Pre- and Post-Henna Hair Care Tips for Best Results

Earlier henna lovers would soak the henna overnight in iron utensils, with coffee and tea powders and add herbs like amla, shikakai to get best results, today life has become simpler with henna cream. The good old henna, that has proven efficacy is now available in a more contemporary form. Henna is being used as a semi-permanent color added to amla extract, in cream form for easier application of the cosmetic. Readily available in market, henna cream is a great alternative to harsh chemical-based hair dyes as this product with natural ingredients does not contain any harmful ingredient. It comes with easy to apply applicator, ensuring a mess free experience, where each strand gets covered

Another problem regular henna users face, especially those with more number of grey hair is the orangish tint it gives. While some are okay with it, others prefer shades that are more inclined towards natural brown and black. When mixed with Herbs found in Amazonian forests such as Acai, Guarana, Brazil nut along with Ayurvedic herbs such as amla henna can give varied colors like copper, dark brown, natural black, chocolate, and even red. Thus, such henna cream will not just cover greys but it is also apt for the fashionistas who love to flaunt the latest hair color. The henna cream is a natural alternative, and it is vegan and cruelty free.

Henna cream is a natural conditioner for hair as it leaves hair soft. It contains babassu oil, which is rich in fatty acids essential for the hair. The deep conditioning with henna cream also makes your hair frizz free and provides hydration to the hair. Compared to harsh chemical dyes that are more popular nowadays, henna is safe to use. These harsh chemical-based hair dyes contain ammonia and its by products such as Ethanolamine, Diethanolamine, and Triethanolamine. With henna cream you can be sure that no such chemicals will impact you. Infact it does not contain parabens, ETDA, synthetic fragrances, PPD, Resorcinol or heavy metals. They don’t just impact hair health but can lead to cancer upon prolonged use. With henna cream you can be sure of a great, natural product that has no side effect.

With so many benefits, henna cream is becoming quite popular amongst users. It also offers the comfort of home as you can apply it on your own, relax and unwind or finish your pending chores and wash it off in one and a half to two hours. You can also apply it at night, and wash off before you sleep. This convenience is only possible because you don’t need to visit a salon to apply it. Wait for a day and then shampoo your hair with a mild shampoo. Infact it is better to use a post coloration hair care range that consists of shampoo, conditioner. Being mild in nature, they ensure that the hair color stays longer.

Henna cream when applied with right products can give lasting results. The color lasts for up to 10 washes. You will only need to do root touch up as per your hair growth. With such great benefits, who wouldn’t want to incorporate it in their hair care. Henna cream not just colors the hair but nourishes them too, leaving you with gorgeous, flowy mane.

Gen Z Sisters Launch Muze, Mumbai’s New Euro-Asian Hotspot

Mumbai, 21 March 2025: Who needs another predictable pasta or sushi roll when you can have gochujang risotto with seafood or carbonara udon? Verdant Entertainment Pvt Ltd has today announced the launch of Muze, a Euro-Asian fusion dining experience by Gen Z sisters Saloni and Anannya. Located in Khar West, this 2,900 sq. ft. space with 100 seats is their most personal venture yet—a love letter to the cuisines, cultures, and design aesthetics that have shaped their experiences from childhood.

Drawing from their travels, the sisters have crafted a space where Art Deco meets bold Asian aesthetics like animal prints, while the menu balances unexpected flavors where familiar dishes take on bold new identities. Carbonara sheds its pasta roots and finds a new home in silky udon noodles. Muze is a place where risotto isn’t just a risotto—it’s infused with the depth of gochujang and topped with fresh seafood. Even a pizza refuses to play by the rules, with fiery sambal prawns and a peppery rocket leaf finish. And for dessert? A Vietnamese tiramisu that brings the richness of condensed milk coffee into the folds of a classic Italian treat.

“We wanted Muze to be a reflection of our travels—each dish carries a memory, a place, a moment that stayed with us,” says Saloni Shelar, Founder Verdant Entertainment Pvt Ltd. “Whether it’s the Carbonara Udon that reminds us of summers in Tokyo or the Lotus Salad inspired by the vibrant night markets of Vietnam, our menu is a passport to flavors we love, reimagined in ways that excite.”

Leading the kitchen is Head Chef Thevar Chandrahasan Pandian (formerly Indigo Fine Dine, Sassy Teaspoon, and Isabella Tapas Bar), whose culinary approach balances innovation with deep respect for tradition. With a focus on refined techniques and unexpected pairings, he transforms ingredients into dishes that are both playful and deeply satisfying.

Muze’s cocktail menu is a bold reflection of its playful yet refined approach to Euro-Asian flavors. Signature drinks like Muze di Gara—a vibrant fusion of white rum, pineapple oleo, and pickled ginger brine—deliver a unique twist on tropical freshness. The Muze Style Negroni reinvents the classic with a coconut fat-wash Campari, homemade pandan liqueur, and gin, adding a silky, aromatic depth. Meanwhile, the intriguing Muze Sa-Bi blends gin with homemade galangal syrup and a touch of wasabi for an unexpected kick.

Anannya, Founder, Verdant Entertainment Pvt Ltd, shared, “Mumbai’s dining scene is constantly evolving, and we wanted to create something that feels fresh and exciting while still being welcoming. MUZE is our tribute to the cities that have inspired us, and we can’t wait to share it with our guests.”

Designed by Designworkx, Muze’s interiors channel the energy of discovery, blending the glamour of the Roaring Twenties with bold Asian aesthetics. Deep jewel tones, striking geometric patterns, and playful touches like flamingo and tiger motifs bring the space to life. You notice the radical lines and geometry referencing the 1920s European flapper girl era in the elevated diners, while the Art Deco influence extends beyond the interiors to the plating as well. Ambient lighting and layered textures create a balance of grandeur and warmth, mirroring the menu’s fusion of familiar comforts with bold new identities.

Muze is now welcoming guests eager for a dining experience that rewrites the rules. With flavors without borders, cocktails that surprise, and an ambiance that invites adventure, this is not just a restaurant—it’s a journey.

PHDCCI to Host 3-Day GI Mahotsav at Dilli Haat, Mar 21-23, 2025

PHDCCI is organizing a 3-days Exhibition and Conference, “GI Mahotsav”, of GI-tagged products from 21st to 23rd March 2025 at Dilli Haat-INA, New Delhi. The event is being organized to raise awareness on GI, with the support of the Office of the Development Commissioner (MSME), Ministry of MSME, Govt. of India.

Geographical Indication (GI) is a label used to identify a product that originates from a specific geographical area and possesses unique qualities, reputation, or characteristics that are essentially attributable to its place of origin. These GI-tagged products help consumers to give guarantee of the authenticity and quality linked to that geographical origin. Further, GI is a form of intellectual property protection given to producers in that region, preventing others from falsely claiming the same origin for their products.

As of March 31, 2024, India has 635 products with Geographical Indication (GI) tags. These products include agricultural products, handicrafts and art wares, food products, and various kind of other consumer products. A significant number of potential products are yet to be recognized with a GI tag in the coming years.

The Indian Government has set a target to register 10,000 Geographical Indication (GI) products by 2030 which means several potential products will receive GI tags in the coming years.

The exhibition aims to bring together various states of India to showcase their unique GItagged products, highlighting the rich cultural and traditional heritage of our nation. The 3 Day Exhibition will provide an excellent platform for artisans, producers, and entrepreneurs to connect with buyers, policymakers and industry experts.

OBJECTIVE:

- Raising awareness about the importance of protecting and promoting products with unique geographical origins

- Providing a platform for producers to connect with consumers and buyers for sales & marketing.

- Celebrating the diverse cultures and craftsmanship associated with these products, essentially aiming to showcase and market India’s GI tagged goods on domestic and international markets

- Encouraging States to identify more products with unique characteristics and specifications which could be tagged under GI.

ACT Fibernet’s Smart Wi-Fi Delivers Lag-Free Cricket Streaming

Bengaluru, March 21, 2025: As the most thrilling cricket season of the year approaches, ACT Fibernet is revolutionizing how fans experience every match with its cutting-edge AI-powered Smart Wi-Fi. Designed to deliver uninterrupted high-speed internet, seamless connectivity, and an adaptive network, ACT’s Smart Wi-Fi ensures you never miss a single boundary, six, or nail-biting finish.

“We understand how important a seamless connection is for an uninterrupted sport-watching experience,” said Mr Ravi Karthik, Chief Marketing and Customer Experience Officer, ACT Fibernet. “With ACT SmartWi-Fi®, fans can enjoy high-speed, uninterrupted streaming, no matter where they are in their home. Our smart technology adapts in real-time, ensuring our customers get the most seamless Wi-Fi experience.”

ACT Fibernet’s Smart Wi-Fi, powered by ACT Zippy, transforms traditional Wi-Fi into an intelligent, self-optimizing network. This AI-driven technology proactively scans your home environment, detecting interference and adjusting in real-time through solutions like channel switching and band steering, delivering a buffer-free streaming experience. With unlimited data plans and AI-powered technology, ACT SmartWi-Fi® takes cricket viewing to the next level.

ACT SmartWi-Fi® brings a game-changing experience of uninterrupted streaming, adaptive network performance, and multi-device connectivity. Whether you’re streaming in 4K on your smart TV, checking match stats on your phone, or live-tweeting the game, ACT SmartWi-Fi® ensures all your devices receive optimal speed and connectivity. With whole-home coverage, you can enjoy the game from any room without disruptions while the intelligent self-healing network continuously monitors and fixes issues for a seamless experience.

ACT Fibernet tailors its plans to suit each city’s unique needs, ensuring their customers get the plan as per their exact needs.

Arete Hospitals Launches Initiative for World Head Injury Awareness Day

Hyderabad , March 21, 2025: Severe Head Injuries Dangers To reduce and Road On security Awareness To accommodate Arete Hospitals World Head Injury Day Awareness Day On the occasion of ” Talasemi” For Foresee – Helmet If worn Survivors ” will get ” Social interest Program Organized by . Road Accidents Because of Happening Head Wounds To avoid Helmet Wearing Most Effective Precaution As an action This Program Attention Attracted .

This In the program Spoken Arete Hospitals Neurosurgery Head of Department Doctor Ramakrishna Chowdhury Y, “ Road Accidents Serious Head For injuries Main Because of Changed . Helmet Wearing By Very Dangers Can be avoided . Two-wheeler Motorists , pillion Riders ( passengers ) On security Special Attention To be held Suggested .”

This In the campaign As part of , arete Hospitals Their For staff Helmets Distribution Did the road On security Among the people Awareness To increase Target Undertaken This Program Two-wheeler On motorists Vision Puts .

Arete Hospitals Senior Neurosurgeon Doctor Ravish Taxable Speaking , ” The road Accidents Because of Happening Head Injuries Life Especially , Scooty Carriers , pillion Riders , women , children , delivery Executives Like They More To the danger are suffering . That is why , every Everyone Helmet To wear Need Very much ” There is ,” he said .

This In the program Cyberabad Traffic Joint Commissioner Off Police Doctor Gaja Rao Bhopal Special As a guest Participate , traffic Police Road Security How Can you confirm? Explained . “ The road Accidents To avoid Helmet Wearing Legal Clause Only Instead , lives Save Good As a habit ” It needs to be changed . ” He Suggested .

Arete Hospitals Medical Director & Critical Care Head Doctor Pawan Kumar , ” Our Hospital State-of-the-art With facilities Head Wounds Treatment Can you do it , actually? Injuries To prevent To be Our Priority Target : Helmet Wearing Most Need . All people Good Quality With Helmet Wearing Habit ” It has to be done, ” he said .

Arete Hospitals Chairman Doctor Vijayender Reddy , “ In public service We always We will be ahead . ‘ Head For ‘ Foresight ‘ program Road On security Among the people Change To bring Our Strong For sure Evidence . Helmet Not wearing Because Many Head Injuries Occurring in the future Similar More Awareness Programs By We Security Culture ” We will encourage ” Said .

iQOO Seeks Gen Z Chief Gaming Officer with INR 10 Lakh Reward

New Delhi, March 21, 2025: iQOO, a high-performance smartphone brand, is on the hunt for its Chief Gaming Officer (CGO) for 2025 to co-create its smartphones, lead the brand’s eSports vision, and actively engage with India’s top eSports gamers. The opportunity offers young gaming enthusiasts, under the age of 25, a chance to turn their passion into a fulfilling and rewarding career. The CGO will gain access to iQOO’s latest products and represent the brand at major gaming events across the world.

Talking about the quest for Chief Gaming Officer, Nipun Marya, CEO, iQOO, said: “We have always believed in the power of India’s gaming community, and the phenomenal response to our previous CGO hunt reaffirmed this. After receiving countless requests from our community, we knew we had to bring it back. At iQOO, we are committed to empowering young gaming enthusiasts by giving them a platform to step into the eSports industry and shape the future of mobile gaming in India. With CGO as an I.P, we continue to create opportunities for Questers to turn their passion into a profession and be a part of the vision.”

The number of gamers in India has grown at an annual rate of 14.6% over the past six years, from 2018 to 2024, with the latest estimate of gamers reaching approximately 48 crore, based on trends from the IMARC report. In 2023, the gaming population stood at 43.9 crore, according to the same report. With the CGO 2.0, iQOO aims to further engage its rapidly expanding community, fostering innovation, and empowering young gaming enthusiasts to shape the future of mobile gaming in India.

iQOO recently teamed up with seven of India’s biggest gaming icons—Dynamo Gaming, GamerFleet, Mortal, Payal Gaming, Scout, Shreeman Legend, and UnGraduate Gamer—in the largest co-creation initiative in mobile gaming. These top gamers are putting iQOO’s gaming smartphones to the test, providing real-time feedback, and certifying devices.

In December 2024, the brand also joined forces with six top BGMI eSports teams and over 100 gamers to fuel the eSports boom in India.

Kotak Mutual Fund Launches ‘Choti SIP’ to Help Plan Your Dreams

Bengaluru, March 21, 2025: Kotak Mahindra Asset Management Company Ltd (“KMAMC” / “Kotak Mutual Fund”) today announced the launch of the “Choti SIP” facility. Choti SIP will be available for all eligible schemes of Kotak Mahindra Mutual Fund*. SEBI and AMFI recently introduced the Choti SIP (Small Ticket SIP), offering an excellent opportunity to bring more Indians into the wealth creation journey.

Nilesh Shah, Managing Director, KMAMC, said, “Only about 5.4 crore unique investors of India’s population are mutual fund investors—leaving a massive, untapped opportunity for penetration and bringing the Indian saver closer to financial freedom. Systematic Investment Plans (SIPs) have been an excellent way to bring new investors and kick-start their mutual fund journey. With the launch of Choti SIP, a new investor can begin their wealth creation journey with a minimum amount of Rs. 250. We can call it ‘Choti Rakam – Bada Kadam’.”

This initiative enables new investors to invest via SIP with a minimum amount of Rs. 250. The rationale behind “Choti SIP” (small Systematic Investment Plan) is to make mutual fund investments more accessible to a wider audience, particularly first-time investors, by lowering the entry barrier. The investor must not have previously invested in mutual funds (SIP or Lumpsum) at the industry level. The investor must invest in the Growth Option and commit to a minimum of 60 instalments on a monthly basis. The payment of instalments should be made through NACH or UPI auto-pay only.

Investors should consult their financial experts and tax advisors if in doubt about whether the plan is suitable for them. Kotak Mahindra Asset Management Company Limited (KMAMC) does not guarantee or promise any returns/futuristic returns.

Nisus Fund Exits Wholly Owned Subsidiary of Shapoorji Pallonji Real Estate

Mumbai, March 2025:

Nisus Finance, a leading real estate credit fund, has recently made its 1st exit from its Real Estate Special Opportunities Fund – 1 (RESO-I). RESO-I had invested INR 105 Crs into rated listed NCDs issued by Suvita Real Estate Private Limited, a wholly owned subsidiary of Shapoorji Pallonji Real Estate Private Limited (SPRE).

The Fund had invested in Senior Secured Rated Listed Non-Convertible Debentures issued in January 2024, wherein the Debentures were listed in the wholesale debt segment of the Bombay Stock Exchange.

The entire NCDs was redeemed by SREPL, the Issuer through internal accruals and capitalization by SPRE. This investment marks the 1st exit from Nisus Finance’s special situation fund “Real Estate Special Opportunities Fund – 1 (RESO-I), managed by Nisus BCD Advisors LLP with an exit IRR of 18.74%.

The investment was towards a land parcel of 12.16 acres located in Manjri Budruk, Pune, which was to assist the SPRE Group in accelerating its assets in Pune within the mid-income affordable housing space. The land has the potential to be developed as an affordable housing mixed-use township with a saleable area of ~2.1 Mn sq. ft. The subject land is a part of a larger layout being developed by the Shapoorji Pallonji Group. Located in the eastern part of Pune, Manjri Budruk is one of the fastest-developing suburban localities of the city that has witnessed significant sales and value appreciation over the past three years, being on the Pune-Solapur Road (National Highway No. 9).

The RESO-1 Fund of Nisus Finance focuses on highly value-accretive opportunities in real estate projects, which provide higher yield and asset cover to unlock value through structured capital in special situations. The investment projects are highly profitable and de-risked within the key micro markets of seven major metros with short to medium tenures of investment.

Mr. Amit Goenka, Chairman & Managing Director of Nisus Finance, stated, “This investment and its timely exit are a testimony to the rigor of our investment process to back strong counterparties like SPRE through smart structured capital. It is a win-win for all stakeholders. We look forward to our continued relationship with SPRE as they accelerate unlocking value across their development portfolio.”

Mr. Venkatesh Gopalakrishnan, Director Group Promoter’s Office, MD – Shapoorji Pallonji Real Estate (SPRE), stated, “Partnering with Nisus Finance helped accelerate our business plan. Given our strong footing, we were able to exit the investment well before its maturity term. We look forward to continued engagement with Nisus Finance as an institutional partner for short- term structured credit.”

Public Sector Emerges as Key Client for Investment Banks Emkay

Mumbai, March 21, 2025: Emkay Investment Banking – the investment banking arm of Emkay Global Financial Services Limited held a virtual media webinar on the state of affairs of the Indian investment banking industry, key highlights and the outlook for the IB industry. While the correction in the market has slowed down activities in the deal street, the government divestment plan is likely to provide a push to the fund raising activities. The SIP flows and DII buying has negated the FII outflows.

Fund raising by PSUs at centre stage

Public sector is turning out to be a material client for Investment Banks in India. The Department of Investment and Public Asset Management (DIPAM) has set a divestment target of Rs 47,000 crore for FY26. This is a huge opportunity for Investment Banks in FY26 and beyond. In the past 3 years, IPOs of LIC, IREDA and OFS of ONGC, IRCTC, HAL, Coal India, RVNL, NHPC, Hudco, Ircon, Cochin Shipyard has kept the deal street buzzing from the PSU segment. The ongoing IPOs of Bharat Coking coal, CMPDI, MNGL and QIP/OFS of IREDA, GRSE, Veedol, Central Bank, Uco Bank, IOB, Bank of Maha, Punjab & Sind is likely to provide prospects to the investment banking industry in FY26 and beyond.

Correction in secondary market is reflecting on the primary markets

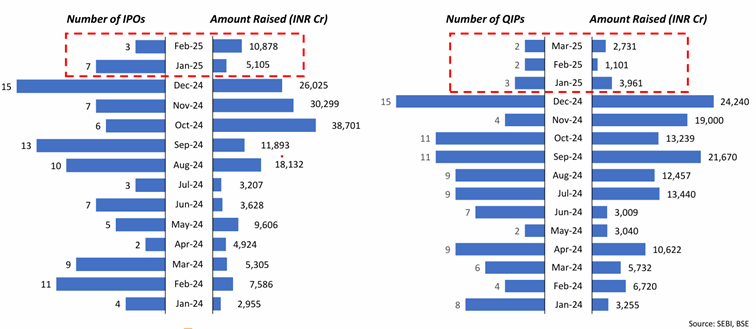

The correction in the equity market has started showing its impact on fund raising activities. CY24 saw 92 IPOs, thereby raising over Rs 1,62,261 crores, whereas companies raised over Rs 1,36,424 crores via 91 QIPs. If we compare the YoY data, the IPOs in Jan-Feb 2025 is limited to only 10 vs 15 in Jan-Feb 2024, whereas QIPs in Jan-Mar 2025 is limited to only 7 vs 18 in Jan-Mar 2024.

SIP flows to the rescue

The resilient SIP inflows are supporting markets to a large extent. SIP flows has been over Rs 20,000 crore for the past 11 months (entire FY25, April 2024 till February 2025). The SIP flows has risen to over Rs 25,000 crore for the past 5 months which is quite an encouraging sign, this despite negative returns from the market since September 2024. The street was expecting a slowdown, fall in SIP flows, – which is quite normal in a falling market. A fall in SIP going forward could have a severe impact on overall market performance.

DII inflows negating FII outflows

DII inflows has more than compensated for the FII outflows in FY25. As per the available data, DIIs have invested over Rs 5,70,000 crore in the market vs 2,88,000 crore in the 11 months of FY25.

RBI rate decision, liquidity measures key to market performance

Key decisions by the RBI to boost lending is expected to trigger liquidity in the markets in the near to medium term. The bank credit is expected to get a strong boost in the medium to long term due to

- Repo rate cut

- Relaxation of risk weights for SCBs on NBFC loans by 25%

- Liquidity measures undertaken by the RBI

- Measures announced in the Union Budget to boost consumption demand