Realtors Share Positive Outlook on Union Budget 2025

Real estate leaders welcomed the Union Budget 2025, presented by Finance Minister Nirmala Sitharaman on February 1. Industry experts hailed the increased income tax exemption limit to ₹12 lakh and the rise in the TDS threshold for rental income to ₹6 lakh as significant steps to boost investments in the sector. They also highlighted the announcement of a ₹1 lakh crore Urban Challenge Fund and the directive to infrastructure ministries to create three-year development plans as game-changers for urban growth. These measures are expected to accelerate housing development, attract investors, and support the government’s vision for inclusive urbanization.

Manoj Gaur, CMD, Gaurs Group & Chairman, CREDAI National

“Budget 2025 underlines the Central government’s commitment to economic expansion, infrastructure advancement, and financial stability, thereby fostering a conducive environment for real estate growth. Measures supporting start-ups and job creation, coupled with much needed reductions in income tax slabs, are set to enhance liquidity and stimulate demand in the sector. While the focus on overall growth is encouraging, we look forward to further initiatives that will accelerate affordable housing development, ensuring inclusive progress for the country.”

Pradeep Aggarwal, Chairman, Signature Global (India) Ltd., on Union Budget 2025

“The Union Budget 2025 is a game-changer, reinforcing India’s commitment to inclusive and sustainable urban growth. The SWAMIH Fund 2 with ₹15,000 crore will accelerate the completion of stalled housing projects, bringing relief to over one lakh homebuyers. The ₹1 lakh crore Urban Challenge Fund will play a pivotal role in transforming cities into vibrant growth hubs, ensuring balanced regional development.

The masterstroke of direct tax reform—exempting income up to ₹12 lakh—will significantly boost disposable income, increasing affordability for homebuyers and driving real estate demand. Additionally, the government’s thrust on PPP-driven infrastructure with a structured three-year project pipeline will accelerate urban expansion, unlocking new opportunities for real estate and housing. These progressive reforms align with India’s vision of ‘Sabka Vikas’, fostering a robust ecosystem for homebuyers, developers, and investors alike.”

Navin M. Raheja, Chairman and Managing Director of Raheja Developers Limited

“The government’s allocation of ₹1 lakh crore to the Urban Challenge Fund is a commendable step towards transforming our cities into dynamic growth hubs. This initiative will not only enhance urban infrastructure but also create significant opportunities for creative redevelopment, benefiting both developers and residents. The introduction of SWAMIH Fund-2, with a corpus of ₹15,000 crore, is a timely intervention to expedite the completion of one lakh dwelling units. This move addresses the pressing issue of stalled projects and will instill confidence among homebuyers awaiting their dream homes.

Furthermore, the tax relief allowing taxpayers to claim the annual value of two self-occupied properties without conditions is a progressive measure. This change reduces the tax burden on homeowners and encourages investment in the housing sector.

The increase in the annual TDS limit on rent from ₹2.40 lakh to ₹6 lakh simplifies compliance and is a welcome relief for both landlords and tenants. Additionally, the formation of a committee for regulatory reforms aimed at streamlining approval processes is a significant development. Faster clearances will reduce the cost of housing, enabling developers to deliver projects more efficiently and affordably.

Collectively, these measures reflect the government’s commitment to revitalizing the real estate sector, promoting urban development, and fostering economic growth. We anticipate that these initiatives will lead to increased investment, job creation, and the development of sustainable urban habitats.”

Amit Modi, Director, County Group

For real estate buyers, the proposal to value two self-occupied properties at nil for tax purposes brings much-needed relief—particularly for middle-class professionals in metro cities who also posess a self-occupied second home in their villages or hometowns. Similarly, raising the TDS threshold on rental income from Rs 2.5 lakh to Rs 6 lakh will benefit those dependent on rental earnings. Furthermore, the revision in tax slabs—exempting income tax up to Rs 12 lakh—places more disposable income in the hands of the middle class planning for future real estate investments._

Sandeep Chhillar, Founder and Chairman, Landmark Group

“The announcement made in the Union Budget shows the government’s balanced approach focused on empowering the middle class, encouraging private investment, and maintaining favorable economic conditions. The reduction in the income tax slab proposes that no income tax is needed to be paid for total income up to Rs 12 Lakh per annum and this has come as a great encouragement for millions of first-time homebuyers. Besides, the government’s continued focus on strengthening infrastructure across states and cities has been mentioned in this year’s budget as well. Extending support to states, an outlay of 1.5 lakh crore is proposed for the 50-year interest-free loans to states for capital expenditure and incentives for reforms. This will bode well in continuing propelling infra upgradation across the country and drive growth for real estate sector as well.”

Rajjath Goel, Managing Director, MRG Group

The allocation for infrastructure development, urban transformation, and SWAMIH Fund 2 along with tax reforms that will improve liquidity lays the foundation of country’s continued economic progress. Steps such as nil tax for two self-occupied properties and rental income upto Rs. 6 lakh will enhance the lucrativeness of real estate investments. We are hopeful that these measures will lead to sustained real estate expansion, benefiting homebuyers and investors alike.

Gurpal Singh Chawla, Managing Director, TREVOC

The budget effectively balances development priorities with financial stability. The emphasis on infrastructure growth, including the Rs 1 lakh crore Urban Challenge Fund, lays a strong foundation for long-term progress. Additionally, key tax revisions enhance market liquidity ultimately creating an optimistic roadmap for the real estate sector.

Yash Miglani, MD, Migsun Group

Prioritizing private sector investments and uplifting household sentiments is set to strengthen homeownership and commercial expansion, fostering sustained momentum in the real estate sector. Measures aimed at empowering the middle class, including tax relief for individuals with annual incomes of up to ₹12 lakh, will provide significant relief and boost disposable income. These initiatives will reinforce a strong foundation for a resilient, future-ready economy and drive investment in the real estate sector, bolstering confidence and contributing to its growth.

Ankit Kansal, MD, SKYE

In the present Union Budget, GOI has taken some laudable steps to promote the tourism and hospitality industry. The “Heal in India” initiative to project India as a leading medical tourism hub in the world is a positive step, as it will enable public sector, private sector to work cohesively to expand its footprint. The current size of medical tourism in India is around USD 9 billion but the underlying potential is much higher. Meanwhile, another important initiative has been offering Mudra Loan to homestay segment in India. The homestay segment in India is rising fast and is becoming one of the key enablers in the hospitality sector. The branded segment alone is growing at a CAGR of 33% and will reach USD 1377 million by 2028. The unorganized segment is even larger. It is a prudent step to support the homestay and rental villa market with right liquidity support and policy impetus.

Pawan Sharma, MD, Trisol RED

The revised tax slabs and increased rebate limits under the new tax regime will significantly boost disposable income, leading to higher savings and greater investment in real estate. With no income tax payable up to ₹12 lakh and reduced tax slabs, we anticipate a stronger inclination towards homeownership, particularly in the mid-income segment. Additionally, the extension of tax benefits for investments in infrastructure and real estate will further strengthen capital inflows into the sector.

Moreover, the government’s ₹1.5 lakh crore allocation for interest-free loans to states for capital expenditure will drive large-scale infrastructure development. This will enhance urban connectivity, upgrade civic amenities, and improve the liveability of emerging real estate hubs.

Ravindra Gandhi, Founder and Managing Director of Tirasya Estates,

“The revised tax slabs, which offer increased rebates and lower tax rates, will enhance disposable income, encouraging greater investment in the overall real estate sector, particularly in second homes and vacation properties. The extension of tax benefits for investments in infrastructure and real estate further strengthens Goa’s position as a lucrative destination for both domestic and international investors.

Dr. Gautam Kanodia, Founder of KREEVA and Kanodia Group

The Union Budget 2025 has brought major relief to the middle class through revised income tax reforms, alongside a bold vision for urban development. The waiving of income tax up to Rs 12 lakh will boost the sentiments of middle-class homebuyers. Further, the establishment of the Rs 1 lakh crore Urban Challenge Fund demonstrates a strong commitment to urban renewal and infrastructural development. This initiative will support the redevelopment of key urban areas, improve infrastructure, and enhance urban livability. Besides, the government’s push for PPP in infrastructure and allocation of 1.5 lakh crore in interest-free loans for capital expenditure and incentives for reforms will help facilitate the development of infrastructure that will support long-term economic growth. We believe all these measures will boost economic growth, laying the foundation for an inclusive, modern, and interconnected urban environment.

Uddhav Poddar, CMD, Bhumika Group

The government’s emphasis on infrastructure development and economic prudence sets the stage for sustained real estate growth. A key highlight is the focus on enhancing the role of Public-Private Partnerships (PPP) in India’s infrastructure development, which will boost the country’s commercial projects while ensuring long-term progress. Moreover, the tax slab revision exempting income tax up to Rs 12 lakh will leave the middle class with more money to consider investing in real estate.

Prashant Tiwari, CMD, Prateek Group

The union budget announcements are a welcome move as it has introduced measures that will benefit the real estate sector. The revision of the income tax slab that makes an annual income of up to Rs 12 lakh tax-free is likely to increase disposable incomes, which will, in turn, boost housing demand, particularly among first-time homebuyers. Additionally, the government’s support for affordable housing through the SWAMIH Fund 2.0, which allocates Rs 15,000 crore for the completion of 100,000 units, is a significant step towards promoting “Housing for All.” This initiative is expected to relieve the financial strain on middle-class families who are currently managing both home loan EMIs and rent for their existing homes. While these two announcements greatly strengthen the middle class—which is urgently needed—we hoped the government would also address the long-standing request for industry status for the real estate sector. Granting this status could enable developers to access credit funds at lower interest rates. Another major concern is the proposal to reduce the GST on construction services from 18 percent to 12 percent. This reduction would significantly lower project costs, thus enhancing the affordability for homebuyers.

Saurab Saharan, Group Managing Director, HCBS Developments

The Union Budget 2025-26 introduces key measures that will strengthen the real estate sector. Raising the TDS threshold on rental income to ₹6 lakh simplifies tax compliance, benefiting the housing market. Additionally, the decision to value two self-occupied properties at Nil for tax purposes offers homeowners greater financial flexibility, encouraging property investments. The exemption of income tax up to ₹12 lakh further makes homeownership more attainable, driving demand in the sector. Furthermore, the ₹1.5 lakh crore allocation for 50-year interest-free loans to states is a crucial step that will drive urban infrastructure, connectivity, and real estate growth, creating new opportunities for residential developments

Ashwani Kumar, Pyramid Infratech

The Union Budget’25 announcements reflect the constructive growth plan chalked out by the government. The emphasis given to the PPP model for infrastructural development and proposing an outlay of 1.5 lakh crore for the 50-year interest-free loans to states for capital expenditure will create various opportunities for private players to contribute to the economic development significantly. Besides, we applaud the government’s decision to revise the tax slab and make the annual income of Rs 12 lakh tax-free. This is a great relief for salaried middle-class income as they will have increased purchasing power and will be able to own their dream home.

Salil Kumar, Director (Marketing & Business Management) of CRC Group

The Union Budget 2025-26 is a pivotal step in accelerating the growth of India’s real estate sector. By increasing the TDS threshold on rental income and exempting income tax on earnings up to ₹12 lakh, it creates an environment that encourages homeownership, especially among the middle class. The allocation of ₹1.5 lakh crore for interest-free loans to states will support urban development and infrastructure, further boosting demand for both residential and commercial properties. This budget brings a renewed sense of optimism, laying a strong foundation for sustained growth in the real estate market.

Harinder Singh Hora, Founder Chairman, Reach Group

“This budget demonstrates the government’s proactive approach towards economic decentralization, with a special focus on promoting the development of GCCs in emerging Tier-II cities. This forward-thinking initiative not only nurtures regional growth but also opens doors for talent acquisition, industry partnerships, and innovation. The creation of a dedicated fund for urban development will reshape our cities, providing the infrastructure and workforce required to attract national and international companies. With these reforms, we foresee a significant boost in inclusive economic growth, making these cities key players on the global stage.”

Harsh Gupta, CEO, Sundream Group

The Union Budget’s focus on urban development and infrastructure is a major milestone for the commercial real estate sector. The boost in investments towards smarter cities, improved connectivity, and strategic infrastructure upgrades sets a strong foundation for the growth of commercial spaces. Annual incomes of up to ₹12 lakh will provide significant relief and boost disposable income, while the urban development fund promises to transform India’s cities into thriving hubs of sustainability and modernity. Moreover, the introduction of a national framework to promote Global Capability Centers will guide states in building the right infrastructure, cultivating a skilled talent pool, and implementing critical by-law reforms. These steps will make Indian cities more attractive to multinational companies, driving demand for high-quality commercial spaces.

Sanjay Sharma Director, SKA Group

In the Union Budget 2025, the government has made commendable efforts for the country’s economic growth, with a focus on tax rationalization and infrastructure expansion. The revised tax slabs and offering zero tax up to Rs. 12 lakh will boost disposable incomes and drive demand for housing, especially among first-time homebuyers. Further, an increase in the TDS threshold limit on rent from ₹2.4 lakh to ₹6 lakh is a significant boost for the rental housing market. In addition, the ₹1 lakh crore Urban Challenge Fund will play a pivotal role in transforming cities into vibrant growth hubs, ensuring balanced real estate development. These policies will propel the country’s development and drive real estate growth at the same time.

Prakash Mehta, Chairman and Managing Director, Ocus Group

The 2025 budget reflects a continued focus on strengthening urban infrastructure, which is crucial for overall real estate growth. By reducing the tax burden, the government is directly boosting consumer confidence, encouraging greater spending, and ultimately stimulating demand in the commercial sector. In addition, the announcement of a national framework for GCCs will decentralize business operations, enhance local talent pools, and drive infrastructure development. As businesses seek to optimize costs and tap into untapped talent, India will emerge as a key hub for global innovation and business services. Hence, we believe this synergy between government support and private sector participation will bring unparalleled growth to these cities, creating job opportunities and boosting the real estate sector.

Ajendra Singh, Vice-President, Sales and Marketing, at Spectrum@Metro

The Union Budget 2025 outlines a transformative vision for India’s commercial real estate sector, with a clear focus on strengthening urban infrastructure. The government’s investments in smarter cities, better connectivity, and sustainability will directly benefit commercial spaces. The reduction in income tax and the establishment of a national framework for Global Capability Centers are poised to drive demand for premium commercial spaces, attracting global businesses and fueling growth in cities across India

Manit Sethi, Director, Excentia Infra

The Union Budget 2025 underscores the government’s commitment to economic growth and infrastructure enhancements, further supporting the real estate sector. The increase in the TDS threshold limit on rent from ₹2.4 lakh to ₹6 lakh is a significant boost for the rental housing market. This move will ease compliance for those in the affordable and mid-segment rental sector. Meanwhile, the ₹1 lakh crore Urban Challenge Fund will focus on urban redevelopment, transforming cities into dynamic growth hubs. This initiative will fund critical projects like improving water and sanitation systems, upgrading infrastructure, and redeveloping key urban areas. The ₹15,000 crore SWAMIH Fund 2 is another transformative step in addressing India’s housing shortage. Besides, allowing taxpayers to claim the annual value of two self-occupied properties, instead of just one, is a major relief for property owners. Further, the change in tax slabs is a welcoming step, bringing relief to homeowners, making real estate ownership more attractive and easing the tax burden on multiple property owners.

The Union Budget 2025 underscores the government’s commitment to economic growth and infrastructure enhancements, further supporting the real estate sector. The increase in the TDS threshold limit on rent from ₹2.4 lakh to ₹6 lakh is a significant boost for the rental housing market. This move will ease compliance for those in the affordable and mid-segment rental sector. Meanwhile, the ₹1 lakh crore Urban Challenge Fund will focus on urban redevelopment, transforming cities into dynamic growth hubs. This initiative will fund critical projects like improving water and sanitation systems, upgrading infrastructure, and redeveloping key urban areas. The ₹15,000 crore SWAMIH Fund 2 is another transformative step in addressing India’s housing shortage. Besides, allowing taxpayers to claim the annual value of two self-occupied properties, instead of just one, is a major relief for property owners. Further, the change in tax slabs is a welcoming step, bringing relief to homeowners, making real estate ownership more attractive and easing the tax burden on multiple property owners.

Ambika Saxena, CEO, TWH Hospitality

This year, the government has presented a well-balanced and growth-oriented budget, specifically supporting the tourism and hospitality sectors. The modified Udaan scheme will open doors for the hospitality sector by bringing new tourist destinations into the spotlight. Hotels, resorts, and homestays in unexplored regions will see a surge in demand, encouraging further investment and development. With the government’s push for connectivity and including new 120 destinations, we expect a stronger pipeline in the hospitality sector, catering to both business and leisure travellers in emerging tourism hotspots

Umesh Bhati, Director of Operations at Bayside Corporations

“Budget 2025 lays a comprehensive roadmap for economic expansion, with a clear focus on strengthening domestic manufacturing and enhancing India’s integration into global supply chains. The government’s support for the electronics industry and advancements in automation, AI, and digital technologies will create a demand for specialized commercial real estate in emerging sectors. Furthermore, the proposed national framework for promoting Global Capability Centres in tier-2 cities is poised to drive both economic diversification and real estate development in these regions. Combined with continued infrastructure investments, these measures position the real estate sector for robust and sustainable growth across both established and emerging markets.”

Devendra Fadanvis unveils Marathi version of Skill India Digital Hub

Chandigarh, February 1st, 2025: In order to foster an inclusive and robust skilling ecosystem in Maharashtra, Honourable Chief Minister Shri Devendra Fadanvis unveiled Skill India Digital Hub (SIDH) platform in Marathi language on occasion of Vishwa Marathi Sammelan 2025 at Fergusson College in Pune on Friday.

Shri Fadnavis, along with Deputy Chief Ministers Shri Eknath Shinde and Shri Ajit Pawar, launched the Marathi version of SIDH which will enable professionals, students, and researchers to engage more effectively with valuable content, ensuring wider knowledge dissemination across Maharashtra.

By breaking language barriers, this initiative fosters linguistic inclusivity and empowers citizens with essential information in their mother tongue, as envisioned in NEP 2020. The platform will assist youth in skilling themselves in over 7000 skill courses that includes Industry 4.0 courses, Artificial Intelligence, Machine Learning and Drone technology to name a few.

Shri Uday Samant, Minister of Marathi Language of Maharashtra, Shri Shrirang Barne, Member of Lok Sabha, Smt Neelam Gorhe, Member of Maharashtra Legislative Council, Sri Siddharth Shirole, Member of Maharashtra Legislative Assembly, Shri Bapusaheb Pathare, Member of Legislative Assembly, along with Shri Ved Mani Tiwari, CEO of NSDC and MD NSDC International and other eminent dignitaries from various fields graced the occasion.

Shri Ved Mani Tiwari, CEO of NSDC, was felicitated by the Hon’ble Minister Shri Uday Samant, for his instrumental role in shaping SIDH into a pioneering initiative that is transforming knowledge accessibility. Shri Tiwari has been at the forefront of driving innovation, integrating technology with education, and ensuring that skill development reaches every corner of the nation. His relentless efforts have positioned SIDH as a model for linguistic inclusivity and empowerment.

Speaking at the ceremony and reinforcing the central government’s commitment to skilling and digital empowerment, Shri Tiwari said, “SIDH has nationally recorded more than 1.26 crore registrations in over a year. It is offering thousands of skilling courses, and with the unveiling of the Marathi version, NSDC is showcasing the utility of the platform to empower millions of Marathi-speaking youth and help them unlock their career prospects.”

In terms of registrations, Maharashtra is among the top five states in the country while in terms of user traffic, at 30 per cent nationally, it stands next to Uttar Pradesh. With the unveiling of the Marathi version, the popularity and registration of the skilling courses and the platform will further go up. Marathi is among the 23 languages in which the platform can be accessed.

The most popular courses in the state include, web design, cybersecurity, kisan drone operator. Over 43,000 female users have enrolled in various online courses, with over 80 per cent being under the age of 30. The top sectors attracting enrolment from the state include IT-ITeS, entrepreneurship, and electronics among others.

People learn more effectively in their native language, so the Ministry of Skill Development and Entrepreneurship, along with NSDC, has been working to offer skilling courses in local languages to maximize results.

“With the unveiling of the Marathi version of SIDH, we are trying to ensure that language is never a barrier to skilling. It aligns with vision of National Education Policy (NEP) 2020, which emphasises the importance of regional language communication in education and skill development. We are enabling the youth of Maharashtra and the global Marathi community to seamlessly integrate into India’s employment and digital skilling ecosystem.” Shri Tiwari said, underscoring the significance of regional inclusivity and digital transformation.

SIDH is a comprehensive digital platform that has been developed to access skilling opportunities, career guidance, and opportunities both in India and abroad. Maharashtra is the largest economy in India, so the demand for a skilled workforce would be maximum.

With the aim of making the state a USD 1 trillion economy by 2028, a district-wise Skill Gap Analysis Report was conducted in the state in 2023 by the Skills, Employment, Entrepreneurship & Innovation Department (SEEID).

The survey engaged with over 1500 industries and over 200,000 trainees across the state to understand skill gaps in traditional and new-age sectors and identified electronics, automotive, agriculture, BFSI, and IT/ITeS among the sectors for immediate intervention.

The 2023 survey also conducted a language proficiency of the labour force, and found that majority of the staffs in the sample, laid huge emphasis on the proficiency of Marathi language. Over 95 percent of industry respondents expected the workforce to know Marathi, while over 83 percent Hindi.

Maharashtra being a hub for industry and commerce, this initiative will provide young aspirants with the necessary resources to upgrade their skills and integrate into the workforce efficiently.

The unveiling event included video on the platforms key features, demonstrating its user-friendly interface and potential to connect youth with over 50,000 industry partners and 5.5 lakh apprenticeship opportunities. The Marathi version of SIDH will serve as a bridge between aspirations and opportunities, furthering the mission to make India the skill capital of the world. Additionally, the platform will include industry-specific skill modules, certification programs, and employer-led training programs to ensure job readiness among youth.

Kalyan Jewellers Celebrates Valentine’s Day with Special Offer

Chandigarh, February 1st: With Valentine’s Day just around the corner, Kalyan Jewellers, one of India’s largest and most trusted jewellery brands, is making celebrations extra special with an exclusive limited-period offer of 10% off on Valentine’s Day collections. In addition to it, there’s a 50% off on making charges across all products till February 9.

This limited-period offer underscores Kalyan Jewellers’ commitment to enhancing customer experiences and catering to India’s deep-rooted sentiments around love and auspicious gifting. Their extensive range of designs ensures that every purchase is a statement of beauty and quality.

Kalyan Jewellers’ Polki and natural diamond collections are a must-see this Valentine’s season. Featuring intricately crafted designs inspired by traditional Indian artistry, the Polki collection showcases the beauty of uncut diamonds in breathtaking patterns. From regal necklaces to elegant earrings, these statement pieces blend heritage into one’s contemporary style. Coming to natural diamonds, they are the perfect symbol of everlasting love. Whether it’s a gift for a special someone or a treasured addition to your own collection, the Polki and natural diamond range promises unmatched elegance and sophistication.

Celebrate the season of love with Kalyan Jewellers and make every moment unforgettable with jewellery that speaks from the heart.

Jimmy Shergill Rejoins HMD After Successful Khoob Chalega Campaign

Mumbai,February 1st, 2025 – Human Mobile Devices today announced the renewal of its successful partnership with acclaimed actor Jimmy Shergill, extending his role as the face for HMD’s feature phone portfolio in India. The extension follows the remarkable success of the ‘Khoob Chalega’ campaign, which resonated strongly with consumers across the country.

This renewed collaboration builds upon the strong foundation established during the initial partnership, where Jimmy Shergill’s authentic persona perfectly aligned with HMD’s commitment to delivering reliable and innovative communication devices to millions of Indians.

Commenting on the extended partnership, Ravi Kunwar, CEO and VP- HMD India and APAC said, “We are delighted to extend our association with Jimmy Shergill. His genuine connection with audiences and credible screen presence has significantly amplified our brand message and innovation story to the masses. His values and appeal perfectly complement Human Mobile Device vision of making technology accessible to everyone.”

Jimmy Shergill expressed his enthusiasm about the renewed partnership, saying, “My journey with Human Mobile Devices has been great and our first campaign has been a huge success. I’m excited to continue this relationship. The brand’s commitment to delivering quality and dependability resonates with my own principles. I look forward to being part of HMD’s continued mission to come.”

The extended partnership will see Jimmy Shergill feature in upcoming campaigns for HMD’s line-up of feature phones across various platforms. This alliance is part of HMD marketing mix to reach out to the target audience and create buzz about the range of products to offer.

Stay tuned as Human Mobile Devices and your all-time favorite hero Jimmy Shergill embark on this exciting journey together one more time, shaping the future of mobile technology and leaving an indelible mark on the industry.

Cube Highways Trust Announces 3.25 Distribution for Q3 FY25

New Delhi, February 1st, 2025 | Cube Highways Trust (“Cube InvIT”) [NSE/BSE: CUBEINVIT/543899], managed by Cube Highways Fund Advisors Pvt. Ltd. (the “Investment Manager”), has today announced its results for the nine-month period ended December 31, 2024. The total consolidated income for the period stood 25,746.21mn, while the consolidated EBITDA for the period was 18,069.21mn.

The Board of Directors of the Investment Manager has declared a Distribution Per Unit (“DPU”) of 3.25 to ordinary unitholders for the 3rd quarter of FY 2024-25, amounting to a total distribution of 4,336.96mn. The record date for the distribution is February 4, 2025, and the distribution payment will be made on or before February 11, 2025.

Pankaj Vasani, Group CFO of Cube InvIT, stated: “We are delighted to deliver yet another quarter of robust business performance, spotlighted by consistent returns and resolute allegiance to excellence in cost leadership and corporate governance. Revenue and EBITDA grew by 14.04% and 25.22% YoY, respectively. Reflecting our dedication to driving stable value for our investors, we are declaring a DPU of 3.25, comprising 1.44 per unit as interest and 1.81 per unit as repayment of SPV loan.”

Cube InvIT continues to maintain AAA/Stable credit ratings from CRISIL, India Ratings, and ICRA. As of December 31, 2024, the portfolio valuation has increased to a total Asset Under Management of 290,291mn.

MasterChef Matt Preston in Exclusive Podcast with Akhilesh Sheoran

The Friend of the Festival Lounge at Vedanta Presents Jaipur Literature Festival in association with Maruti Suzuki, powered by Vida 2025 is set to host an exclusive podcast session featuring renowned MasterChef judge Matt Preston in conversation with Akhilesh Sheoran, Brand Ambassador for Craft Spirits, Diageo India, on January 31, 2025, from 5 PM onwards. This invite-only event will explore the intersection of gastronomy, culture, and fine spirits, offering exclusive insights from two industry experts. Following the session, guests will enjoy a specially guided sensory exploration of Godawan 01 and Godawan 02, highlighting the craftsmanship and unique profiles of these exceptional spirits.

Godawan at Vedanta Presents Jaipur Literature Festival in association with Maruti Suzuki, powered by Vida 2025

Vedanta Presents Jaipur Literature Festival 2025 in Association with Maruti Suzuki, powered by Vida, a prestigious literary and cultural gathering this year places a special emphasis on conservation and the environment. As a brand deeply committed to sustainability and heritage, Godawan aligns with the festival’s vision of fostering dialogue on ecological preservation.

Among the Festival’s notable sessions today, The First Eco-Warriors: The Extraordinary Stories of the Bishnoi brings to light the legendary conservation efforts of the Bishnoi community. Featuring Martin Goodman and Narendra Budhnagar Bishnoi in conversation with Prakash Dan Detha, with an introduction by Akhilesh Sheoran, this session explores the rich legacy of the Bishnoi people in safeguarding wildlife and their environment. My Head For A Tree, by Martin Goodman, tells the inspiring story of the Bishnoi community of Rajasthan, who, for over 600 years, have defended nature with extraordinary dedication, often at great personal cost. From shielding trees against loggers to protecting wildlife from poachers, the Bishnoi way of life exemplifies indigenous activism. As climate change accelerates environmental degradation, Goodman reveals how the Bishnoi’s practices offer a powerful model for sustainable living and resilience.

Conservation & Sustainability: Preserving Heritage and Crafting a Greener Future

The Great Indian Bustard, a majestic bird and the inspiration behind Godawan, symbolizes the brand’s commitment to conservation. Once found across India, this critically endangered species now survives only in Rajasthan, with fewer than 150 remaining. In partnership with Gramodaya Samajik Sansthan (GSS), the Forest Department, and the Wildlife Institute of India (WII), Godawan has been actively restoring habitats through safe enclosures, water provision, and native grassland development. Every bottle sold contributes to these conservation efforts, ensuring a thriving ecosystem for the bird’s survival.

Godawan’s commitment extends to sustainability at its distillery in the Aravali Hills, which operates using locally sourced ingredients and is Asia’s first spirit distillery with the Alliance for Water Stewardship (AWS) Core Certification. It employs hydro panels to extract moisture from the air for blending and bottling and runs on 55% solar energy through a 406 KWP rooftop system. By supporting local barley farmers and implementing water-efficient practices, Godawan integrates heritage, conservation, and sustainability into every bottle it crafts.

Preeta Singh, President, Teamwork Arts, said, “With Godawan, we are proud to partner with a brand that offers a refined sensory experience while staying committed to environmental responsibility. Each year, we strive to further reduce our carbon footprint at the Festival, aiming for net zero in the coming years. As a literature festival, we have consistently prioritized environmental themes in our programming and will continue to do so.”

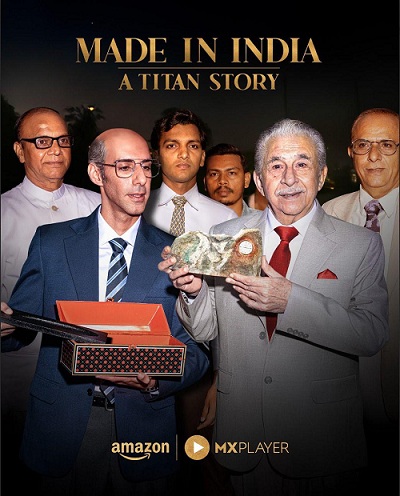

Made in India A Titan Story to Premiere in 2025

Chandigarh, 1st Febraury 2025: Titan Company Ltd., a leading retail conglomerate, is thrilled to announce the upcoming premiere of ‘Made in India – A Titan Story,‘ a six-part series that delves into the brand’s extraordinary journey from its inception to becoming a symbol of Indian innovation and excellence. The series will premier exclusively on Amazon MX Player in 2025. This compelling series chronicles Titan’s remarkable journey from its inception to becoming one of India’s most iconic consumer brands.

Produced by Almighty Motion Picture and T-Series Films, the series is directed by Robbie Grewal and written by Karan Vyas. The stellar cast features renowned actors Naseeruddin Shah and Jim Sarbh, bringing depth and authenticity to this inspiring story. Adapted from Vinay Kamath’s acclaimed book, TITAN: Inside India’s Most Successful Consumer Brand, the series offers an intimate portrayal of Titan’s evolution. Through the visionary leadership of its first CEO, Xerxes Desai, and the embodiment of JRD Tata’s philosophy, the series highlights, how Titan navigated early challenges to achieve entrepreneurial success. The narrative captures pivotal moments, including the creation of the world’s slimmest watch, highlighting Titan’s commitment to innovation and excellence.

C.K. Venkataraman, Managing Director, Titan Company Ltd., expressed his enthusiasm, “Titan’s journey is a testament to the spirit of Indian entrepreneurship and the passion of everyone involved in building a brand that resonates with millions. We are excited to share our story with the world through this compelling series.”

Prabhleen Sandhu, Founder, Almighty Motion Pictures, the producer of the series, shared her sentiments, “It’s an honour to get an opportunity to tell such an important chapter of history. Titan’s story is one of perseverance and innovation, and we are proud to bring it to the screen.”

Bhushan Kumar, Founder, T-Series Films, also the producer of the series, added “We are honoured to present this prestigious project—#ATitanStory,—an extraordinary narrative that brings to light one of India’s most treasured stories, one that truly deserves to be told in this era.”

Amogh Dusad, Head, Content – Amazon MX Player, said, “We are excited to bring our vision to life with this compelling story featuring talented cast. The story around the journey of Titan brand building is inspiring and would be a treat for the Amazon MX Player customers to watch and appreciate. We begin filming this soon and it’s a special project for all of us.”

Each episode will unveil the essence of Indian entrepreneurship and its pivotal role in shaping the nation’s spirit of innovation. The show will be premiering exclusively on Amazon MX Player in 2025.

India’s Carbon Credit Market Set for Growth Industry Leaders Outline Roadmap

Mumbai,1st Februrary 2025 – India’s carbon credit market is expanding rapidly, valued at millions, as the government, industry, and society collaborate to establish a robust value chain system for sustainable carbon trading.

In a high-impact roundtable discussion organized by FCF India, industry leaders and policymakers deliberated on the need for a comprehensive policy framework and streamlined government regulations to ensure India’s sustainable development goals for 2047.

FCF India, a leading think tank dedicated to sustainable development, convened top sustainability leaders, corporate executives, and subject matter experts to explore the opportunities and challenges within India’s carbon credit ecosystem. The discussions centered around the evolving role of carbon credits in enhancing India’s environmental and economic landscape.

Dr. Basanna P., Director of Cambridge Institute of Technology, highlighted the accelerating growth of the carbon credit market and its vital role in sustainable development. He emphasized that regulatory frameworks and carbon credit mechanisms are under active development by the government, while global stakeholders recognize India as a key player in the carbon credit market. He further stressed the need for collaborative efforts to create a greener world for future generations.

Mumbai Deputy Municipal Commissioner, Mr. Kiran Dighavkar, renowned for his work on the Dharavi COVID Model, underscored the city’s waste management and water treatment challenges amidst its rising population and infrastructure growth. He revealed that currently, only one sewage water treatment plant in Mumbai is operating at full capacity, with the rest expected to be completed within the next 2-3 years. Consequently, a significant amount of untreated wastewater is discharged into the sea. He also pointed out that solid waste management remains a pressing issue, with only a fraction of waste being effectively treated. To address these challenges, he advocated for an inclusive approach to convert waste into energy.

Jasmeet Singh, Founder and Director of FCF India, stated, “The roundtable provided a unique opportunity for industry stakeholders to gain valuable insights into India’s carbon credit initiatives in light of new central policies and legislation.”

The event under the leadership of Sarah Tantray working as lead for strategic partnerships at FCF India helped put together this roundtable, which witnessed the participation from key industry players, including Reliance, AllCargo, Mahindra Logistics, IDBI Bank, Union Bank, ICICI Bank, MMRDA, IIT Bombay, Wary Solar and carbon credit project developers along with consultants for FCF who are helping companies achieve their net zero goals. Sustainability professionals shared thought leadership and the need for a regulatory framework on corporate decarbonization, ESG (Environmental, Social, and Governance) objectives, and integrating carbon credits into business strategies. The discussion also explored how carbon markets can unlock economic opportunities while supporting India’s commitment to reducing carbon emissions.

As India progresses toward a sustainable future, industry leaders and policymakers continue to emphasize the importance of a well-regulated carbon credit market to drive economic growth and environmental responsibility.

Mumbai Records Surge in Property Registrations, Reaching Highest Level in 13 Years

Mumbai City, under the Brihanmumbai Municipal Corporation (BMC) jurisdiction has registered its highest January property registrations in 13 years, reflecting the city’s sustained real estate momentum. According to property consultant Knight Frank India, approximately 11,773 properties were registered in January 2025 in Mumbai, marking a 7% year-on-year (Y-o-Y) growth.

These transactions generated over ₹952 crore in stamp duty collections, witnessing a significant 25% Y-o-Y growth, driven by a notable increase in high-value transactions. However, on a month-on-month (M-o-M) basis, property registrations saw a slight decline of 5%, while revenue collections dipped by 16% compared to December 2024.

The report also highlights a growing preference for premium real estate. The share of registrations for properties priced at ₹2 crore and above increased from 16% in January 2024 to 19% in January 2025. This segment accounted for 2,298 transactions in January 2025, demonstrating strong demand for luxury housing. Conversely, the share of registrations for properties valued under ₹50 lakh declined from 31% to 28% during the same period, indicating a shift in buyer preferences towards higher-value properties.

Mumbai’s western and central suburbs retained their dominance, collectively contributing to 86% of the city’s total property registrations. However, there was a noticeable increase in market share for central suburbs, which rose from 29% to 33%, while the share of the western suburbs declined from 57% to 53%. “This growth reflects a surge in supply and heightened end-user interest in these locations,” the Knight Frank India report stated.

Here is what real estate industry leaders have to say on the registrations numbers in January 2025:

Mr. Prashant Sharma, President, NAREDCO Maharashtra

“Mumbai’s property market continues to demonstrate resilience and growth, as evidenced by the highest January property registrations in 13 years. The 7% year-on-year increase in transactions and a significant 25% rise in stamp duty collections highlight the enduring confidence of homebuyers. The rise in high-value transactions reflects evolving buyer preferences, particularly towards premium housing. However, there is a need for continued policy support, including rationalization of stamp duty and interest rates, to sustain momentum in the sector.”Mr. Rohan Khatau, Director, CCI Projects

“The latest data underscores the strength of Mumbai’s real estate market, particularly in the premium segment. The increase in transactions for properties priced at ₹2 crore and above showcases a growing appetite for larger apartments. While the western and central suburbs continue to dominate, the rising market share of these suburbs highlights the demand for well-connected, evolving micro-markets. This trend reinforces the importance of delivering high-quality projects that cater to modern homebuyer aspirations.”Ms. Shraddha Kedia-Agarwal, Director, Transcon Developers

“The significant rise in high-value transactions and the consistent dominance of western and central suburbs indicate that homebuyers are prioritizing location, connectivity, and lifestyle-driven amenities. Despite a slight month-on-month dip, the long-term trajectory remains positive, fueled by strong end-user demand. We remain committed to delivering premium and sustainable living spaces that align with these market trends.”Mr. Samyak Jain, Director, Siddha Group

“The Mumbai property market’s performance in January 2025 reflects a healthy demand trajectory, especially in the premium housing segment. The shift towards higher-value properties highlights the evolving aspirations of homebuyers, with a preference for larger, well-appointed residences. The growth of central suburbs further emphasizes the need for integrated developments that offer connectivity, modern infrastructure, and elevated living. Moving forward, stability in interest rates and continued infrastructure development will be crucial in sustaining this demand.”Mr. Abhishek Jain, COO, Satellite Developers Private Limited (SDPL)

“The growing demand for premium housing is a testament to Mumbai’s evolving real estate landscape. The increased share of transactions in the ₹2 crore and above segment signifies that homebuyers are willing to invest in quality, space, and long-term value. With the western and central suburbs continuing to drive most transactions, developers must focus on delivering high-end projects that cater to this demand. Sustained policy support, such as stamp duty benefits, could further accelerate this positive trend.”