Strong Impact: ENTOD’s National Hearing Week 2025 Raises Hearing Health Awareness Among 3 Crore People

New Delhi, 13th March 2025: ENTOD Pharmaceuticals, in collaboration with the Matanand Welfare Foundation, successfully concluded the National Hearing Week 2025, held from March 3rd to March 9th, under the theme “Hear Their World: Early Detection, Early Action.” The week-long initiative focused on children, with the aim to raise awareness about congenital hearing loss and highlight the need for early detection and preventive care. By reaching 3 crores people across India, the campaign helped improve awareness and access to pediatric hearing healthcare.

The initiative gained strong momentum both online and offline, engaging thousands across the country and bringing together healthcare professionals, influencers, and volunteers. More than 1200 free hearing screening camps were conducted in clinics, hospitals, and community centers, ensuring early diagnosis opportunities for children. The campaign’s social media efforts also had a significant impact, with #HarBacchaSunega trending at number two on X (formerly Twitter) and reaching millions nationwide on the other hand social media campaign reached to 25 Million people.

To amplify the message further, a national radio awareness campaign aired on 92.7 BIG FM in Mumbai, Ahmedabad, Kolkata, Lucknow, and Bangalore.1200 + physical camps, 20+ walkathons and rallies, along with ENT specialists at clinics, hospitals, 5 Street skits, and community centers were organized across INDIA. Over 100+ awareness videos featuring top ENT specialists were shared on social media, while more than 20 school awareness camps educated parents and children about hearing health. Additionally, five major walkathons and rallies brought communities together in support of the cause.

Additionally, funds raised through Matanand.org and ENTOD’s CSR initiatives will support cochlear implant surgeries for children from underprivileged backgrounds, ensuring they have access to critical treatment and a better quality of life.

The campaign’s impact was strengthened by the participation of over 105 ENT specialists and 100 social media influencers, who helped emphasize the importance of early intervention for congenital hearing loss. Awareness camps were also conducted for healthcare workers, ASHA, and Anganwadi members to help them identify hearing disabilities in children at the community level.

Mr. Nikkhil K Masurkar, CEO of ENTOD Pharmaceuticals, shared the vision behind the initiative, saying, “National Hearing Week 2025 has been a significant milestone in raising awareness about congenital hearing loss. Through 1200+ free hearing camps, a nationwide radio campaign, and a dynamic social media movement, we have reached millions across India—but this is just the beginning. Our mission is to ensure that every child, regardless of background, has the opportunity to hear, speak, and thrive. The funds raised will support cochlear implants for underprivileged children, strengthening our commitment to making hearing care accessible to all.”

Dr. Sanjeev Pethe, M.S. ENT, stressed the importance of early diagnosis, saying, “Congenital hearing loss is more common than people think, yet many cases go unnoticed until it’s too late. Without early intervention, children struggle with speech, education, and social interactions. National Hearing Week 2025 is a crucial step in spreading awareness and inspiring action. This initiative is a reminder for parents, teachers, and healthcare professionals to make hearing screenings a priority so that no child is denied the ability to hear and communicate.”

Although National Hearing Week 2025 has concluded, ENTOD Pharmaceuticals remains committed to making hearing healthcare accessible for all children. The success of this campaign marks the beginning of sustained efforts to educate communities, provide screenings, and support children with hearing disabilities across India.

Warehouse Demand in Bengaluru Skyrockets: 27% Growth Recorded in 2024

Bengaluru, 13 March 2025: Knight Frank India, a leading international property consultancy, , cited that Bengaluru has witnessed transaction volume growth of 27% year-on-year (YoY) with a total area leasing of 6.6 million square feet (mn sq ft) in 2024 which when compared to 2023 was 5.2 mn sq ft. Bengaluru’s warehousing market thrives on strong infrastructure connectivity and solid economic fundamentals. With major highways like NH-75 and NH-48 ensuring smooth cross-border transportation, the city has emerged as a key hub for logistics and warehousing operations.

Source: Knight Frank Research

The city of Bengaluru has a development potential of 28.5mn sq ft to service any additional demand. This translates to around four times the annual transaction volumes in 2024.

Industry wise, other manufacturing (excluding FMCG and FMCD) emerged as the leading sector in Bengaluru’s warehousing market, accounting for 41% of total leasing activity, up from 32% in 2023. This trend underscores the increasing significance of industrial occupiers in the region. Meanwhile, retail and e-commerce sectors experienced notable growth, with their leasing share rising from 12% to 16% and 3% to 11%, respectively. The expansion of e-commerce reinforces Bengaluru’s position as a technology and consumption hub, driving higher demand for last-mile fulfilment centres. Additionally, the FMCG sector expanded its presence, growing from 3% in 2023 to 7% in 2024.

INDUSTRY SPLIT OF TRANSACTION VOLUME

• Warehousing transactions data includes light manufacturing/assembling.

• Other Manufacturing – These include all manufacturing sectors (automobile, electronics, pharmaceutical, etc.) except FMCG and FMCD.

• Miscellaneous – These include services such as telecom, real estate, document management, agricultural warehousing and publishing.

The Nelamangala-Dabaspete cluster has emerged as Bengaluru’s preferred warehousing hub, marking a significant shift in cluster-wise leasing. Major tenants such as Bosch, Shoppers Stop, and ABB have played a key role in driving this growth. In 2024, the region accounted for 52% of total leased space, a sharp increase from 21% in 2023, with the Nelamangala market contributing to over half of the transactions. This surge is largely attributed to the cluster’s strategic connectivity via National Highway 48, facilitating access to key consumption centers across southern and western India.

Shishir Baijal, Chairman and Managing Director, of Knight Frank India said, “Bengaluru’s warehousing market continues to expand, driven by rising leasing activity, manufacturing sector growth, and increasing demand from e-commerce and retail players. Strengthened by improved infrastructure, supportive policies, and sustained occupier interest, the market is set for long-term growth. As warehousing needs evolve, Bengaluru is expected to reinforce its position as a leading logistics hub in Southern India”.

Ditch the Colours, Embrace the Thrill – Holi Celebrations at The Game Palacio

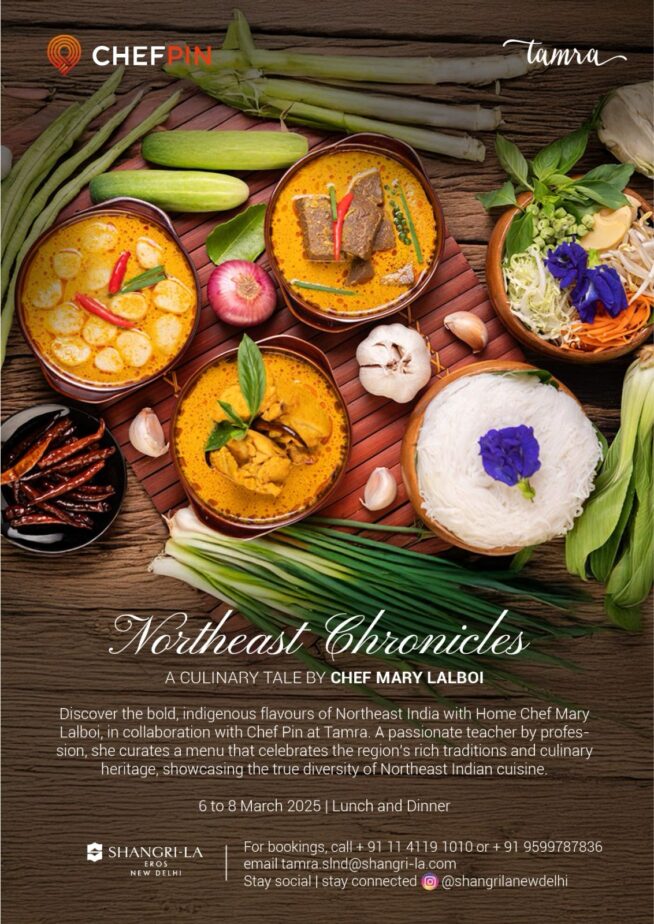

Discover the Rich Flavours of Northeast India at Tamra, Shangri-La Eros New Delhi with Chef Pin

New Delhi, March 2025: Shangri-La Eros New Delhi in collaboration with Chef Pin, presents an incredible culinary experience celebrating the indigenous flavours of Northeast India. Running from 6th to 8th March 2025, Tamra, the hotel’s international cuisine restaurant, will serve an authentic selection of regional specialities crafted by Chef Mary Lalboi.

A changemaker in Northeast Indian cuisine, Chef Mary Lalboi has been influential in bringing the region’s exquisite and diverse culinary traditions to the spotlight. As the founder of Rosang Café, one of the first establishments to introduce Northeast Indian flavours to Delhi, she has dedicated her journey to preserving and sharing the treasured food culture of her homeland.

This exclusive pop-up highlights the soul of Northeast India with a meticulously curated menu featuring signature dishes that complement the region’s bold and earthy flavours. Guests can savour Kelsa, a mutton curry infused with exotic Northeast herbs; Kanga, a flavoursome goose curry with Manipuri wild roots and leaves; and Kolposola, a notable Assamese banana trunk curry. The experience continues with comforting delights like Bai, a Mizo-style seasonal mixed curry. Sanpiau, a delicate Northeast rice porridge, and Chow Satui, a soulful mutton noodle soup, complete this delightful journey. To conclude the overall experience on a sweet note, the rich and aromatic Chakhao Kheer, a black rice pudding, offers the perfect finish.

Set against the cosmopolitan backdrop of Shangri-La Eros New Delhi, this exclusive three-day event welcomes guests to appreciate the lesser-explored yet interesting world of Northeast Indian cuisine. Each dish presents guests with an enveloping experience applauding authenticity, heritage, and excellent culinary craftsmanship.

Guests can enjoy the Lunch Buffet at INR 3,200 plus taxes per person or the Dinner Buffet at INR 3,500 plus taxes per person, making this an unmissable experience for food connoisseurs.

Discover the Ultimate Sunday Brunch Experience at Grand Market Pavilion

Experience an exquisite journey of taste with the Sunday Brunch at Grand Market Pavilion, ITC Royal Bengal. Inspired by the iconic Hogg Market of Kolkata, this culinary haven captures the vibrancy of a global food district, offering a diverse and immersive dining adventure.

At the heart of the Grand Market Pavilion are the Seven Stations, each a gateway to distinct flavors and cuisines. Delight in the freshness of locally sourced ingredients with the Living Grid of zero-kilometer microgreens. The Asian Kitchen beckons with steaming baskets of dim sums, a live wokery, a noodle bar, and Asian soup cauldrons that transport your palate across the East.

For those who love hearty meals, Stews & Casseroles offers made-to-order pasta and an enticing fry bar. Cheese enthusiasts will revel in the Pavilion Deli’s extensive selection, alongside a vibrant medley of veg and non-veg antipasti, salads, sushi, and charcuterie.

The Global Gallery presents a world of flavors, spotlighting international favorites and a roast station that promises a gourmet indulgence. Meanwhile, the Kebaberie showcases the magic of Indian kebabs, while the Indian Island brings forth the traditional and the new, from decadent chaats to the unique tastes of Northeast India.

Conclude your culinary journey at The Dessert Studio, where decadent creations such as market puddings, elegant entremets, and handcrafted pies await to tantalize your senses.

Each Sunday, the Grand Market Pavilion transforms brunch into a captivating celebration of world cuisines, making it an unmissable gastronomic experience. Join us for a brunch that transcends borders and delights your senses every step of the way.

Selling the Future: Landmark Shopping Complexes in Sonipat Lead the Real Estate Revolution

The historic city of Sonipat, Haryana’s fast-growing urban hub, is poised for a significant transformation in its retail landscape, driven by the far-reaching initiatives of the Haryana State Industrial and Infrastructure Development Corporation (HSIIDC).

Boasting a strategic location and seamless connectivity to the National Capital Region (NCR), Sonipat is evolving into a bustling commercial and residential hotspot. The development of new shopping complexes, including the iconic Khari Baoli Market, Bhagirath Palace, and Ganaur Market, is set to elevate the retail experience for consumers while boosting the region’s economic prospects.

A Visionary Leap

The HSIIDC’s ambitious proposals aim to create a harmonious blend of tradition and modernity. Among these, the Khari Baoli Market promises to echo the vitality of Delhi’s renowned spice market, offering an eclectic mix of wholesale goods and retail delights. Meanwhile, Bhagirath Palace, inspired by its namesake in Chandni Chowk, will serve as a haven for electronics and consumer goods, catering to the rising demand for quality products in the region.

Ganaur Market, on the other hand, is projected to become a hub for local artisans and vendors, providing them with a platform to showcase their offerings to a wider audience. Together, these developments are expected to enhance the shopping experience for residents and visitors, ensuring centralized access to a diverse range of products.

Transforming Buyer Experiences

The upcoming markets are designed to emphasize convenience, accessibility, and an enriched shopping ambiance. State-of-the-art infrastructure, ample parking spaces, and organized layouts are just some of the features aimed at ensuring a seamless experience for buyers. The integration of digital payment systems and smart retail solutions further aligns these complexes with modern consumer expectations.

For families and casual shoppers, these spaces will not only serve as shopping destinations but also offer recreational facilities, food courts, and entertainment zones, making them community-centric hubs.

Mr. Rahul Singla, Director of Mapsko Group said, “Sonipat is on the brink of a real estate revolution. The city’s evolving infrastructure, coupled with its strategic location near Delhi, makes it a hotbed for investors looking for substantial returns on investment. The burgeoning demand for quality residential and commercial properties in Sonipat is fueled by a combination of affordability, spacious layouts, and a better quality of life compared to the crowded metropolitan areas. With the rise of remote working models is encouraging more people to move away from traditional city centers. Every month, Sonipat is attracting not only locals but also people from Delhi and other metros who are looking for a peaceful yet connected place to settle. Sonipat’s emergence as a prime destination for real estate investment is attributed in large part to the city’s burgeoning plotted developments, which offer homebuyers spacious layouts and the opportunity to customize their dream homes. These plotted developments cater to the preferences of modern homebuyers, who prioritize both affordability and lifestyle quality. The well-planned plotted development in Sonipat is reshaping the real estate landscape, making the city the preferred choice for individuals seeking to invest in or settle down in a peaceful yet connected environment.”

Catalysing Regional Growth

The retail sector in Sonipat is poised for exponential growth, driven by these developments. The creation of these shopping complexes is expected to generate employment opportunities, attract investments, and boost local businesses. Moreover, these projects will enhance Sonipat’s appeal as a real estate destination, drawing attention from homebuyers and commercial developers alike.

The strategic placement of these complexes near major highways and residential areas ensures their role as pivotal landmarks in the city’s growth story. Their presence is likely to encourage further urbanization and improve the quality of life for residents.

Stimulating Real Estate Demand

The upcoming shopping complexes will not only influence the retail sector but also play a significant role in shaping Sonipat’s real estate dynamics. With enhanced commercial activity, the demand for residential properties in proximity to these markets is naturally expected to rise. Developers are likely to leverage this opportunity by introducing projects that cater to a range of buyer preferences, from affordable housing to premium apartments.

Evidently, Sonipat’s journey toward becoming a modern urban center is marked by the visionary initiatives of HSIIDC. The development of shopping complexes like Khari Baoli Market, Bhagirath Palace, and Ganaur Market is a testament to the city’s potential as a retail and real estate powerhouse. These projects not only promise to elevate the shopping experience but also contribute significantly to the region’s economic and infrastructural growth.

Ganga Realty Hosts Exclusive Realty Trip for Gurgaon Real Estate Leaders in Phuket

Phuket, Thailand: Ganga Realty, one of the fastest-growing real estate developers, successfully organized a three-day Realty Trip in Phuket, Thailand for the top real estate professionals of the NCR region. Over 150 prominent real estate leaders and industry veterans from Gurgaon participated in this exclusive event, fully sponsored by Ganga Realty.

The trip was designed to foster collaboration, recognize industry leaders, and showcase Gurgaon’s real estate potential on an international platform. Through this initiative, Ganga Realty aimed to not only expand the reach of Gurgaon’s real estate market beyond domestic boundaries but also to inspire and motivate professionals within the industry.

During the event, several distinguished real estate experts and organizations were felicitated by the management of Ganga Realty for their contributions to the sector. The trip also featured engaging discussions, networking sessions, and knowledge-sharing opportunities, making it a valuable experience for all attendees.

Mr. Vikas Garg, Joint Managing Director of Ganga Realty, and Mr. Neeraj K Mishra, Executive Director of Ganga Realty, were present at the event. They actively engaged with the attendees sharing their expertise and insights on the evolving real estate landscape.

Speaking about the initiative, Mr. Vikas Garg, Joint Managing Director of Ganga Realty, said, “At Ganga Realty, we believe in fostering strong relationships within the real estate fraternity and continuously encouraging innovation and growth. This Realty Trip to Phuket was a step towards bringing Gurgaon’s real estate market onto the international stage and motivating our partners to strive for excellence. We are thrilled to have provided a platform for industry leaders to connect, collaborate, and celebrate their achievements.”

The Realty Trip was a grand success, reinforcing Ganga Realty’s commitment to driving industry growth and creating opportunities for real estate professionals. By hosting such international events, Ganga Realty continues to establish itself as a forward-thinking developer dedicated to enhancing the real estate sector’s global footprint.

Book Vietjet Flights at Up to 83 percent Off for Women’s Day

Mumbai, February 28, 2025 – Vietjet, Vietnam’s new-age airline, is celebrating International Women’s Day on March 8 with an exciting promotion, offering 83,000 Eco-class tickets available at discounts of up to 83% (*). This deal is valid for bookings made between March 3 and March 5, 2025, using the promo code VJ83 on Vietjet’s official website (www.vietjetair.com) and the Vietjet Air mobile app.

This limited-time offer applies to Vietjet’s entire flight network for travel between March 17 and May 22, 2025 (**), making it the perfect opportunity to explore Vietnam in spring. Don’t miss this special opportunity to honor the women in your life with unforgettable journeys!

Vietjet is solidifying its position as the airline with the most routes between India and Vietnam. In March 2025, the airline will launch two new direct services from Bangalore and Hyderabad to Ho Chi Minh City, Vietnam’s largest metropolis, expanding its India-Vietnam network to 10 routes with 78 weekly flights.

Further strengthening its presence across the Asia-Pacific region, Vietjet will also introduce new international routes connecting Ho Chi Minh City and Hanoi with Beijing and Guangzhou (China) in the coming weeks.

Event Listing | Neil Simon’s The Odd Couple at PVR HOME

PVR HOME is hosting a night of laughter and entertainment with Neil Simon’s legendary comedy, The Odd Couple, taking the stage on March 2nd at 7:30 PM. This iconic play, known for its sharp wit and timeless humor, promises an evening of uproarious laughter and brilliant performances.

The Odd Couple is Neil Simon’s Broadway comedy adapted to India. This urban non-stop comedy that invariably draws housefull shows, is based on a hilarious classic story set in the bustling metro city of Gurgaon about two women of opposite personalities who find themselves living together in a shared apartment and that’s when the comedy of errors begins. The play is full of witty dialogues and funny banter that delves into the challenges and humorous moments of co-existence, shedding light on the complexities of marriage, friendship, and personal space. This exclusive show is brought to you by Club HOME by PVR and presented by Dreamcatchers Theatre Group.

Details:

Date & Time: March 2nd, 7:30 PM

Venue: PVR HOME, Ambience Mall, Vasant Kunj

Duration: 90 Minutes

IceWarp’s Anita Kukreja Wins ‘Most Admired Brand Leader’ & ‘Mark of Excellence’ at World Brand Congress 2025

Mumbai, India – February 28, 2025: Anita Kukreja, Head of Strategic Alliances and Brand, IceWarp, has been honored with 2 prestigious awards – “Most Admired Brand Leader” and “Mark of Excellence” at the World Brand Congress & Awards 2025, held at Taj Lands End, Mumbai. These recognitions highlight her mark of excellence in branding & strategic vision for her organization as well as her outstanding contributions to brand strategy, innovation, and business leadership in the ever-evolving Indian IT landscape.

The World Brand Congress & Awards is a highly esteemed platform that celebrates excellence in brand leadership and marketing innovation. The event brings together industry leaders, marketing experts, and brand strategists to discuss emerging trends and share insights into the future of branding.

Apart from receiving distinguished awards, Anita Kukreja was also an esteemed panelist at the event, where she shared her insights on the topic “Brand Evolution: Adapting to the Future.” Drawing from her vast experience, she elaborated on how brands must continuously innovate and adapt to stay relevant in the rapidly changing market dynamics. She emphasized the importance of customer-centric strategies, digital transformation, and agile marketing approaches in building resilient brands.

On receiving the award, Anita Kukreja expressed her gratitude, stating:

“I am deeply honored to receive the awards for being a “Most Admired Brand Leader” and “Mark of Excellence “at the World Brand Congress & Awards 2025. This award is a testament to the collective efforts of my team and the unwavering commitment to brand excellence. In today’s fast-evolving business landscape, adaptability and innovation are key drivers of success, and I am committed to steering brand strategies that align with future market trends.”Speaking on Anita’s accomplishments, Dr. Aalok Pandit, Executive Director, CMO Global said “Anita Kukreja’s recognition as the ‘Most Admired Brand Leader’ and the ‘Mark of Excellence’ at the prestigious World Brand Congress & Awards 2025 is a testament to her unwavering dedication, strategic vision, and exceptional leadership in the world of branding and marketing. Her ability to craft compelling brand narratives and drive impactful marketing initiatives has set new benchmarks in the industry. We are proud to celebrate her achievements and look forward to witnessing her continued success in shaping the future of brand excellence.”

Anita Kukreja’s recognition at this esteemed forum underscores her exemplary leadership and strategic vision in brand building. Her participation in the panel discussion further reinforced her thought leadership in shaping the future of branding.