BSNL and OTTplay Team Up to Launch BiTV for Mobile Users

Mumbai, 30th January 2025 – Bharat Sanchar Nigam Limited (BSNL), in collaboration with OTTplay, India’s leading streaming platform aggregator, has introduced BSNL Intertainment—an innovative Internet TV service. This service provides BSNL mobile users all over India with free access to over 450+ live TV channels, including premium channels.

Following the launch of pilot in Pondicherry, BiTV is now being launched pan India as part of BSNL’s vision to bring world-class entertainment to its users. With BSNL Intertainment, BSNL customers can access OTTs like Bhaktiflix, Shortfundly, Kanccha Lannka, STAGE, OM TV, Playflix, Fancode, Distro, Hubhopper and Runn Tv along with 450+ live TV channels, blockbuster movies, and web series.

Speaking at the launch event, BSNL CMD Robert J Ravi I T S, stated, “With BiTV, through our partners, BSNL is giving every customer the power to access entertainment on the go, ‘anytime, anywhere’, free of cost, irrespective of the plan they are on. BiTV is a testament to BSNL’s commitment to digital inclusion and BSNL will be one of the first telecom service provider to revolutionize through this groundbreaking service.”

Echoing this vision, Avinash Mudaliar, Co-founder & CEO of OTTplay, shared, “We are incredibly excited to announce our partnership with BSNL for the launch of BiTV. Through this partnership, BSNL users will gain exclusive access to an extensive library of premium content, offering a truly elevated viewing experience. Whether it’s movies, TV shows, or exclusive content, we’re committed to delivering world-class entertainment. Together with BSNL, we aim to set a new standard for entertainment services in the region, ensuring that users can enjoy high-quality, on-demand content anytime, anywhere.”

Arya Omnitalk Enhances Fleet Management with State-of-the-Art Technological Advancements

Mumbai, 29th Jan’25: With over 20 years of experience, Arya Omnitalk has been a leader in the telematics industry. In the ever-growing telematics industry with IOT implementation of GPS solutions in the Logistics and Transport Industry, there remain many unique challenges and practical implementation aspects, which finally become a bottleneck in decision making for clients in identifying an effective and dependable GPS solution provider and this becomes a challenge in actual adoption of the technology

Be it Trucking & logistics , transporting hazardous chemicals and perishable food items, managing employee transportation, enabling efficient deliveries etc, Arya Omnitalk’s GPS tracking devices and Fleet Vigil, a SaaS-based Fleet Management platform, goes beyond traditional tracking. These solutions are designed to optimize fleet operations, enhance safety, and provide significant returns on investment for clients, so as the decision making for the clients is clearer and faster

The landscape of transportation and road safety in India is undergoing a significant transformation with the implementation of AIS 140 GPS tracking devices. This mandate, introduced by the Indian government, is set to revolutionise the way commercial vehicles operate, ensuring higher safety standards, improved fleet management, and overall transportation efficiency.

At the forefront of this movement there is Arya Omnitalk, a trailblazer in the field, providing state-of-the-art AIS 140-compliant solutions that empower fleet operators and transportation authorities to streamline operations while prioritising public safety. The real-time tracking and driver behaviour analysis features of the AIS 140-compliant GPS tracking unit are crucial for reducing accidents and ensuring driver and passenger safety.

In India’s growing urban landscapes, Arya Omnitalk’s solutions align with Smart City initiatives of the government by providing Emergency Response Management, Solid Waste Management and Intelligent Transport Solutions to enhance industrial and municipal solid waste management and empower Cities with Intelligent Transport Management Solutions and enhance public safety by reducing response time in situations of distress

With unique capabilities in solution lifecycle management—conceptualisation, design, implementation, and maintenance—the company addresses complex transportation challenges with customised applications, IoT integrations, and intuitive dashboards.

“Our mission is to provide differentiated solutions that cater to the unique needs of each client. We leverage our time-tested, highly reliable IoT platform to ensure secure, efficient, and optimized transportation operations across industry verticals.” said Saumil Dhru, COO & CTO of Arya Omnitalk.

MediBuddy Wellness League Highlights Corporate India’s Focus on Employee Well-being

30th January 2025: MediBuddy, India’s leading digital healthcare company, today hosted its first-ever physical awards ceremony for the MediBuddy Wellness League (MWL) 2024. Building on the success of its previous edition, the second edition of MWL continued to drive significant corporate employee engagement, with rewards worth INR 1.5 crore distributed to recognize excellence in employee health and wellness initiatives.

The event celebrated the top performers from both corporate and individual categories who actively championed wellness initiatives throughout the league. This year’s MWL achieved record-breaking participation, reinforcing its position as a game-changer in the corporate wellness space.

MediBuddy’s commitment to fostering health and wellness across Corporate India took shape through the MediBuddy Wellness League (MWL) 2024, a pioneering initiative to empower employees to prioritise their wellbeing. Through an engaging gamified framework, the 2.5 months league transformed the wellness journey of corporate employees into an exciting competition, where participants earned points by completing activities across physical fitness, nutrition, mental health, and sleep. This innovative approach not only drove remarkable engagement but also fulfilled MediBuddy’s mission of giving back to Corporate India by helping employees develop lasting healthy habits that enhance their overall quality of life.

Mr. Saibal Biswas, Senior Vice President, Head of Marketing, Partnerships, and PR at MediBuddy, emphasised the significance of this milestone even. “MWL’s first-ever physical awards ceremony marks a pivotal moment in our journey to transform corporate wellness. Bringing together leading organisations and individuals under one roof allows us to go beyond recognising their achievements; we are reinforcing the importance of prioritising employee health at scale. The enthusiastic participation we’ve seen demonstrates that our gamified approach to create healthy habits is successfully creating lasting behavioural change across corporate India. At MediBuddy, our vision is to make high-quality healthcare accessible to a billion people, and this event is a step forward in realising that mission by inspiring corporate India to prioritise holistic well-being.”

The ceremony recognised both corporate achievers and individual champions who exemplified extraordinary commitment to health and wellness.

Through initiatives such as the MediBuddy Wellness League, MediBuddy remains committed to revolutionising corporate wellness in India. As MWL continues to grow, it promises to inspire even more organisations and employees to prioritise health, fostering a healthier and more productive workforce across the nation. The program continues to serve as a powerful engagement lever for HR leaders, helping them drive meaningful participation in health and wellness activities while improving overall productivity.

Aspect Bullion Introduces India’s First Premium Bullion Signature Store in R City Mall

Mumbai, January, 2025: Aspect Bullion & Refinery, a leading division of Aspect Global Ventures Pvt. Ltd., unveiled India’s first Bullion Signature Store today at the R City Mall, Ghatkopar West, Mumbai. This landmark store offers luxurious and innovative ways to experience gold and silver buying, setting new benchmarks in the precious metal industry.

Located on the ground floor of R City Mall (Unit No. G 58 A), the store features an extensive collection of gold and silver coins & bars, personalized coins for every occasion along with standout signature treasures that make each piece truly unique and memorable. A unique feature offered by Aspect Bullion is their first-of0its-kind innovative gold and silver coin vending machines designed for high-traffic locations like malls, temples, and airports. These self-service machines will enable quick, seamless, and staff-free purchases with real-time pricing. The brand is also expanding its reach through e-marketplaces, offering secure online transactions with real-time pricing. Additionally, Aspect Bullion is franchising its stores and vending machines, with investment opportunities ranging from ₹1 crore to ₹5 crores for stores and exclusive vending machine placements at prime locations like airports.

The grand opening was graced by the Guest of Honor, Mrs. Aksha Kamboj, Executive Chairperson of Aspect Global Ventures Pvt. Ltd. and Vice President of the India Bullion & Jewellers Association (IBJA). Speaking at the event, Mrs Kamboj said, “The Bullion Signature Store revolutionizes how consumers experience gold and silver, setting new benchmarks for trust, quality, and innovation in the bullion industry. With personalized options for special occasions and automated gold and silver vending machines, we’re redefining gifting and customer convenience. We look forward to welcoming customers to explore our offerings and transform their buying experience.”

Aspect Bullion is committed to blending tradition with modernity, ensuring a luxurious, customer-first experience in this iconic destination for gold and silver enthusiasts.

For inquiries or to explore the offerings, visit the Bullion Signature Store at R City Mall, Ghatkopar West, Mumbai.

Providing Healthcare Access: Aster Volunteers and BAPS Launch Mobile Medical Units for the Marginalized

Gujarat, January 30, 2025: Aster Volunteers, the global CSR arm of Aster DM Healthcare, launched two new Mobile Medical Service units aimed at assisting villages in Sankari, Surat and Khedbrahma of Sabarkantha districts of Gujarat. The newly launched units, equipped with state-of-the-art facilities, aims to deliver essential medical and healthcare services directly to disadvantaged individuals, significantly enhancing healthcare accessibility.

The Mobile Medical Units were launched by Shri Rushikesh Patel, Hon Minister for Health and Family Welfare, and Shri Harsh Sanghavi, Minister of Home, Police Housing & Disaster Management, Govt of Gujrat in the presence of Pujya Swami Brahmaviharidas, Head BAPS Global Outreach & Head BAPS Hindu Mandir Abu Dhabi, BAPS, Pujya Swami Nikhileshdas, Head BAPS Medical Activities, and Mr Jaleel PA Head CSR, Aster DM Healthcare.

The new mobile units are equipped with essential facilities such as a patient waiting area and registration desk, vital data collection desk, basic mini lab with refrigerated storage, safe storage of medicine and dispensing facility, consultation Room for General Practitioner, health education and awareness programs, and expandable awning for outdoor shade.

The mobile clinics also have air conditioning, infection control mechanisms, and Wi-Fi connectivity and are capable of navigating remote village roads, thereby reaching marginalized communities.

Aster Volunteers Mobile Medical Services (AVMMS) is a one-of-a-kind CSR initiative by Aster DM Healthcare aimed at bridging the gap in healthcare accessibility by providing free medical camps and disaster aid support to needy communities in remote areas. Since its inception, AVMMS has treated over 1.4 million individuals across India, the Middle East, and Africa, positively impacting lives in regions with limited or no access to medical facilities. The initiative has a global network of 50+ units, including units in Karnataka, Maharashtra, Rajasthan, Bihar, Haryana, Jharkhand, UP, MP, Andhra Pradesh, Uttarakhand, Odisha, Tamil Nadu, Kerala, West Bengal, Madhya Pradesh, Uttar Pradesh, and J&K.

Dr. Azad Moopen, Founder & Chairman, Aster DM Healthcare, commented, “The launch of two new mobile medical units further underscores our unwavering dedication to making quality healthcare accessible to underserved communities. This initiative builds on the remarkable milestone achieved last month with the inauguration of the 50th mobile medical unit by the Honorable Vice President of India, reaffirming our commitment to bridging gaps in access to essential medical care. Through the Aster Volunteers program, we strive to go beyond the conventional boundaries of healthcare, delivering critical services directly to those who need them the most. These mobile units are more than just vehicles; they are lifelines that bring hope, healing, and a promise of better health to individuals and families. This initiative represents another meaningful step in our mission to transform lives, empower communities, and ensure that quality healthcare is never out of reach for anyone, no matter where they are.” Aster DM Healthcare remains committed to its mission of providing accessible healthcare to all through innovative and sustainable solutions. The launch of the new units marks a significant milestone in this journey, reaffirming Aster’s dedication to global health and well-being.

Shri Pujya Swami Brahmaviharidas, Head of BAPS Global Outreach said, “True service is when we reach out to those who need us the most. The collaboration between BAPS and Aster Volunteers is a shining example of how faith, compassion, and medical expertise can come together to heal and uplift communities. These Mobile Medical Units will not just provide healthcare—they will offer hope, dignity, and a path to a healthier future for many.”

Mr. Jude Gomes on Life Insurance 2025: Growth and Future Prospects

By Mr. Jude Gomes, MD & CEO, Ageas Federal Life Insurance

Life Insurance 2025 – Exploring New Frontiers

As we reflect on the transformative journey of 2024 and look ahead to 2025, we are heartened by the steady growth of the Indian life insurance sector. With an 11% CAGR over the past three years, the industry has reached premiums of $107 billion, cementing its crucial role in driving financial security and inclusion.

The Assets Under Management (AUM) of the insurance industry forms a formidable part of the Indian financial markets, highlighting its significant contribution to capital formation and economic stability. Beyond its economic impact, insurance plays a vital role in ensuring the well-being of society at large by fostering resilience and safeguarding livelihoods.

Despite global economic uncertainties, the sector has shown remarkable resilience by embracing technology and innovative distribution models to cater to a digitally savvy population. Looking forward, we anticipate the sector will continue to grow at 11% to 13%, fuelled by GDP expansion, urbanization, and a rising demand for savings and protection products.

To further accelerate this growth and move towards the vision of ‘Insurance for All by 2047,’ we urge focusing on key reforms in the upcoming Budget:

Tax Relief for Annuity Plans:

With the retirement savings gap projected to reach $85 trillion by 2050, simplifying or removing taxes on annuity and pension products, including those under the National Pension System (NPS), will encourage greater participation in retirement planning. Extending the ₹50,000 tax exemption for NPS contributions to annuities and pensions will help millions secure post-retirement income.

Enhanced Tax Benefits for Life and Health Insurance:

Many Indian families still face financial vulnerability in case of an untimely loss of a breadwinner. Offering a separate limit for deductions under Section 80C for insurance premiums will make insurance more accessible and attractive, helping bridge the coverage gap.

GST Reforms for Greater Access:

Revising the GST on term life insurance policies will reduce the cost of essential protection plans. A ‘zero rating’ for schemes like Pradhanmantri Jeevan Jyoti Bima Yojana, smaller policies (up to ₹2 lakh), and annuity products for NPS subscribers will expand access to insurance, ensuring inclusivity and sustaining growth.

Universal Digital Insurance Accounts:

Establishing a government-backed Digital Insurance Repository System to store and manage all insurance policies on a single platform can simplify claims processing and policy management, improving transparency and trust.

Retirement Security Bonds:

Introducing long-term Retirement Security Bonds that combine insurance and guaranteed returns, will encourage long-term savings with tax-free maturity benefits.

Flexible Microinsurance Framework:

Implementing flexible microinsurance guidelines will encourage insurers to design products for underserved rural areas and informal sectors, supported by targeted government subsidies.

Incentives for InsurTech Innovation:

Providing fiscal benefits to companies investing in InsurTech startups and AI-driven solutions will modernize underwriting, claims, and risk management systems.

Public-Private Partnerships for Insurance Awareness:

Allocating funds to promote insurance literacy through joint campaigns involving the government and insurers, especially targeting Tier 2 and Tier 3 cities.

In 2024, Ageas Federal Life Insurance demonstrated its commitment to delivering tailored financial solutions through innovative initiatives such as the launch of the MAGIC Savings Plan, Golden Years Plus Plan (GYPP), and strategic partnerships like our association with PhonePe. These efforts were further complemented by grassroots initiatives like Bima Vahak and Bima Vistaar, along with the digital platform Bima Sugam, underscoring the company’s focus on customer-centricity and financial inclusion. We remain agile in adapting to regulatory changes to ensure the success of these efforts. As we reflect on the past year’s achievements and challenges, these milestones inspire us to move towards a future where insurance is not just a transaction but a vital component of financial well-being for all, making a meaningful impact on lives.

Raymond Lifestyle Posts Stable Performance Despite Weak Demand

New Delhi, 30th January 2025: Raymond Lifestyle Limited today announced its unaudited financial results for the quarter ended 31st December 2024.

Amidst weak consumer demand and subdued sentiments, Raymond Lifestyle Limited reported a decent quarterly performance in Q3 FY25 with a total income of ₹ 1,796 Cr. EBITDA stood at ₹ 221 Cr in Q3 FY25 with an EBITDA margin of 12.3% during these challenging market conditions. Additionally, we have reclaimed our net debt-free status, which had gone into borrowing in the previous two quarters. Our primary objective remains to establish a long-term sustainable business, by continued investments in our retail store expansion, product innovation, and marketing.

Commenting on the performance, Sunil Kataria, Managing Director of Raymond Lifestyle Limited said; “Q3FY25 continued to be a challenging quarter for our business. Despite weaker market conditions, our efforts have resulted in low single-digit revenue growth. Our continued focus on retail expansion led to the opening of 135 new stores during the current financial year, reaching a total of 1,653 stores including 143 stores in Ethnix by Raymond. During the quarter we have expanded into the Innerwear Category by launching Park Avenue Innerwear, which has received positive feedback from the trade channel. Our focus remains on our strategy to build a long-term sustainable and profitable business.”

Q3 FY25 Segmental Performance (Post IND AS 116)

Branded Textile segment revenue declined by 6% to ₹ 856 Cr in Q3 FY25 vs ₹ 909 Cr in Q3 FY24 predominantly on account of weaker consumer demand. EBITDA margins at 18.0% were impacted due to scale deleverage.

Branded Apparel segment revenue stood at ₹ 458 Cr in Q3 FY25 as compared to ₹ 437 Cr in the same quarter last year. The performance was on account of the new range of product launches during challenging market conditions and muted consumer demand. The segment reported an EBITDA margin of 9.6%, impacted by upfront investments in retail store expansion.

During the quarter we have opened 61 new stores including 14 ‘Ethnix by Raymond’ stores. The total retail store network now stands at 1,653 stores as of 31st December 2024.

The garment segment reported revenue at ₹ 309 Cr in Q3 FY25 as compared to ₹ 261 Cr in the same quarter the previous year. EBITDA margin for the quarter was 7.8%, impacted on account of adverse sales mix, higher freight costs, and additional cost of training of manpower for the new lines within our manufacturing facilities.

High-Value Cotton Shirting segment reported revenue of ₹ 201 Cr in Q3 FY25 as compared to ₹214 Cr in Q3FY24, lower on account of weak consumer demand. The segment reported an EBITDA margin of 10.3% due to scale deleverage.

Shreyas Webmedia Solutions Participates in Informative Session on SME Funding and IPO Listings

Bhubaneswar, India – January 30, 2025 – Shreyas Webmedia Solutions Pvt. Ltd. took part in an insightful interactive session on SME Funding and IPO Listing today, organized by the World Trade Center Bhubaneswar in collaboration with the National Stock Exchange (NSE) and Affinity Global Services Pvt. Ltd. The event was held at the IDCO Conference Hall, 5th Floor, New Annex Building, IDCO Towers, Janpath, Bhubaneswar.

The session brought together prominent industry experts and financial leaders who provided valuable insights into SME funding avenues, IPO preparation strategies, and the advantages of stock exchange listings. The discussions empowered businesses to explore new financial opportunities while gaining a deeper understanding of the regulatory framework for public listing.

The session commenced with a warm welcome from Nimishika Natarajan, Assistant Director of WTC Bhubaneswar, followed by an engaging discussion on SME funding and IPO listing dynamics.

Key Speakers and Their Insights

The event featured a distinguished panel of speakers, including:

Sanjeev Mahapatra, Secretary of Utkal Chamber of Commerce and Industry Ltd., who inaugurated the session with a warm welcome and insightful remarks on SME funding challenges. He highlighted why SME projects often struggle, the need for financial support in Odisha, and various funding sources available for SMEs.

Avik Gupta, Senior Manager of Primary Markets Relationship at NSE, who provided a comprehensive overview of NSE Emerge. He discussed the advantages of listing on NSE, eligibility criteria, post-listing compliance, SME listing incentives by the state government, and the step-by-step process for companies to get listed on NSE Emerge.

Sanjay Baoltia, CA, Chairman of Affinity Global Services Pvt. Ltd., who emphasized the importance of technology adoption, AI integration, and resource allocation for SMEs. He also detailed the eligibility criteria for listing, share dilution requirements, compliance management, and transitioning from SME listing to the main board.

Neeraj Agarwal, representative of Vdeal System Pvt. Ltd., who shared his personal journey and struggles with financial constraints and collateral challenges in securing bank funding. He encouraged SMEs to explore IPO listings as a viable growth strategy.

Representing Shreyas Webmedia Solutions at the event were Ms. Gouri Achary, Director (Finance), Ms. Rekha Nair, Director (HR & Operations), and Mr. K Sai Krishna. Their presence underscored the company’s commitment to staying informed about emerging financial trends and exploring new growth opportunities. Shreyas Webmedia Solutions continues to stay proactive in gaining industry knowledge and leveraging networking opportunities to enhance its business strategy.

The event concluded with a networking session and a luncheon, allowing attendees to connect with industry professionals, financial experts, and peers in an informal setting.

Infosys Finacle Rolls Out Innovative Asset Liability Management Solution to Boost Risk Management

Bengaluru, India – January 30, 2025: Infosys Finacle, part of EdgeVerve Systems, a wholly-owned subsidiary of Infosys (NSE, BSE, NYSE: INFY), today announced the launch of the Finacle Asset Liability Management Solution – a liquidity and interest rate risk management solution that provides banks with an enterprise-wide view of all on-and-off balance sheet exposures. The solution enables banks to identify gaps, assess impact on net interest margin and liquidity, and take corrective actions, to better manage their funding and liquidity decisions.

The Finacle Asset Liability Management Solution allows monitoring of a broad range of liquidity and interest rate risk metrics and deliver an aggregated view of such risks across entities, geographies, and currencies. This helps banks make informed decisions regarding funding and liquidity strategies, optimize asset allocation, and effectively manage risk and compliance.

Finacle Asset Liability Management Solution highlights:

- The solution has advanced data analytics and AI-infused capabilities to address asset liability management (ALM) objectives, along with a cashflow engine to generate forecasts for contractual and behavioral cash flows.

- It will enable banks in strategic management decisions, including balance sheet planning, liability mix optimization, asset/liability pricing, and funding concentration regulation.

- It also has stress testing and scenario modeling functionalities that allow banks to simulate and optimize key liquidity and interest rate risk drivers, to better respond to market shocks.

- The solution integrates reporting infrastructure with a range of on-demand and pre-configured Basel norms-based reports for enhanced compliance management.

Sajit Vijayakumar, Chief Business Officer and Global Head, Infosys Finacle, said, “With Finacle Asset Liability Management, we are equipping banks to navigate the global economic uncertainty and the complexities of liquidity and interest rate risk with unprecedented clarity and precision. Our solution offers a holistic view of exposures while providing financial institutions with intelligent capabilities and tools to manage risks effectively, streamline reporting, and enhance their risk modelling capabilities.

Mohammad Muzaffar Wani, DGM – IT and BPR, Jammu and Kashmir Bank, said, “We are delighted to announce our adoption of Finacle’s advanced Asset Liability Management solution. This strategic initiative empowers us to enhance our liquidity and interest rate risk management capabilities, while also improving our modeling sophistication to better adapt to changing market dynamics. The solution will streamline our ALM operations, offer valuable insights and enable informed decision-making in managing our assets and liabilities.”

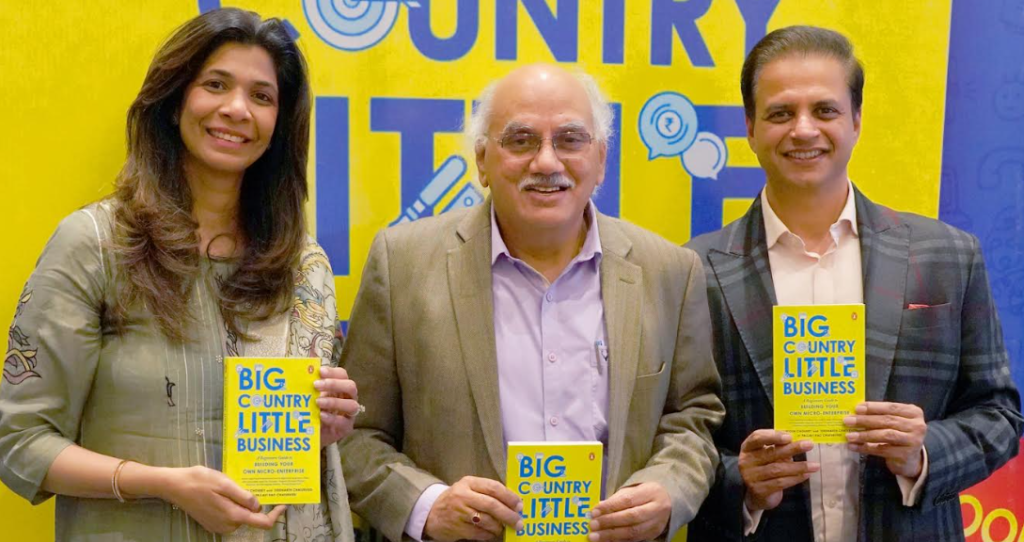

Book ‘Big Country, Little Business’ Inspires Indian Micro-Entrepreneurs to Achieve Success

30 January 2025,Bhopal: The book ‘Big Country, Little Business,’ a comprehensive guide for Indian micro-entrepreneurs and small businesses. The book offers an in-depth analysis of the challenges faced by small businesses, which serve as the backbone of the Indian economy. Authored collaboratively by eminent author, social entrepreneur, educationist, and chairman of the AISECT Group Shri Santosh Choubey; business leader, educationist, and Chancellor, SCOPE Global Skills University, Dr. Siddharth Chaturvedi; and educationist, influencer, author, and EVP of the AISECT Group, Dr. Pallavi Rao Chaturvedi, the book combines their diverse expertise of 40 years and success secrets from 40 successful businesses. It provides practical tips, actionable strategies, and over 100 innovative business ideas to guide small enterprises towards success.

During the book launch event, the authors shared their personal experiences and the inspiration that led to the creation of this book. The event commenced with a warm welcome to the guests, followed by an in-depth discussion by the authors on the key highlights and objectives of the book.

On this occasion, Mr. Santosh Choubey said, “Today 90 percent of the small businesses in India are coming from Tier 2 and Tier 3 cities. So there is a lot of potential for small businesses, but they also face many challenges. This book is a guide for small businesses, which not only inspires them, but also teaches practical ways to make their business successful.”

Dr. Siddharth Chaturvedi, while talking to journalists, said that “At present, India has the third largest small businesses ecosystem in the world. There are more than 1.60 lakh registered small businesses and 5 crores 70 lakh micro enterprises here. Medium and small industries contribute 30 percent to the country’s GDP. Keeping these things in mind, we have emphasized on explaining the process of starting a business in the Indian context. Our effort was that this book presents a detailed picture of business possibilities. In the digital age, small businesses should know how to use technical tools correctly and we have tried to explain it in simple words.”

Dr. Pallavi Rao Chaturvedi, co-author of the book, while highlighting the relevance of this book for women and youth, said that “Women and youth are the future of our country’s economy. Today more than 73 thousand small businesses are being run by women. Understanding their specific needs and struggles, we have included specially designed solutions and business ideas for them in this book. I believe that if they get the right direction and opportunity, they can do wonders.”

Big Country, Little Business” is not just a book, but a comprehensive guide for aspiring entrepreneurs looking to establish and scale small businesses successfully. It delves into the ground realities of Indian business dynamics, offering bespoke solutions tailored to their needs. Authored by seasoned experts with a proven track record of fostering micro-enterprises, ‘Big Country, Little Business’ stands as a testament to the authors’ profound insights into India’s entrepreneurial ecosystem. This book serves as a roadmap for millions of small businesses across the nation to not just survive but to thrive in an ever-evolving global landscape, especially in an era where an entrepreneurial mindset is more crucial than ever.

The main themes of the book include a comprehensive analysis of the key challenges faced by Indian micro-enterprises, strategic approaches to conducting business with limited resources, and business ideas tailored specifically for women and youth. It also delves into business strategies crafted to align with local market dynamics, consumer behaviour, and cultural diversity, as well as leveraging technological tools to empower small businesses in the digital age. Furthermore, the book provides detailed insights into the importance of networking, funding options, and sustainable strategies for ensuring long-term business success. Moreover, eminent doyens such as Mr. Pavan K. Verma, author, diplomat, and former member of parliament (Rajya Sabha), Mr. Anand Kumar, Padma Shri awardee, and founder, Super 30 programme, Mr. Yogesh Chander Munjal, chairman and managing director, Munjal Showa Ltd, Mr. Harish Bijoor, brand guru and founder, Harish Bijoor Consults Inc., and Mr. K Mantrala, former editor-in-chief, Journal of Retailing, Alexander Von Humboldt Research Award (Berlin) recipient, and Ned D. Fleming professor of marketing, University of Kansas School of Business, Lawrence, Kansas have heaped praises on this book.