics, including re-vamped raytracing accelerators and powerful AI accelerators for ultra-fast, cutting-edge performance, and breakthrough gaming experiences.

In a YouTube Premier, David McAfee, CVP and GM, Ryzen CPU and Radeon Graphics at AMD, was joined by Andrej Zdravkovic, SVP of GPU Technologies and Engineering and Chief Software Officer, as well as Andy Pomianowski, CVP of Silicon Design Engineering, to discuss the outstanding performance and value proposition of the Radeon RX 9000 Series. In a related event in Zhuhai, China, Jack Huynh, SVP of the Client and Graphics Group, AMD, led a regional event for the new products. Huynh was joined by David Wang, SVP of GPU Technology and Engineering, and Lanzhi Wang, Senior Director of Product Management. The celebration was also marked by a customer celebration with Darren Grasby, EVP and AMD Chief Sales Officer, Spencer Pan, President of AMD China, and partners including Asrock, ASUS, Gigabyte, Sapphire, Tul, Vastamore, Veston, and XFX.

“Today, we’re thrilled to unveil the AMD Radeon™ RX 9000 series, a significant leap forward in graphics performance powered by our next-generation AMD RDNA™ 4 architecture,” said McAfee. “These GPUs are designed to meet the demands of today’s games, delivering enthusiast-class gaming experiences to gamers everywhere, while ready to support tomorrow’s innovations. Through the power of advanced AI and Raytracing accelerators, we’re not just improving frame rates – we’re fundamentally enhancing the gaming experience. Offering incredible performance, AI-powered features, and next-gen display support at competitive price points, the Radeon RX 9000 series delivers exceptional value for gamers looking to upgrade their systems.”

The RX 9000 series, powered by the new AMD RDNA™ 4 architecture, offers gamers and creators a powerful blend of performance, visuals, and value. These advanced graphics cards redefine incredibly fast, high-resolution gaming with third-generation raytracing technology enabling realistic lighting, shadows, and reflections to deliver immersive gaming experiences while integrating a suite of AMD features to maximize hardware utilization. Beyond gaming, the RX 9000 series GPUs leverage new second-generation AI accelerators with up to 8x INT8 throughput per AI accelerator (for sparse matrices) to enhance creative applications and effectively run generative AI applications (vs. RDNA 3). The RX 9000 series GPUs also implement the newly redesigned AMD Radiance Display™ Engine & Enhanced Media Engine for broad display support and elevated quality in both recording and streaming.

Gaming For Today and Tomorrow

The Radeon RX 9000 Series unlocks new levels of performance while delivering a suite of new and enhanced features that improve the gaming experience. The Radeon RX 9070 Series offers 16GB of GDDR6 memory, allowing gamers to render the most exciting games of today and tomorrow at max settings. Compared to the previous generation RX 7900 GRE, the latest AMD Radeon RX 9070 is able to deliver over 20% more performance on average when gaming at 1440, with the AMD Radeon RX 9070 XT extending that lead to over 40% on average.

Both graphics cards make smart upgrades for gamers looking to future-proof their systems with a suite of next-gen features that will keep their experiences feeling fresh for years to come. Key features include:

- Unified AMD RDNA™ 4 Compute Units – Features up to 64 advanced AMD RDNA™ 4 compute units delivering up to 40% higher gaming performance than the previous-generation AMD RDNA™ 3 architecture.iii

- High-Performance Raytracing – With 3rd generation Raytracing Accelerators, AMD RDNA 4 is able to deliver over 2x the Raytracing throughput per compute unit when compared to our previous generation.i Gamers with the latest AMD Radeon RX 9000 series are ready for immersive gaming experiences with high-quality graphics, including realistic lighting, shadows, and reflections.

- Supercharged AI Acceleration – 2nd Generation AI Accelerators received several enhancements, allowing AMD RDNA™ 4 to efficiently process advanced AI models much faster than what was possible with RDNA 3, through a combination of additional math pipelines for AI calculations, expanding the capabilities of the AI Accelerator to support new emerging data types such as FP8, and support for inference optimization techniques such as structured sparsity. These changes deliver up to 8x INT8 throughput per AI accelerator (for sparse matrices) per compute unit vs the previous generation. i

- AMD FidelityFX™ Super Resolution Technology 4 (FSR 4) – AMD’s new cutting-edge ML-powered upscaling technology delivers high-quality boosted frames under even the most demanding workloads such as 4K gaming with maximum raytracing settings and will be supported in over 30 games at launch.

- Innovative suite of features through HYPR-RX – Gamers can instantly improve their experience by activating AMD HYPR-RX and the suite of features within AMD Software, including AMD Radeon™ Super Resolution, AMD Fluid Motion Frames 2.1, AMD Radeon™ Anti-Lag, and AMD Radeon™ Boost. These features can all be tailored to gamers’ hardware and preferences within AMD Software: Adrenalin Edition™ to drive increased FPS, responsiveness and efficiency.

- AI-Enhanced AMD Software: Adrenalin Edition™ Application – A new suite of software and resources designed to deliver an industry-leading AI user experience with AMD Radeon RX 9070 series graphics cards. Keep your drivers and AI software up to date with the new Software Manager. Find the answers to your questions about all things AMD or create free and private text and images with AMD Chat. Discover, download and install new and exciting AMD-partnered AI applications with the App Portal, and leverage AI to improve software quality with the AMD Image Inspector. Learn more about these new features here.

- Ready for Next-Generation Displays – AMD Radiance Display™ Engine supports the latest DisplayPort™ 2.1a and HDMI® 2.1b connections, enabling ultra-high resolutions and refresh rates up to 8K 144Hz, with 12-bit HDR and full REC2020 Color Space for incredible color accuracy. Paired with AMD FreeSync™ technology, gamers can enjoy tear-free, stutter-free gaming experiences on over 4000 compatible displays, including upcoming 4K 240Hz and 8K 144Hz DisplayPort™ 2.1 monitors.

ML-Powered AMD FidelityFX™ Super Resolution 4 (AMD FSR 4) upgrade

- Available exclusively on AMD Radeon™ RX 9000 Series graphics cards, AMD Software: Adrenalin Edition™ adds a new easy-to-use AMD FidelityFX™ Super Resolution 4 (AMD FSR 4) Upgrade feature that helps maximize performance at maximum quality in over 30 games at launch, with 75 coming later this year. AMD FSR 4 delivers a substantial image quality improvement over AMD FSR 3.1 upscaling, with the new ML-based algorithm helping to improve temporal stability, better preserve detail, and reduce ghosting.

- Utilizing features already built into the AMD FidelityFX™ API added when game developers integrate AMD FSR 3.1 into their games, AMD FSR 4 enables an easy upgrade for supported FSR 3.1 games and can be combined with existing in-game AMD FSR 3.1 advanced frame-generation and AMD Radeon™ Anti-Lag 2 for ultra-smooth, ultra-responsive gaming at incredible frame rates on AMD Radeon RX 9070 Series graphics cards.

- The new ML-accelerated AMD FSR 4 upscaling algorithm is trained using high-quality ground truth game data on AMD Instinct™ Accelerators and uses the hardware-accelerated FP8 Wave Matrix Multiply Accumulate (WMMA) feature of the AMD RDNA™ 4 architecture to ensure maximum upscaling quality while still providing a substantial game performance boost.

AMD Radeon RX 9000 Series Product Specifications

| Model | Compute Units | GDDR6 | Game Clock (GHz) | Boost Clock (GHz) | Memory Interface | Infinity Cache | TBP | Price

(USD SEP) |

| AMD Radeon RX 9070 XT | 64 | 16 GB | 2.4 | Up to 3.0 | 256-bit | 64 MB | 304W | $599 |

| AMD Radeon RX 9070 | 56 | 16 GB | 2.1 | Up to 2.5 | 256-bit | 64 MB | 220W | $549 |